A Sample Credit Report from Equifax is a detailed summary of your credit history. Learn how to read and understand this report to take control of your financial future.

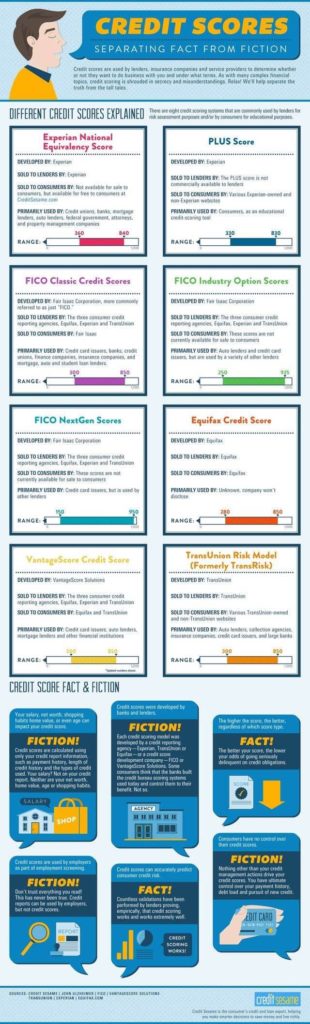

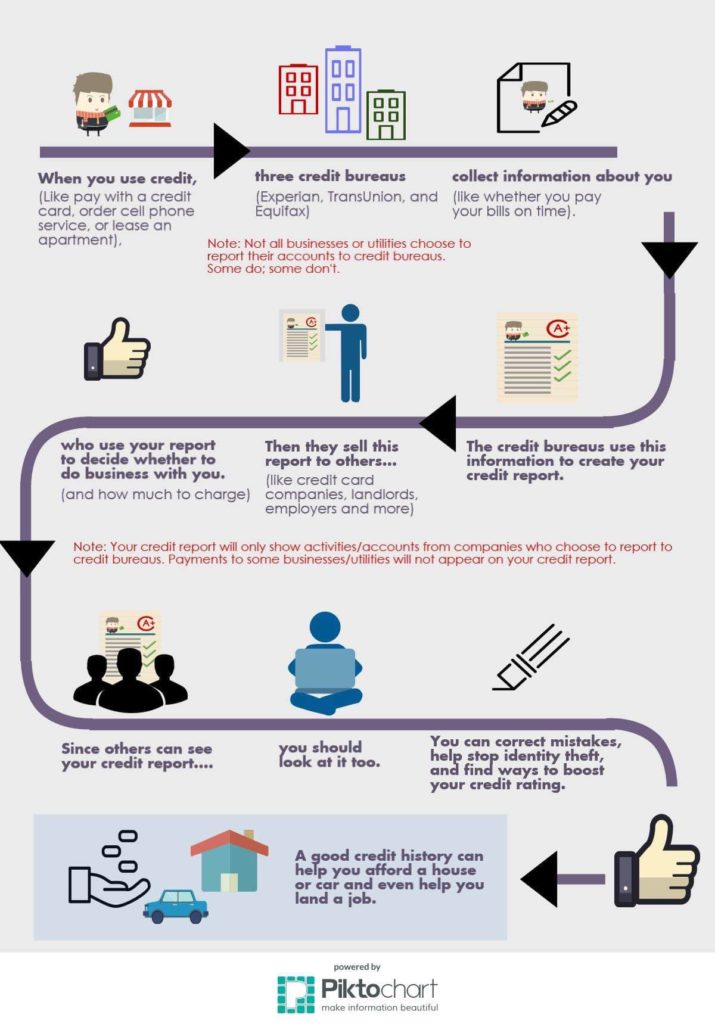

If you’re planning to take out a loan, rent an apartment, or apply for a credit card, your credit score plays a crucial role in the decision-making process. A credit score is a three-digit number that represents your creditworthiness, and it’s based on the information in your credit report. One of the three major credit reporting agencies, Equifax, provides a Sample Credit Report that gives you an idea of what lenders see when they review your credit history.

In this article, we’ll explore what a Sample Credit Report Equifax is and what information it contains. We’ll also provide tips on how to read and interpret this report.

What is a Sample Credit Report Equifax?

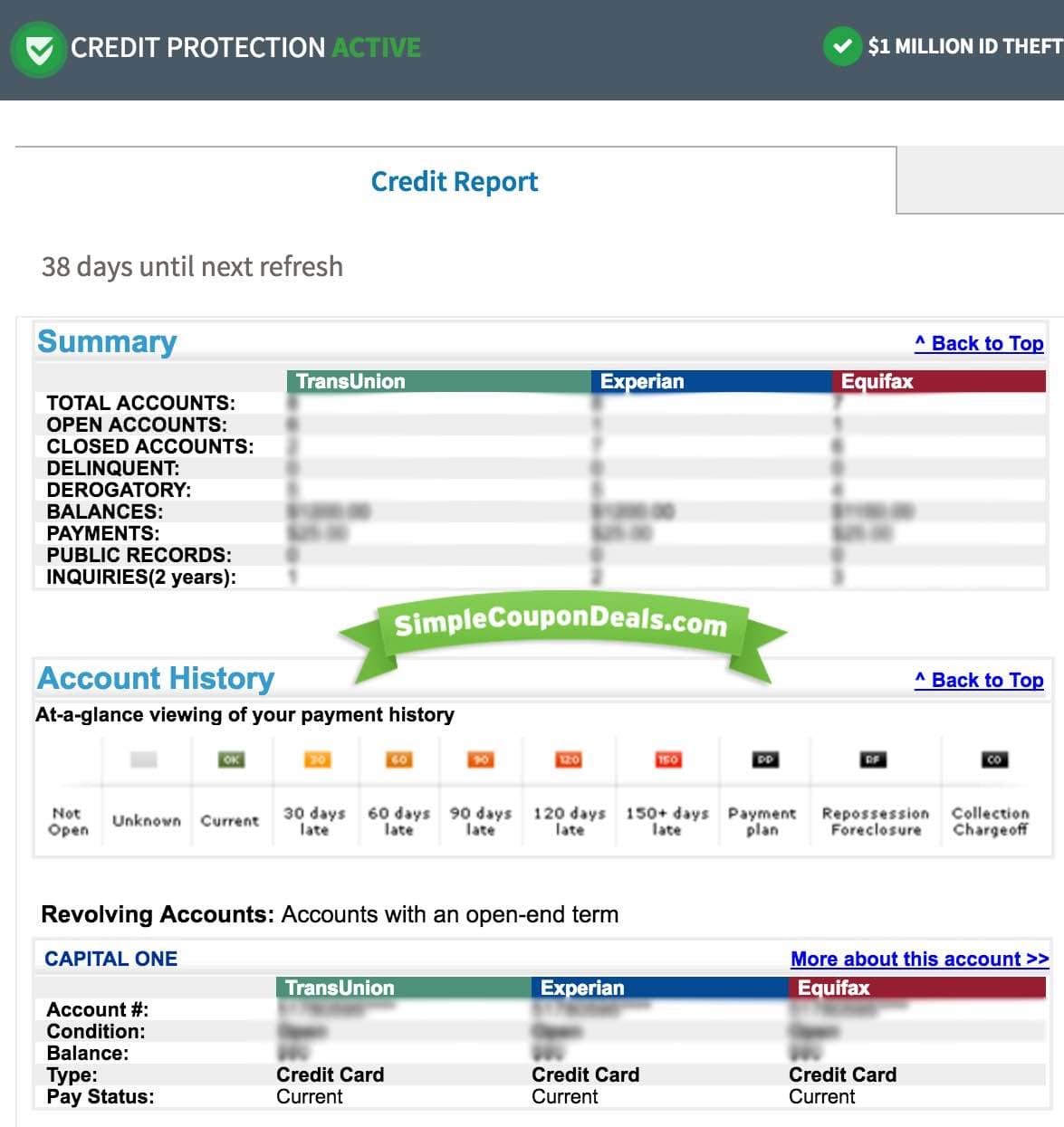

A Sample Credit Report from Equifax is a detailed summary of your credit history. It contains information such as your personal details, credit accounts, payment history, public records, and inquiries. Equifax uses this information to generate your credit score, which ranges from 300 to 850.

What Information Does a Sample Credit Report Equifax Contain?

- Personal Information

This section includes your name, address, date of birth, and Social Security number. It also includes your current and previous employers. - Credit Accounts

This section lists all of your credit accounts, including credit cards, loans, and mortgages. It shows the date you opened the account, the credit limit or loan amount, and your payment history. - Payment History

This section shows your payment history for each credit account. It includes the date of each payment, the amount paid, and whether the payment was on time or late. - Public Records

This section includes any bankruptcies, foreclosures, or liens on your record. - Inquiries

This section shows a list of companies that have requested your credit report in the past two years.

How to Read and Interpret a Sample Credit Report Equifax?

Reading a Sample Credit Report from Equifax can be overwhelming, but it’s important to understand what’s on it. Here are some tips on how to read and interpret your report:

- Check your personal information for accuracy

Make sure your name, address, and Social Security number are correct. - Review your credit accounts

Check that all of the accounts listed belong to you. Make sure the payment history is accurate, and that there are no late payments or collections. - Look for errors in the public records section

If you have any bankruptcies or foreclosures on your record, make sure they’re accurate. - Check the inquiries section

Make sure you recognize all of the companies listed. If there are inquiries you don’t recognize, it could be a sign of identity theft.

In Conclusion

A Sample Credit Report from Equifax is an important tool for understanding your credit history. By knowing what information is on your report and how to interpret it, you can take control of your financial future. Make sure to review your report regularly and correct any errors you find. With a good credit history and score, you’ll be on your way to achieving your financial goals.

It’s important to note that while Equifax provides a sample credit report, the report may vary depending on the credit reporting agency used by the lender. It’s a good idea to check your credit report from all three major credit reporting agencies (Equifax, Experian, and TransUnion) to ensure that your credit history is accurate and up-to-date.

If you find errors on your Sample Credit Report Equifax, you can dispute them by contacting Equifax directly. The credit reporting agency has a process for investigating and correcting errors on your credit report. It’s important to do this as soon as possible, as errors can negatively impact your credit score and financial future.

In addition to checking your credit report, it’s also important to monitor your credit score. There are many free tools available online that allow you to check your credit score regularly. Monitoring your credit score can help you identify any changes or potential issues with your credit history.

In conclusion, a Sample Credit Report Equifax is an important tool for understanding your credit history and taking control of your financial future. By knowing what information is on your report and how to interpret it, you can ensure that your credit history is accurate and up-to-date. Make sure to check your report regularly and correct any errors you find to maintain a good credit score and achieve your financial goals.