Looking for an easy way to manage your bills? Check out these free spreadsheet templates for bills that can help you streamline your finances and stay on top of your payments.

Are you tired of the stress and hassle that comes with managing your bills each month? Do you struggle to keep track of due dates, payment amounts, and account numbers? If so, you’re not alone. Many people find it challenging to stay on top of their bills and avoid missed payments, late fees, and other financial headaches.

Fortunately, there’s an easy solution to this problem: free spreadsheet templates for bills. These handy tools can help you simplify your finances, stay organized, and ensure that you never miss a payment again. Here’s what you need to know about using spreadsheet templates for bills.

What are Spreadsheet Templates for Bills?

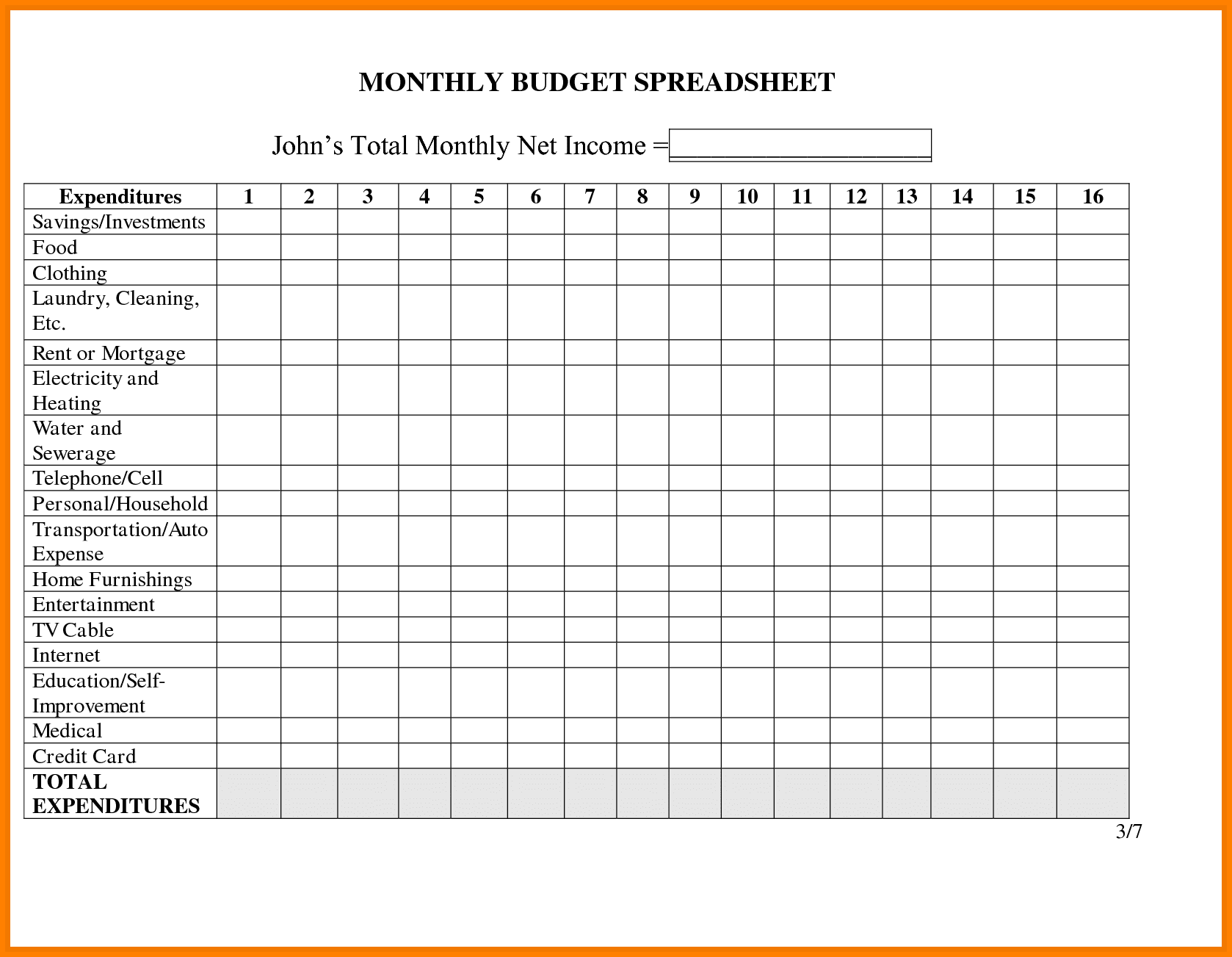

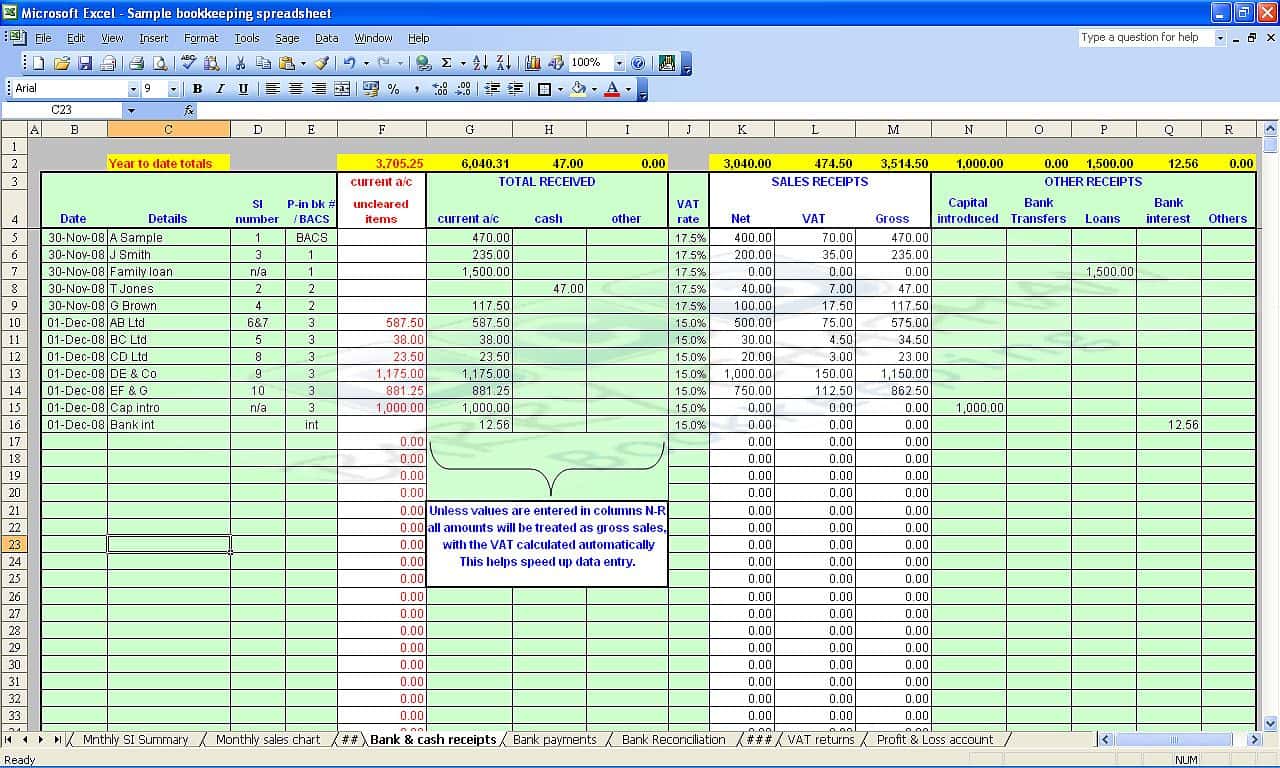

Spreadsheet templates for bills are pre-designed spreadsheets that you can use to track your bills and payments. These templates typically include columns for the name of the bill, the due date, the amount due, the payment date, and any notes or comments you want to add. Some templates may also include additional columns for account numbers, billing cycles, or other information.

Why Use Spreadsheet Templates for Bills?

There are several reasons why using spreadsheet templates for bills can be beneficial:

- Organization

Spreadsheet templates can help you keep all your bills and payments in one place, so you don’t have to juggle multiple documents or accounts. - Convenience

With a spreadsheet template, you can easily view all your bills and payments at a glance, making it easy to track due dates and stay on top of your finances. - Accuracy

By using a spreadsheet template, you can reduce the risk of errors and avoid missed payments or other financial mistakes. - Customization

Spreadsheet templates can be customized to meet your specific needs, so you can add or remove columns as necessary to fit your unique financial situation.

Where Can You Find Free Spreadsheet Templates for Bills?

There are many websites that offer free spreadsheet templates for bills. Here are a few options to consider:

- Microsoft Office

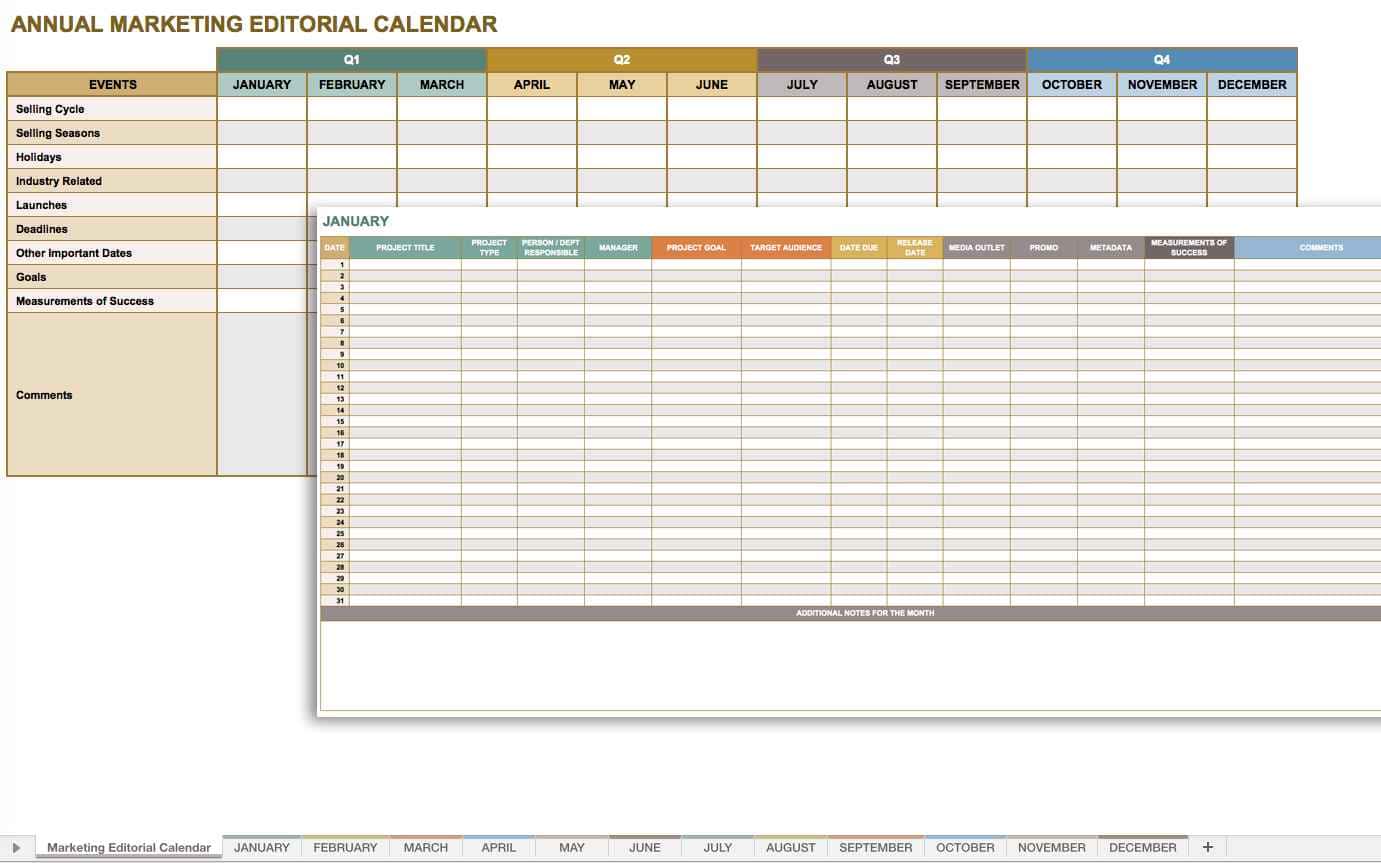

If you have Microsoft Office, you can access a variety of free templates for Excel, including several options for bill tracking. - Google Sheets

Google Sheets also offers a variety of free templates, including bill tracking templates that you can use for free. - Template.net

Template.net offers a wide range of free templates, including several options for bill tracking and financial management. - Vertex42

Vertex42 offers a variety of free templates for Excel, including several bill tracking templates that you can download and use for free.

How to Use Spreadsheet Templates for Bills

Using spreadsheet templates for bills is a simple and straightforward process. Here are the steps you can follow to get started:

- Choose a spreadsheet template

There are many spreadsheet templates available for bills, including those that are pre-installed in software like Microsoft Excel or Google Sheets, or those that can be downloaded from websites or other sources. Choose a template that meets your needs and preferences. - Customize the template

Once you have selected a template, you can customize it to fit your specific financial situation. For example, you may want to add or remove columns, adjust the formatting, or change the color scheme. You can also enter your own bills and payment information into the template. - Input your bills and payments

The next step is to input your bills and payments into the template. This may include information such as the name of the bill, the amount due, the due date, the payment date, and any additional notes or comments. - Update the template regularly

To keep your finances up-to-date, be sure to update the template regularly. This may involve adding new bills and payments as they arise, or updating existing information to reflect changes in your financial situation. - Use the template to track your bills and payments

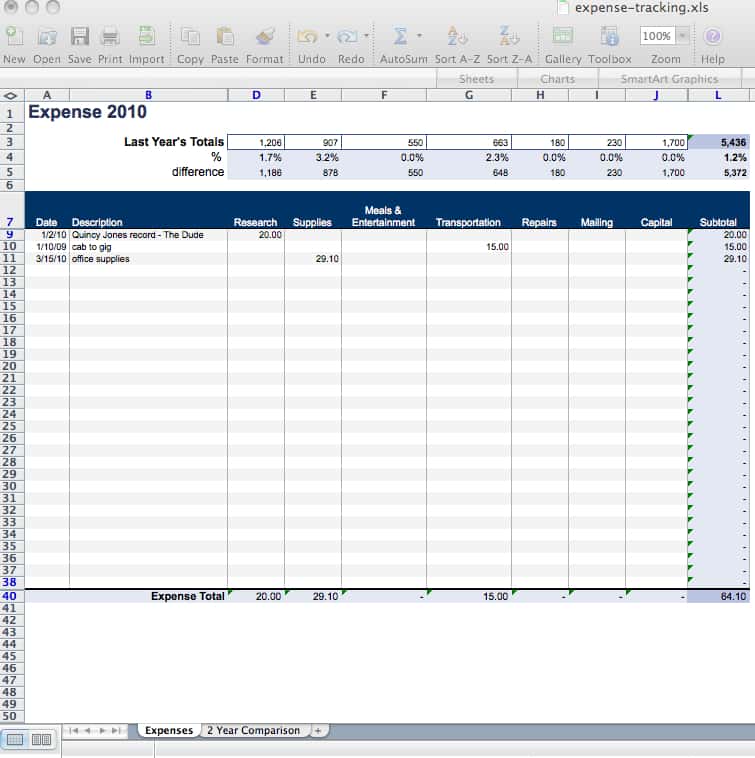

Once you have input all of your bills and payments into the template, you can use it to track your finances and ensure that you are staying on top of your bills. This may involve sorting the information by due date, using formulas to calculate totals, or color-coding bills to prioritize payments.

By following these steps, you can effectively use spreadsheet templates for bills to simplify your financial management and ensure that your bills are paid on time.

Additional Tips for Using Spreadsheet Templates for Bills

To get the most out of your spreadsheet template for bills, here are a few additional tips to keep in mind:

- Be consistent

Use the same format and style for each bill and payment to make it easier to read and understand. - Update the template regularly

Set aside time each week to update your spreadsheet with new bills and payments to ensure that it remains accurate and up-to-date. - Use formulas and functions

Excel and Google Sheets offer a variety of formulas and functions that can make it easier to calculate totals, track due dates, and more. Take advantage of these tools to simplify your financial management. - Use color coding

Color coding can help you quickly identify bills that are due or past due, making it easier to prioritize your payments and avoid late fees. - Keep backups

Be sure to save copies of your spreadsheet templates in a secure location, such as a cloud-based storage service, to avoid losing your data in case of a computer crash or other issue.

By following these tips, you can make the most out of your spreadsheet templates for bills and enjoy greater financial control and peace of mind.

Final Thoughts

Managing bills can be a challenging and stressful task, but it doesn’t have to be. With the help of free spreadsheet templates for bills, you can simplify your finances and stay on top of your payments with ease. Whether you choose to use Microsoft Office, Google Sheets, or another platform, there are plenty of options available to help you streamline your financial management and avoid missed payments and late fees. So why not give them a try today and see how they can benefit your financial health?