A financial budget worksheet is an online free to use template, designed specifically to help you track your expenses. Many companies have developed and produced these free to use Budget Templates to be available for free access on the web, so you can have them at absolutely no cost. By using this tool, you will have an easy time keeping track of your money as it is spent on things you need and want.

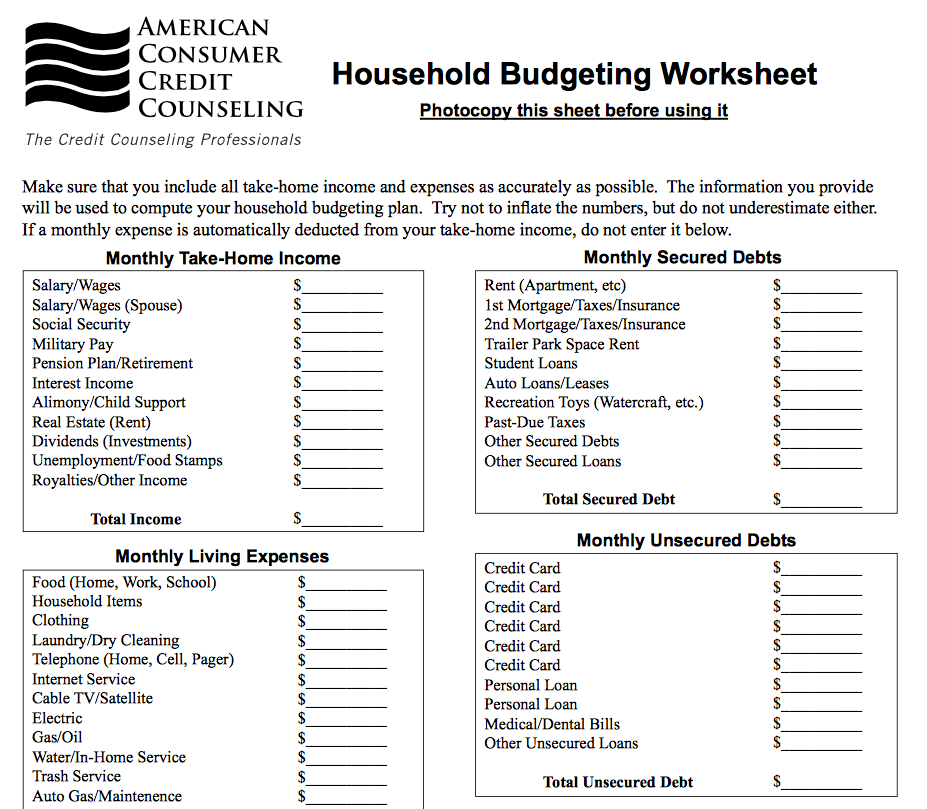

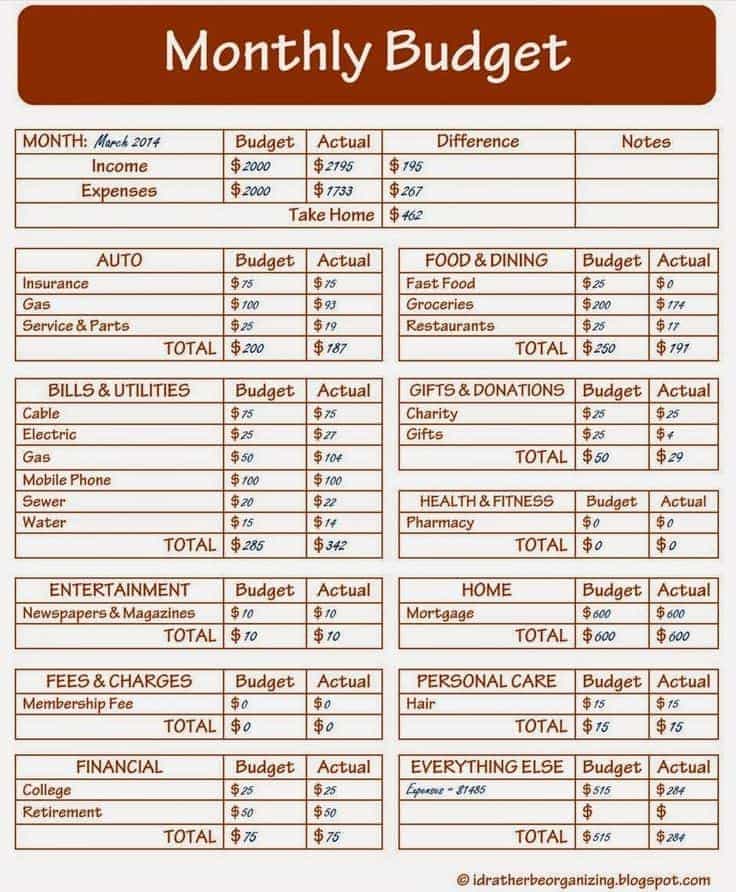

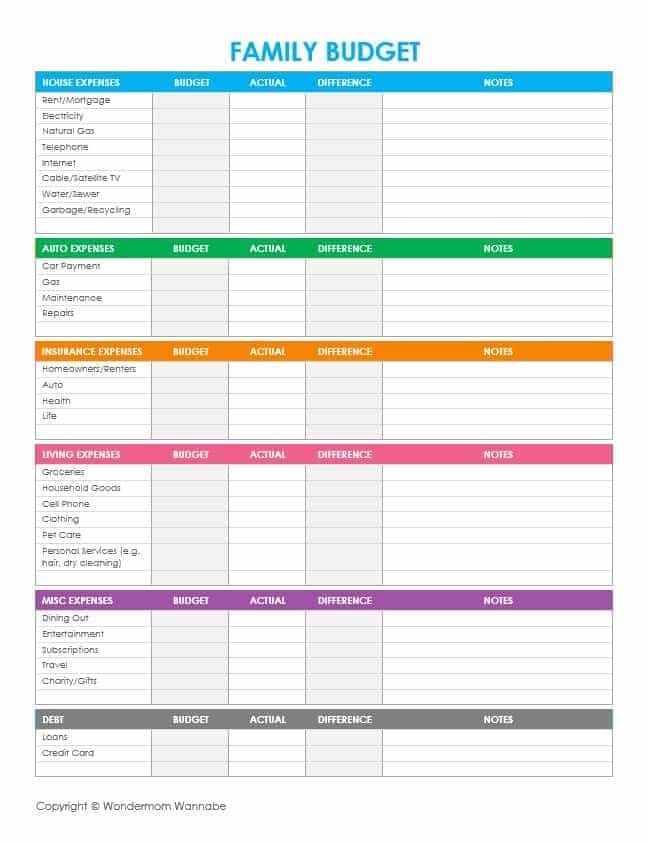

What’s an Online Budget? Basically a financial budget worksheet is a spreadsheet that you can input your expenses into in order to get a total cost or expense of all your expenses. The main purpose of a worksheet is to allow you to view your expenses at a glance, which will help you see where your money is being spent. Most online financial budget worksheets can also show you the total amount you currently owe on the debt, credit cards, etc. This is great information if you need to make any budgeting changes to your current financial situation.

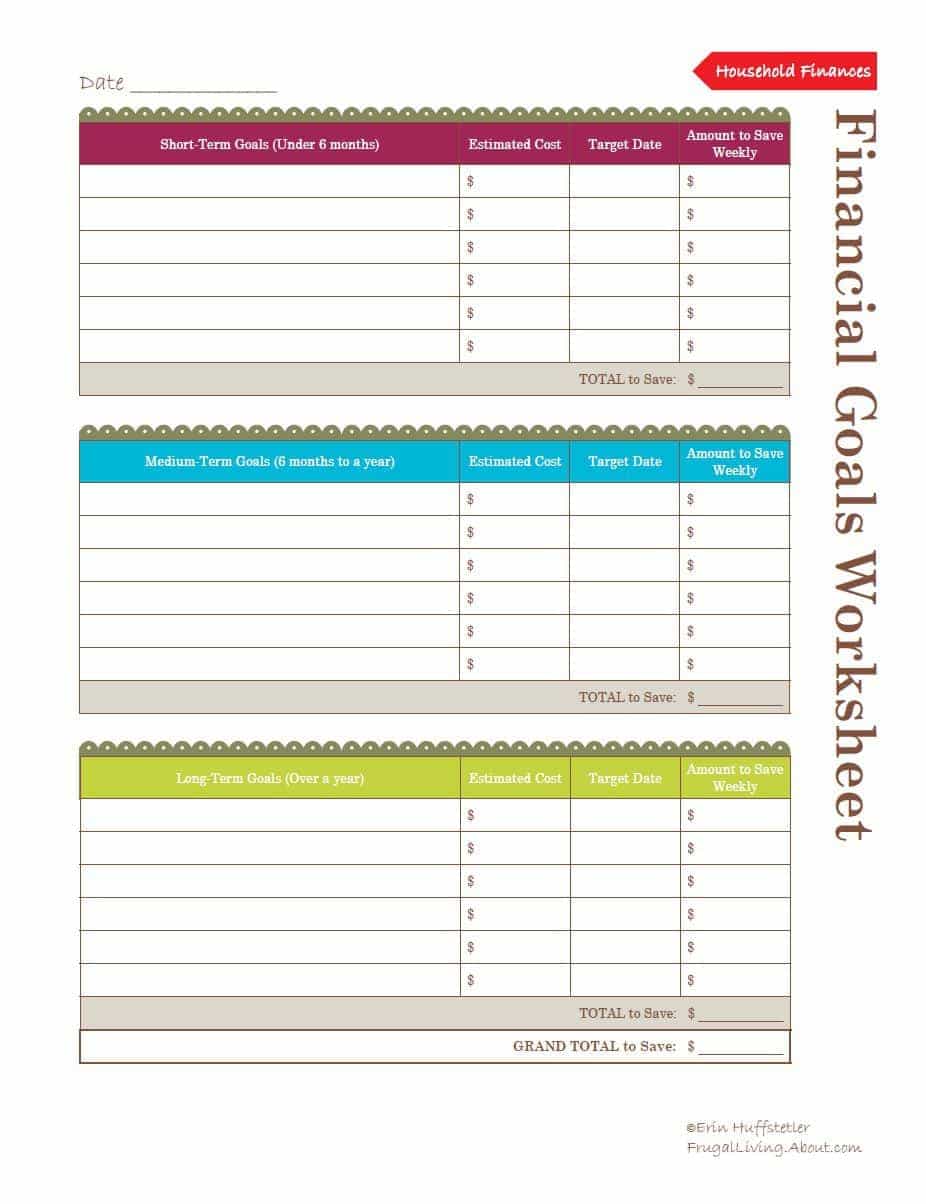

The reason you want to use financial budget worksheets to track your expenses is because they are very accurate and are completely customizable to fit just about any budget you may have. Here is some information on how to make your own financial worksheet that will help you track your expenses.

You should first of all take a look at the terms used in the online financial budget worksheet you are looking for. Some people use blank forms in to create their worksheets. If this is the case, make sure you fill in the form completely. If there is information missing, it may not be accurate. If you find yourself using a worksheet with blank fields that are filled in incorrectly, chances are the information isn’t going to be accurate.

Once you have chosen your worksheet, you can then click “Create Worksheet” on the top right corner of the screen to save time by creating an online financial budget worksheet within minutes. From there, it’s easy to insert a new expense, change the dates of when you spend the money, add more than one expense, or to just track any new changes that might come up in the future.

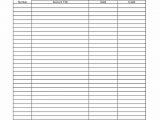

To track your financial status, you should always check to see if you are on track with your financial plan. To do this, take a look at your statement on a monthly basis. You should find that you have the following columns in which the amount of income, expenses, savings, and other miscellaneous expenses will be listed.

Expenses are items that you have to pay for at the end of the month and the difference between your income and expenses. Savings are things you have set aside to use at a later date. Any additional income is the difference between your income and expenses, if you have received an expense allowance. Anything else in between is called a miscellaneous expense.

To help you track your expenses, try adding the items that cost more in one column to the expenses than in another. To get a sense of the trend of your expenses, try to write down each of these expenses on a regular basis. Be sure to keep track of the trends in order to determine if you have a steady spending or saving trend going on.

Most online financial budget worksheets include an option where you can print out a copy of the results from your financial statements and take it with you to your bank. This is a great way to review what you are spending on and where you might be able to save.

You can also use this as a guide to create a personal budget. Just take a look at how much you are spending on each item on your monthly statement. Use the financial worksheet to identify the expenses that you are spending more money on and the areas where you can save money.

Financial statements can give you the tools you need to properly plan your financial planning for the future. You can look up information such as interest rates, the amount of money saved, monthly or annually, or how your financial plan is performing.