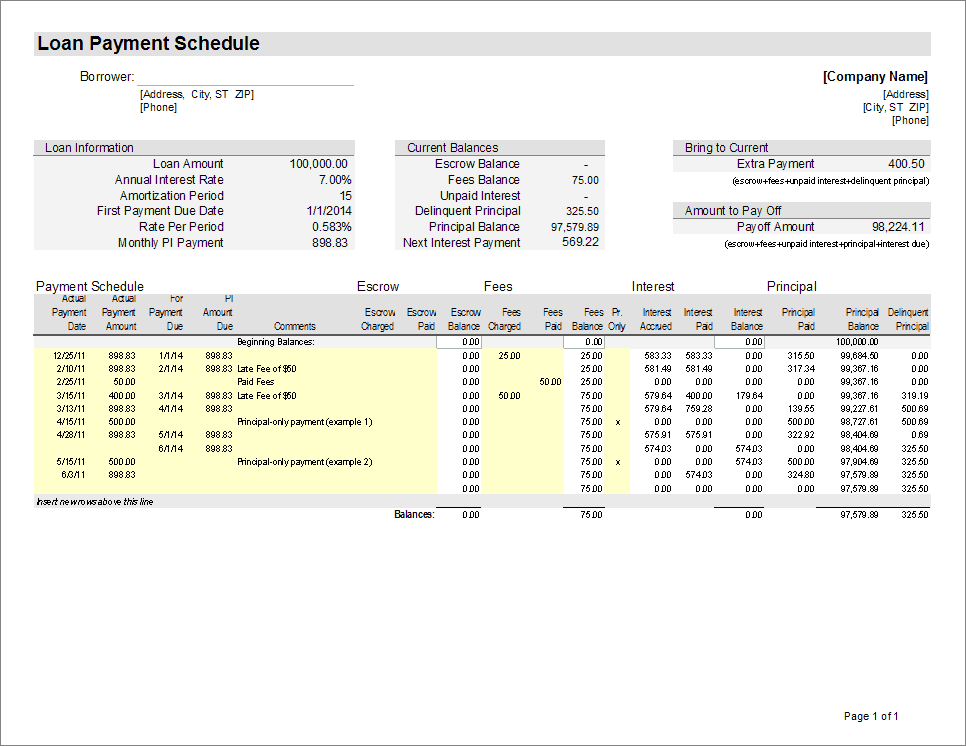

While the home loan spreadsheet is nothing more than a template, it is still a great way to get started when shopping for your next loan. Here are some reasons why:

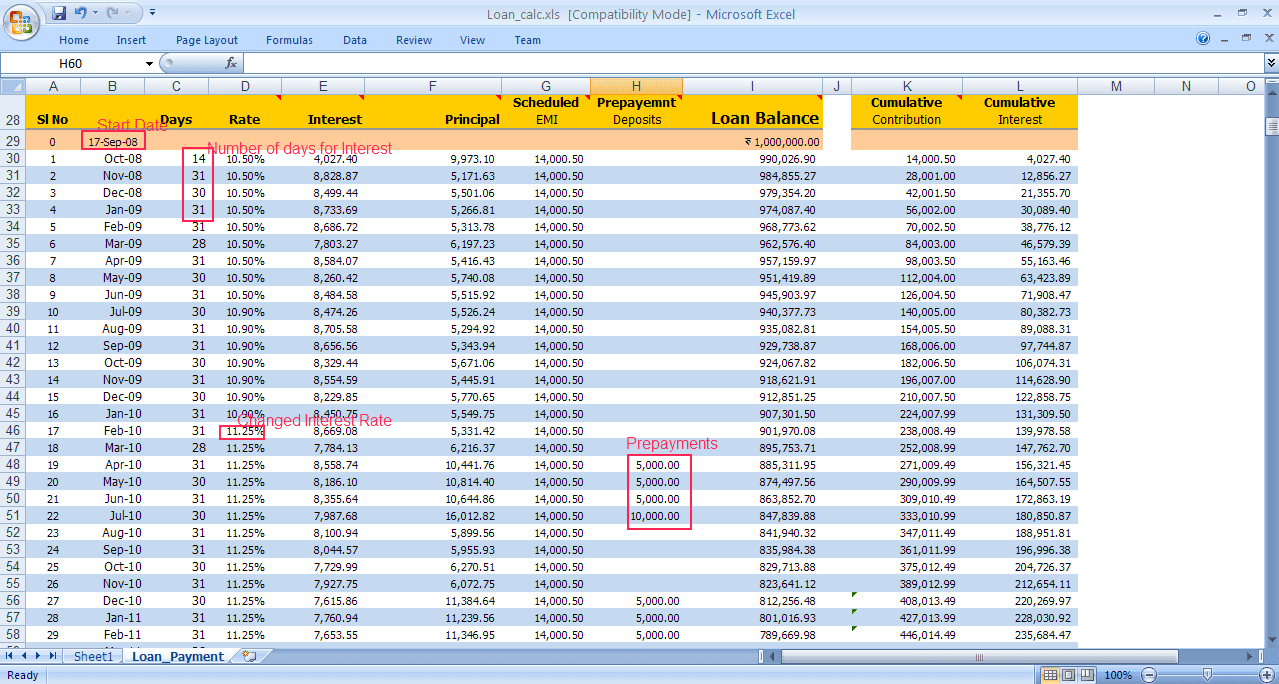

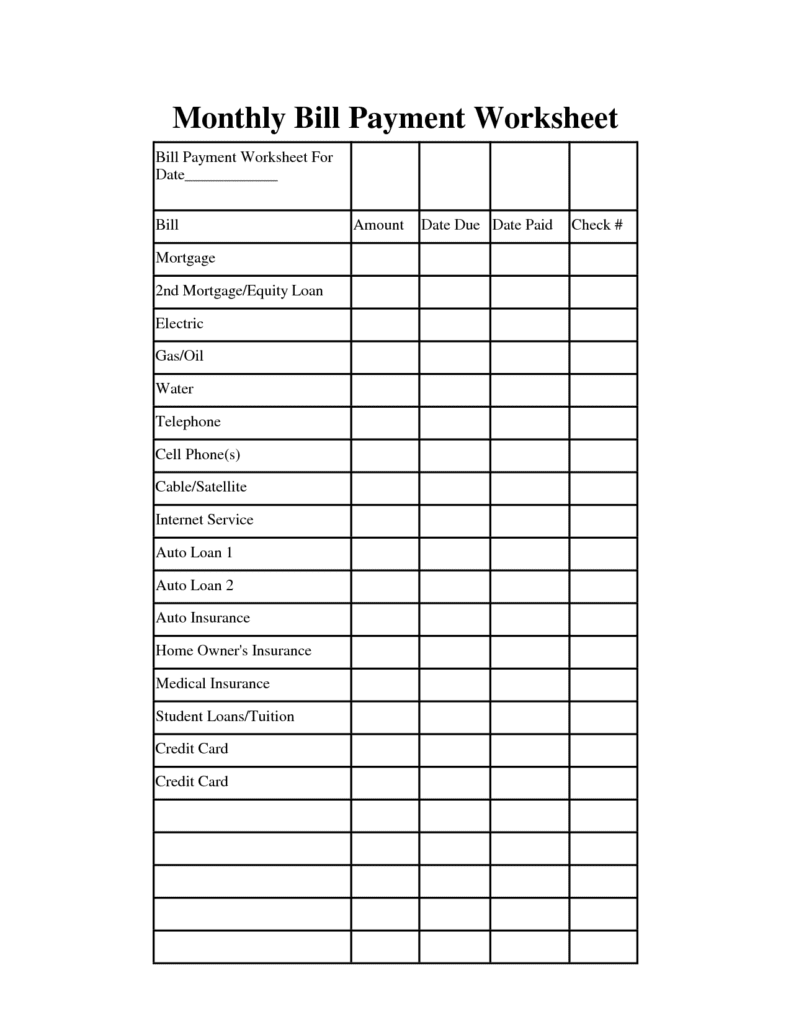

A spreadsheet can be used for several different reasons. These include but are not limited to, researching financing options, calculating the cost of a loan, finding out which lenders offer the best deals, and keeping track of your payments. It is a great way to get everything in one easy to read place.

When you’re using this spreadsheet, you should always be clear on what type of business model you are working with. While a traditional loan works well with the traditional loan spreadsheets, if you wish to use a different loan model, you need to change the way the spreadsheet is formatted to reflect the new loan models. You will then need to go back and convert all of your current loans to the new model.

Many people take advantage of a certain lender’s online tool, which allows you to enter your information into the home loan spreadsheet. This will allow you to compare the different lenders and find the best home loan for your needs. However, this option can be overrated, and you should always have a set of professional guidelines in place before doing this.

Some people don’t want to spend time going through multiple spreadsheets to find the right loan, or to make comparisons. For those people, there is an even better solution. With a spreadsheet, you can have all of your loan information right at your fingertips.

Multiple spreadsheets will allow you to see all of the different variables for each lender that you’re considering. This includes but is not limited to: the interest rate, down payment, closing costs, closing fees, and even their terms of business. You will also have the ability to compare the terms of each lender as well. This will help you determine which lender provides the best deal, as well as provide you with a way to use your spreadsheet to gather more information.

One of the best ways to find the best deal is to maintain high standards for your home loan. This will prevent you from making the same mistakes that other borrowers have made and will save you money in the long run. With a spreadsheet, you can make sure that you get the most accurate comparisons possible.

The home loan spreadsheet is a great way to get started shopping for your next loan. This way, you will have all of the necessary information at your fingertips to compare lenders, as well as get the best deal. Making the right choices can save you thousands of dollars in the future, so it’s important to do your research and shop around wisely.