Learn how a financial spreadsheet can help small business owners to track and manage their finances effectively. Read on to discover the best practices for creating and using a financial spreadsheet for small businesses.

As a small business owner, managing finances can be a daunting task. With multiple transactions happening every day, keeping track of everything can be overwhelming. However, with the help of a financial spreadsheet, small business owners can easily track and manage their finances.

A financial spreadsheet is a tool that can help small business owners to organize their finances in a structured and organized manner. It is a simple yet powerful tool that can help you to keep track of your income, expenses, and cash flow. In this article, we will explore the benefits of using a financial spreadsheet and the best practices for creating and using one.

Benefits of using a financial spreadsheet for small businesses

Better organization and structure

One of the most significant benefits of using a financial spreadsheet is that it provides a structure and organization for your finances. It allows you to keep all your financial information in one place, making it easy to access and review.

Accurate and up-to-date financial information

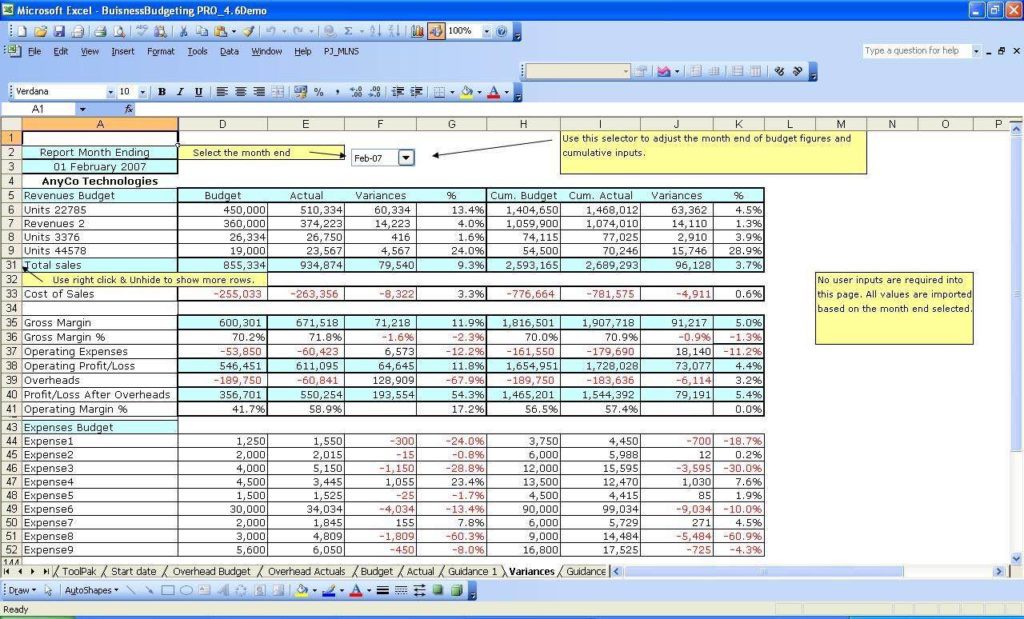

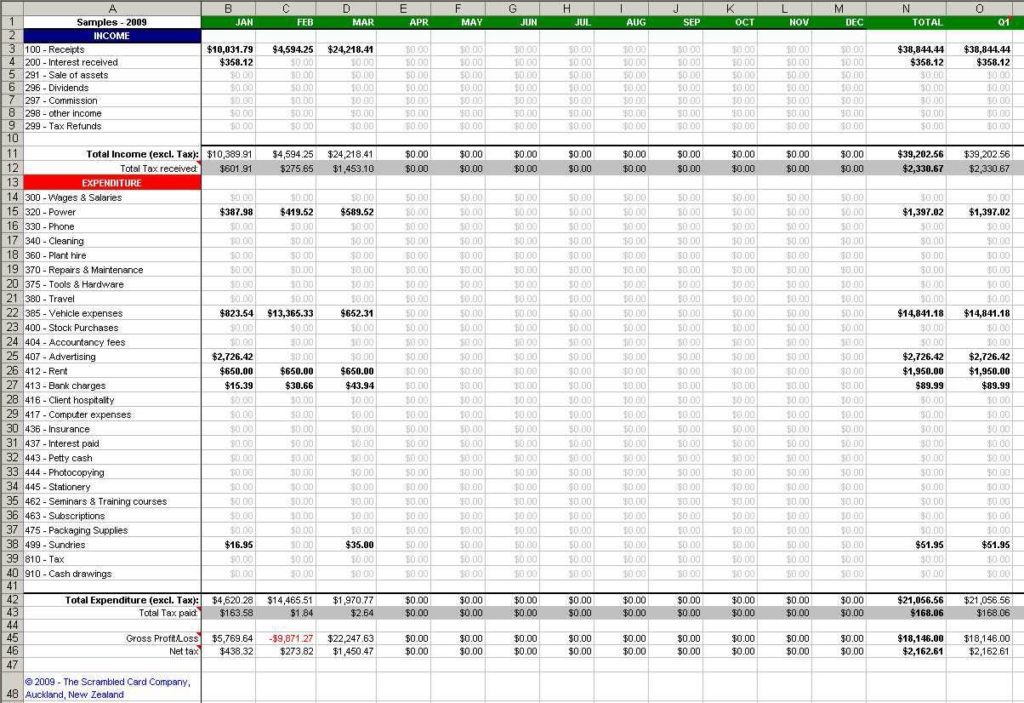

A financial spreadsheet allows you to keep track of your income, expenses, and cash flow in real-time. This enables you to have accurate and up-to-date financial information at all times, which is crucial for making informed business decisions.

Improved financial analysis

A financial spreadsheet enables you to analyze your financial data easily. You can use it to create charts and graphs that help you to visualize your financial data, making it easier to identify trends and patterns.

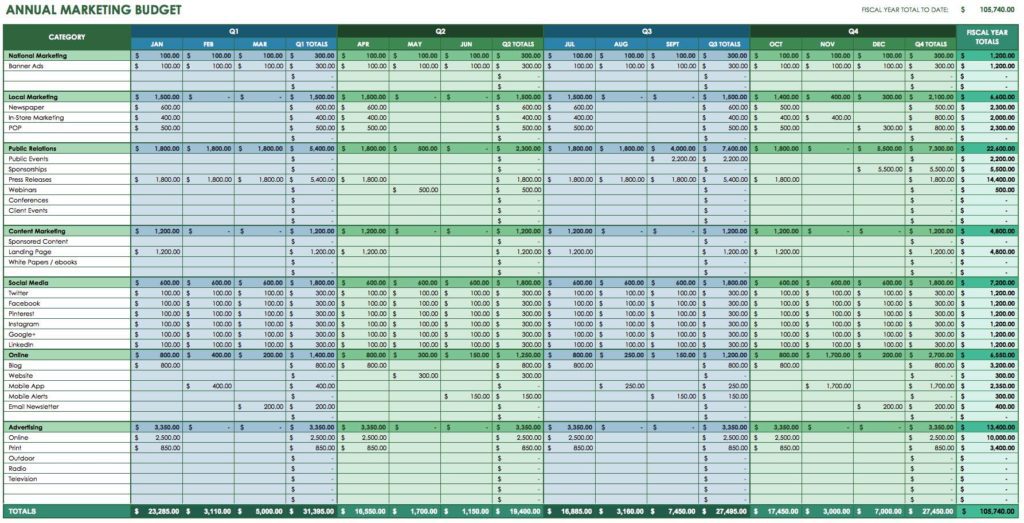

Better budgeting and forecasting

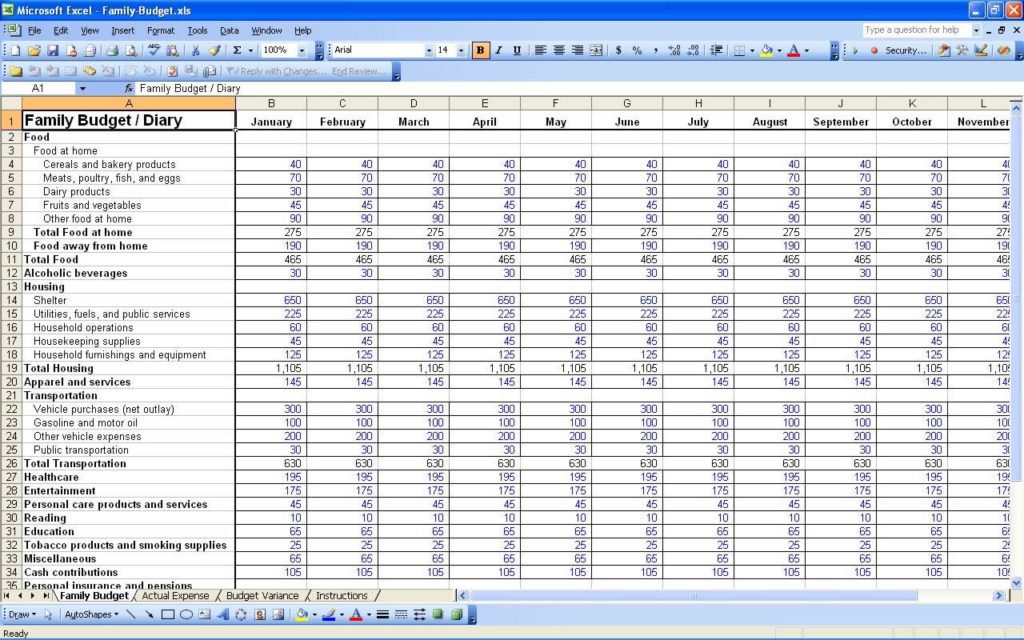

With a financial spreadsheet, you can create a budget and forecast your financial performance. This helps you to plan for the future and make informed business decisions.

Best practices for creating and using a financial spreadsheet for small businesses

Choose the right spreadsheet software

There are many spreadsheet software options available, such as Microsoft Excel, Google Sheets, and Apple Numbers. Choose the one that works best for your needs and budget.

Create a basic template

Start with a basic template that includes income, expenses, and cash flow categories. Customize it as per your business needs.

Regularly update your spreadsheet

To get the most out of your financial spreadsheet, you must regularly update it with accurate and up-to-date information.

Use formulas and functions

Formulas and functions are powerful tools that can help you to perform complex calculations and analysis easily. Learn how to use them to get the most out of your financial spreadsheet.

Keep it simple

A financial spreadsheet does not have to be complicated. Keep it simple and easy to understand, and use it to track the metrics that matter most to your business.

Categorize your expenses

Categorizing your expenses in your financial spreadsheet can help you better understand your spending patterns. Group expenses into categories such as rent, utilities, supplies, and advertising. This will help you identify areas where you can cut back on spending or allocate more resources.

Set financial goals

Setting financial goals is important for any small business. Use your financial spreadsheet to set realistic financial goals and track your progress towards achieving them. This will help you stay focused and motivated, and will also give you a sense of accomplishment when you reach your targets.

Use charts and graphs

Charts and graphs can help you visualize your financial data and make it easier to understand. Use them to display your revenue, expenses, and cash flow data in a clear and concise way. This will make it easier to identify trends, patterns, and areas for improvement.

Share your financial spreadsheet

Sharing your financial spreadsheet with key stakeholders such as investors, partners, or employees can help keep everyone on the same page. It can also help you get feedback and insights from others who may have different perspectives or expertise.

Backup your financial spreadsheet

Make sure to backup your financial spreadsheet regularly to avoid losing important data in case of a system failure or data loss. You can backup your spreadsheet to a cloud-based storage service or an external hard drive.

In conclusion, a financial spreadsheet is a crucial tool for small business owners to manage their finances effectively. It provides a structure and organization for your finances, allows you to keep accurate and up-to-date financial information, and enables you to perform financial analysis easily. By following the best practices for creating and using a financial spreadsheet, small business owners can gain greater control and insight into their finances, making informed business decisions that drive growth and success.