Learn how an invoice record keeping template can help you organize your financial transactions and improve your business’s financial management.

As a business owner, keeping track of your financial transactions is essential to your success. Whether you are a small business owner or a large corporation, it’s important to maintain accurate records of your invoices, payments, and expenses. One way to do this is by using an invoice record keeping template. In this article, we’ll explore the benefits of using this tool and how it can improve your financial management.

What is an Invoice Record Keeping Template?

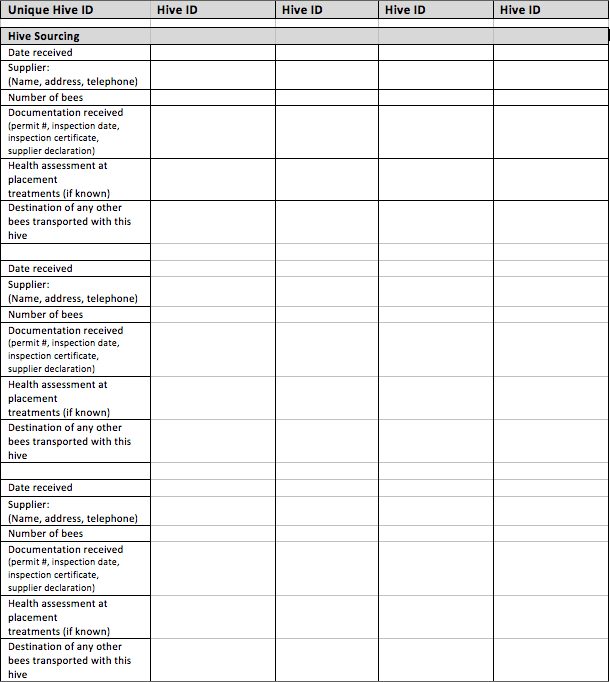

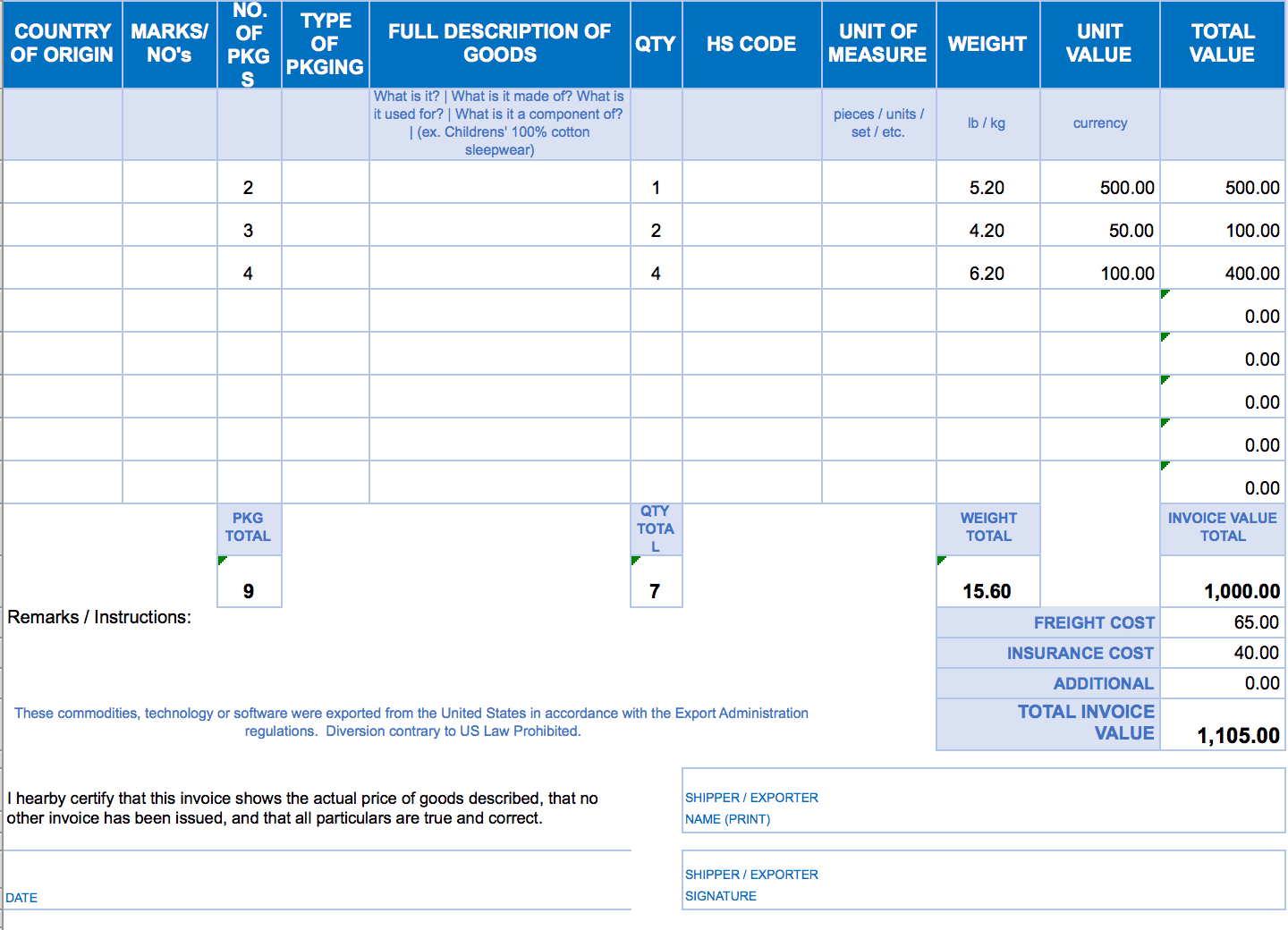

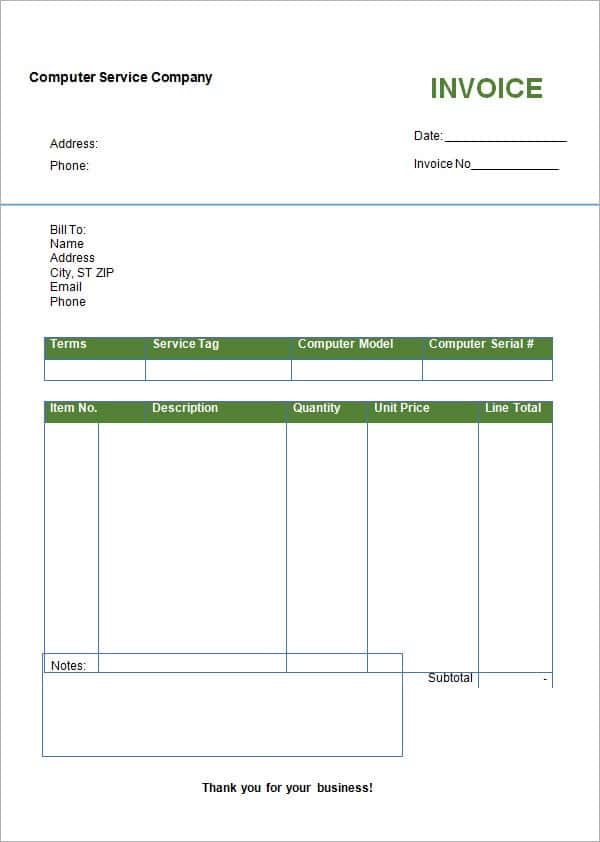

An invoice record keeping template is a pre-designed document that you can use to organize and manage your invoices. It typically includes fields for the customer’s name and contact information, the date of the invoice, a description of the goods or services provided, the amount owed, and the payment due date. By using this template, you can easily track your invoices and payments and keep your financial records organized.

Why is an Invoice Record Keeping Template Important?

Using an invoice record keeping template is essential for several reasons. First, it helps you stay organized. With all of your invoices and payments in one place, you can easily track your financial transactions and avoid any confusion or errors. This can save you time and money in the long run.

Second, it can help you avoid late payments. By using an invoice record keeping template, you can keep track of when payments are due and send reminders to customers who are late. This can help you avoid cash flow problems and improve your business’s financial stability.

Third, it can improve your customer relationships. By sending professional-looking invoices that are easy to understand, you can build trust with your customers and improve their overall experience with your business.

How to Use an Invoice Record Keeping Template

Using an invoice record keeping template is simple. You can download a pre-designed template from a variety of sources online or create your own using a spreadsheet program like Microsoft Excel. Once you have your template, you can customize it to fit your business’s needs.

Here are some tips for using an invoice record keeping template:

- Include all of the necessary information

Make sure your template includes fields for the customer’s name and contact information, the date of the invoice, a description of the goods or services provided, the amount owed, and the payment due date. - Use a consistent format

Use a consistent format for all of your invoices to make it easier to track your payments and avoid errors. - Keep track of your invoices

Make sure to keep track of all of your invoices and payments in one place. This can be a spreadsheet or an accounting software program. - Send reminders for late payments

If a customer is late with a payment, send a friendly reminder to encourage them to pay. - Review your records regularly

Review your financial records regularly to ensure that everything is accurate and up-to-date.

Conclusion

Using an invoice record keeping template is an easy and effective way to improve your financial management. By keeping track of your invoices and payments, you can avoid cash flow problems, improve your customer relationships, and stay organized. Whether you download a pre-designed template or create your own, make sure to include all of the necessary information and use a consistent format. With this tool in your toolkit, you can take control of your finances and set your business up for success.

Additionally, using an invoice record keeping template can help you prepare for tax season. When it comes time to file your taxes, having accurate financial records can make the process much easier. You’ll have all of the information you need to prepare your tax return, including income, expenses, and deductions.

Moreover, an invoice record keeping template can also help you track your business’s financial performance. By regularly reviewing your financial records, you can identify areas where you may need to cut costs or increase revenue. This can help you make informed decisions about your business and improve its profitability over time.

Finally, using an invoice record keeping template can save you time and money. With all of your financial records in one place, you can easily track your invoices and payments, which can reduce the risk of errors and save you from having to manually input data. This can free up time for other important tasks, such as growing your business.

In conclusion, using an invoice record keeping template is a simple yet effective way to improve your business’s financial management. It can help you stay organized, avoid cash flow problems, improve your customer relationships, and prepare for tax season. Whether you download a pre-designed template or create your own, make sure to include all of the necessary information and use a consistent format. With this tool in your toolkit, you can take control of your finances and set your business up for success.