In the dynamic world of contracting, efficiency is key. From managing projects to communicating with clients, every aspect of your business demands precision and organization. One area where efficiency can make a significant difference is invoicing. Crafting professional, accurate invoices not only ensures timely payments but also solidifies your reputation as a reliable contractor. To help you streamline your invoicing process, we’ve curated the ultimate guide to the perfect invoice template for contractors.

Understanding the Importance of a Well-Designed Invoice Template

Before delving into the specifics of an ideal invoice template, let’s emphasize why it matters. A well-designed invoice template serves as more than just a billing tool. It reflects your professionalism, attention to detail, and commitment to excellence. Here’s why it’s crucial:

- Professionalism

Clients perceive well-designed invoices as a mark of professionalism. It instills confidence in your abilities and enhances your reputation as a reliable contractor. - Clarity and Transparency

Clear, concise invoices minimize misunderstandings and disputes. By providing a breakdown of services rendered and corresponding costs, you ensure transparency in your transactions. - Timely Payments

Prompt, easy-to-understand invoices facilitate faster payments. Contractors rely on steady cash flow to sustain their operations, making timely payments essential for business continuity. - Legal Protection

Invoices serve as legal documents that outline the terms of your agreement with clients. A comprehensive invoice template can protect your interests in case of disputes or legal issues.

Key Elements of an Effective Invoice Template for Contractors

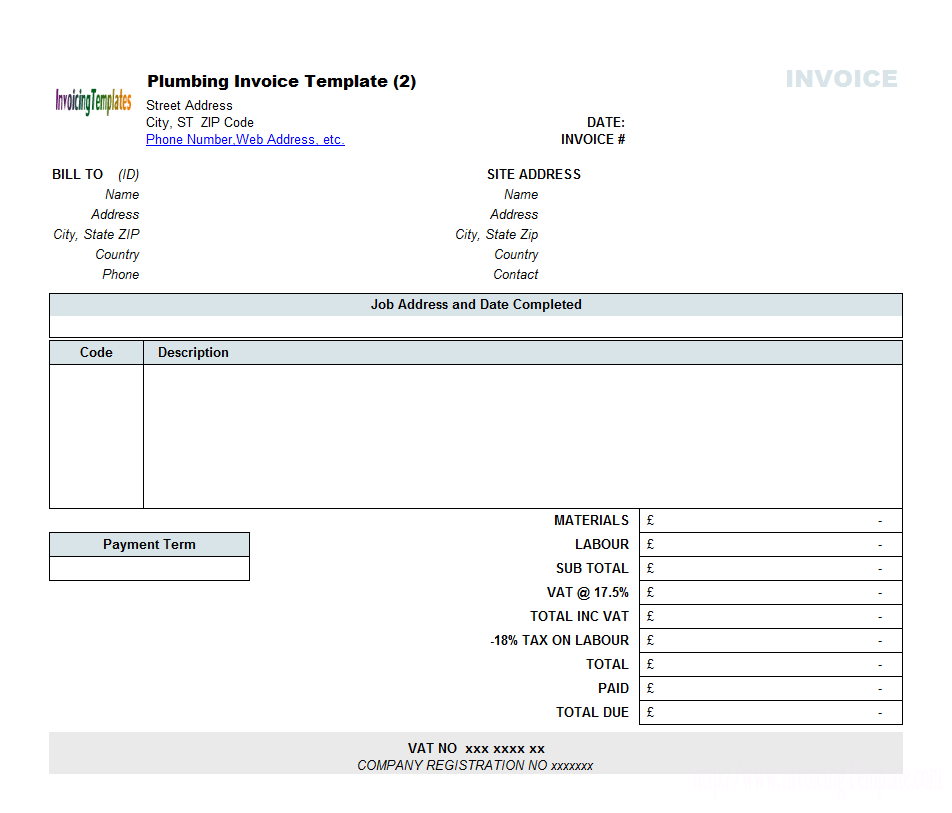

Now that we’ve established the significance of a well-designed invoice template, let’s explore the essential elements it should incorporate:

- Header

Include your business name, logo, contact information, and the invoice date at the top of the invoice. This establishes your identity and makes it easier for clients to reach out if they have any questions. - Client Details

Clearly state the client’s name, address, and contact information to ensure accurate delivery of the invoice and facilitate communication. - Invoice Number and Date

Assign a unique invoice number and specify the date of issuance for reference and record-keeping purposes. Sequentially numbering your invoices helps in tracking payments and maintaining organized records. - Description of Services

Provide a detailed description of the services or tasks completed, including the quantity, rate, and total cost for each item. This clarity eliminates ambiguity and ensures that clients understand what they’re paying for. - Payment Terms

Outline the payment terms, including due date, accepted payment methods, and any late fees or penalties for overdue payments. Clearly communicating your expectations sets the precedent for timely payments. - Total Amount Due

Summarize the total amount due, including any applicable taxes or discounts, to provide a clear overview of the invoice’s financial obligations. - Payment Instructions

Specify the preferred method of payment and provide detailed instructions on how clients can remit payment. This streamlines the payment process and minimizes delays.

Choosing the Right Invoice Template Format

When selecting an invoice template for your contracting business, consider the following factors:

- Customization

Opt for a template that allows for customization to align with your brand identity. This includes incorporating your logo, brand colors, and fonts for a cohesive look. - Accessibility

Choose a template format that is easily accessible and compatible with common software applications such as Microsoft Word, Excel, or Google Sheets. This ensures convenience and flexibility in creating and sending invoices. - User-Friendly Design

Prioritize simplicity and clarity in the template design to enhance readability and usability for both you and your clients. - Mobile Compatibility

In an increasingly mobile world, ensure that your chosen template is compatible with mobile devices for on-the-go invoicing convenience.

Exploring Template Options

Now that we’ve outlined the key elements and considerations for an effective invoice template, let’s explore some template options tailored specifically for contractors:

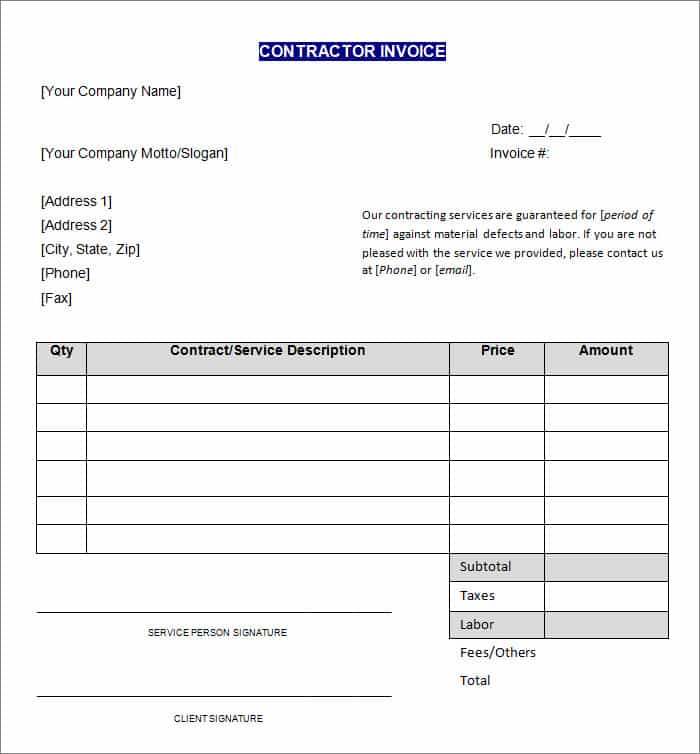

- Basic Invoice Template

Ideal for beginners or those seeking simplicity, a basic invoice template includes essential elements such as business details, client information, services rendered, and total amount due. It offers a clean, minimalist design without overwhelming details. - Detailed Invoice Template

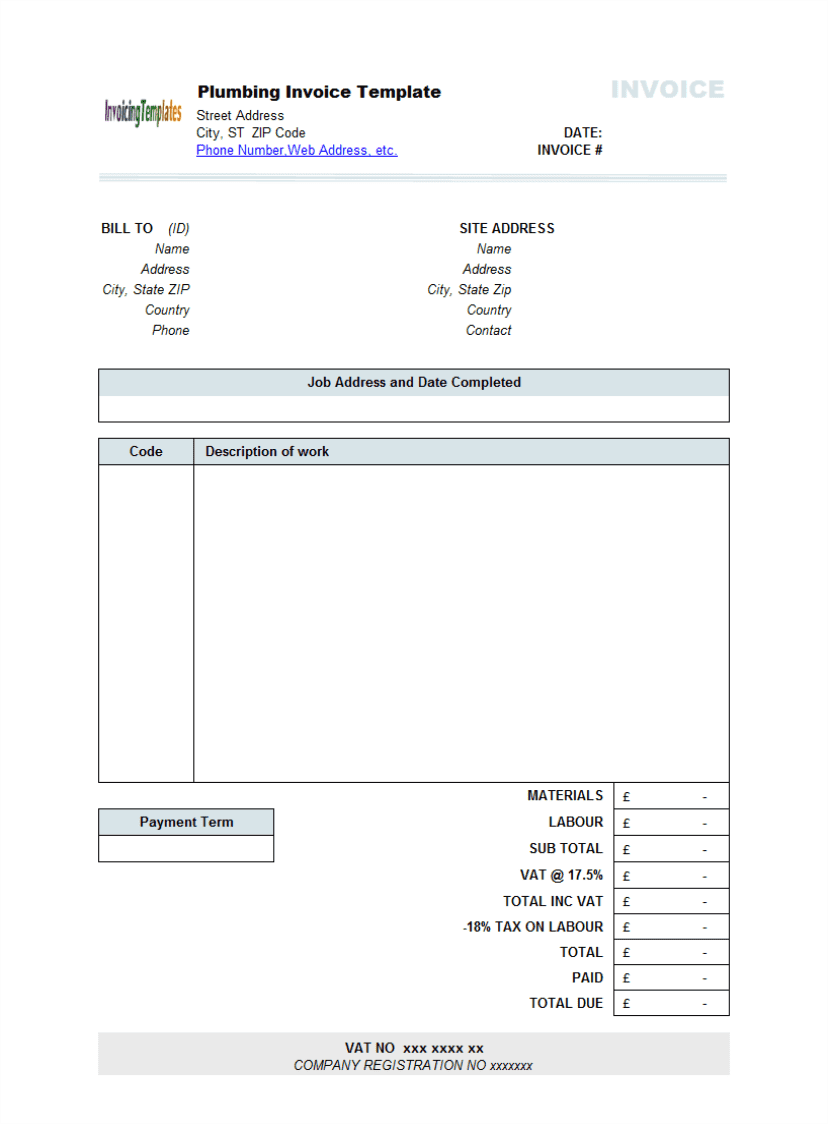

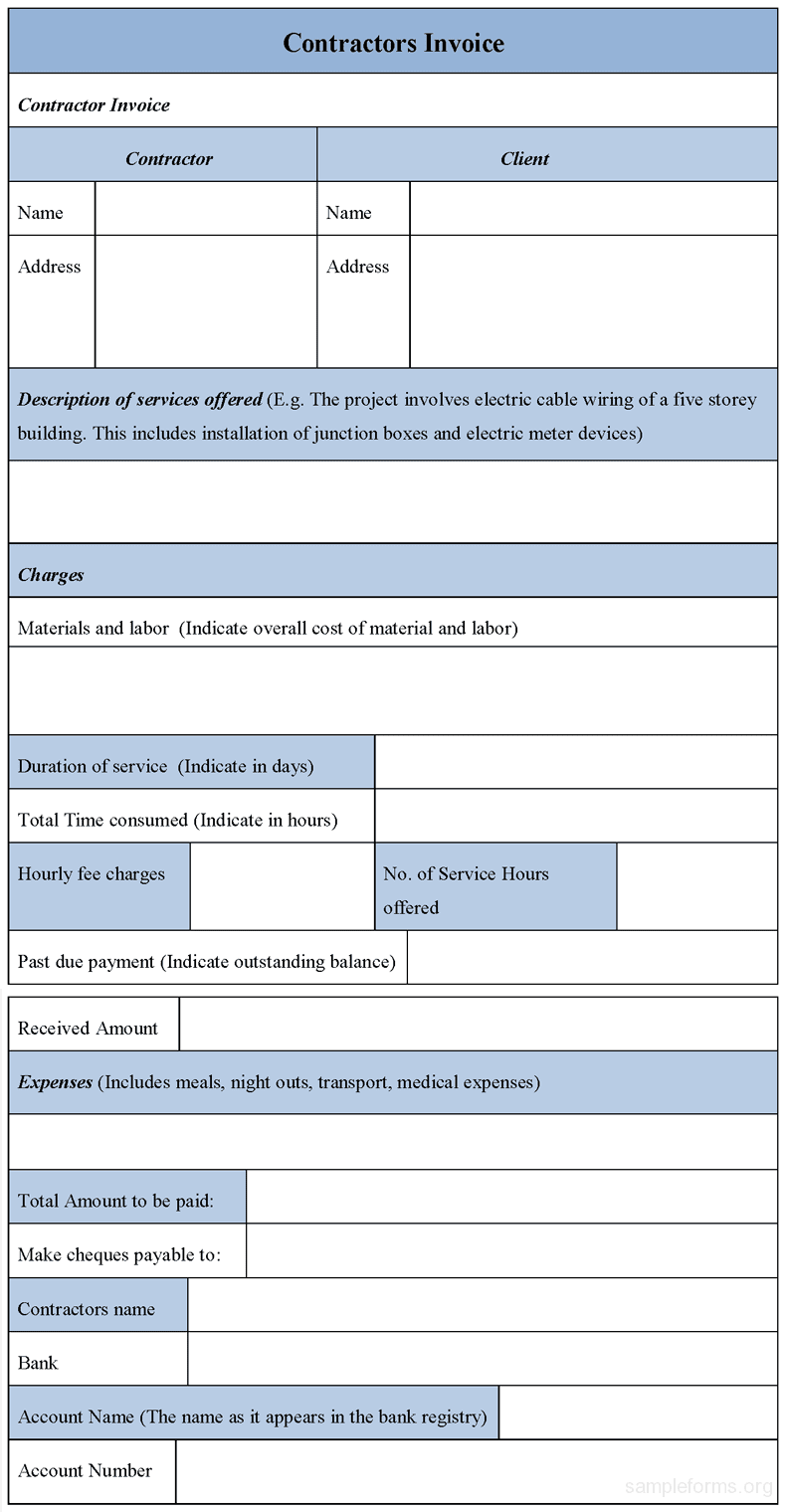

For contractors handling complex projects with multiple tasks or milestones, a detailed invoice template provides a comprehensive breakdown of services, hours worked, rates, and subtotals for each item. This level of detail enhances transparency and facilitates accurate billing. - Hourly Rate Invoice Template

If you primarily charge clients based on hourly rates, an hourly rate invoice template is essential. It allows you to record the number of hours worked, hourly rate, and total amount due, providing clarity for both you and your clients. - Project-Based Invoice Template

Contractors working on fixed-price projects may prefer a project-based invoice template. This format highlights the project name, description, flat fee, and any additional expenses or adjustments, simplifying billing for one-time projects. - Retainer Invoice Template

For contractors offering ongoing services under retainer agreements, a retainer invoice template is indispensable. It outlines the retainer fee, billing period, and any services rendered within the retainer agreement, ensuring transparent billing for recurring clients.

Customizing Your Invoice Template

While pre-designed templates offer convenience, customizing your invoice template allows you to tailor it to your unique business needs and branding preferences. Consider the following customization options:

- Branding Elements

Incorporate your logo, brand colors, and fonts to reinforce brand identity and professionalism. - Additional Fields

Add custom fields or sections to capture specific project details, terms, or payment instructions relevant to your contracting business. - Client Communication

Personalize the invoice template with a brief thank-you message or note of appreciation to strengthen client relationships and foster goodwill. - Automation Features

Explore invoicing software or tools that offer automation features such as recurring invoices, invoice tracking, and payment reminders to streamline your invoicing process further.

Final Thoughts

Invoicing is not just about sending bills; it’s about effectively communicating the value of your services and ensuring seamless transactions with clients. By investing in the right invoice template and customization options, you can optimize your invoicing process, enhance professionalism, and ultimately, drive business success as a contractor. Remember, your invoice is more than just a piece of paper—it’s a representation of your commitment to excellence and reliability in the contracting industry. Choose wisely, customize thoughtfully, and watch your invoicing process become a seamless part of your business operations.