How to Create an Example of Business Expenses Spreadsheet for Your Small Business

Learn how to create an example of business expenses spreadsheet for your small business to track and manage your finances effectively. This article provides step-by-step guidance, tips, and best practices to help you get started.

If you’re a small business owner, keeping track of your expenses is crucial to the success of your business. One of the best ways to do this is by creating an example of business expenses spreadsheet that helps you to monitor and manage your finances effectively. In this article, we will provide you with step-by-step guidance on how to create an example of business expenses spreadsheet for your small business.

Step 1: Identify your expenses

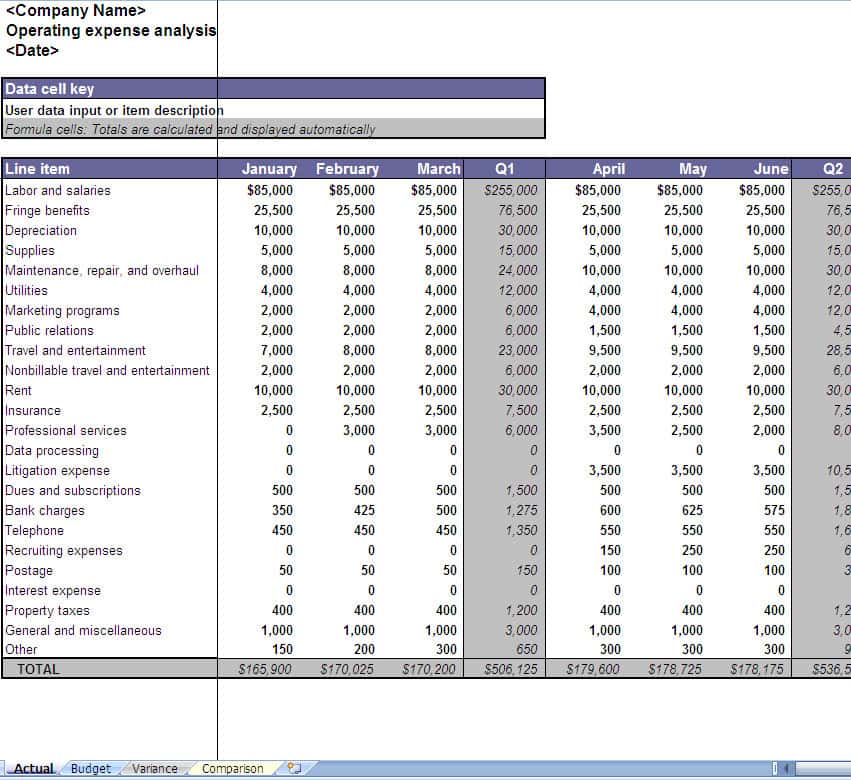

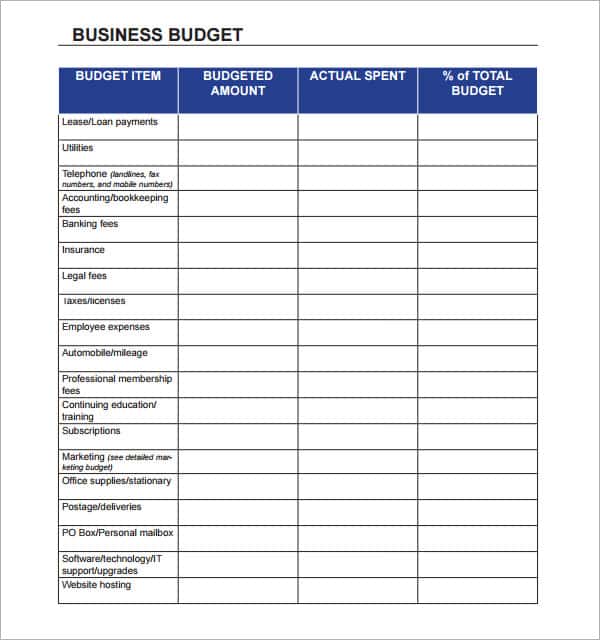

The first step in creating an example of business expenses spreadsheet is to identify all the expenses that your business incurs regularly. This may include expenses such as rent, utilities, office supplies, employee salaries, travel expenses, and more. Make a list of all these expenses and categorize them accordingly.

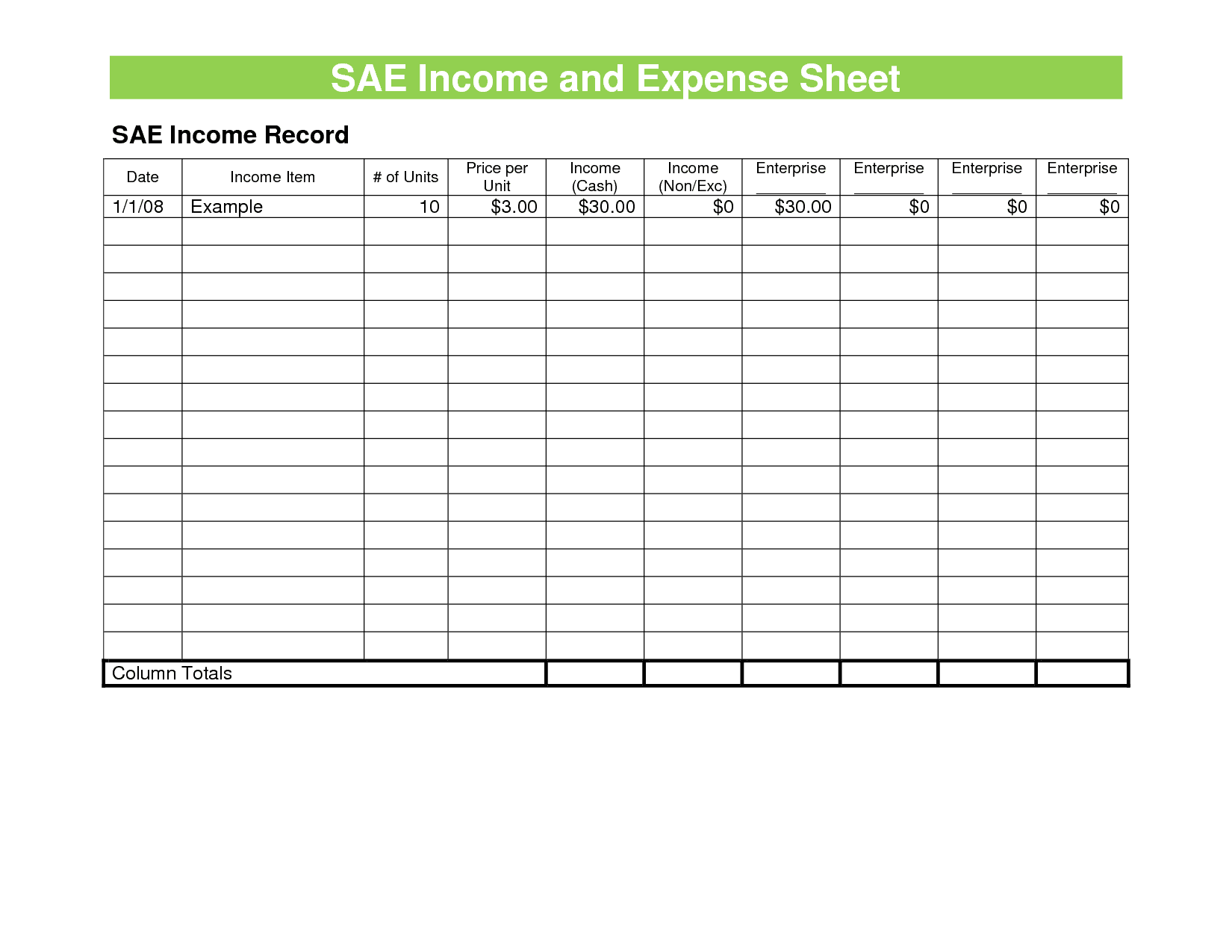

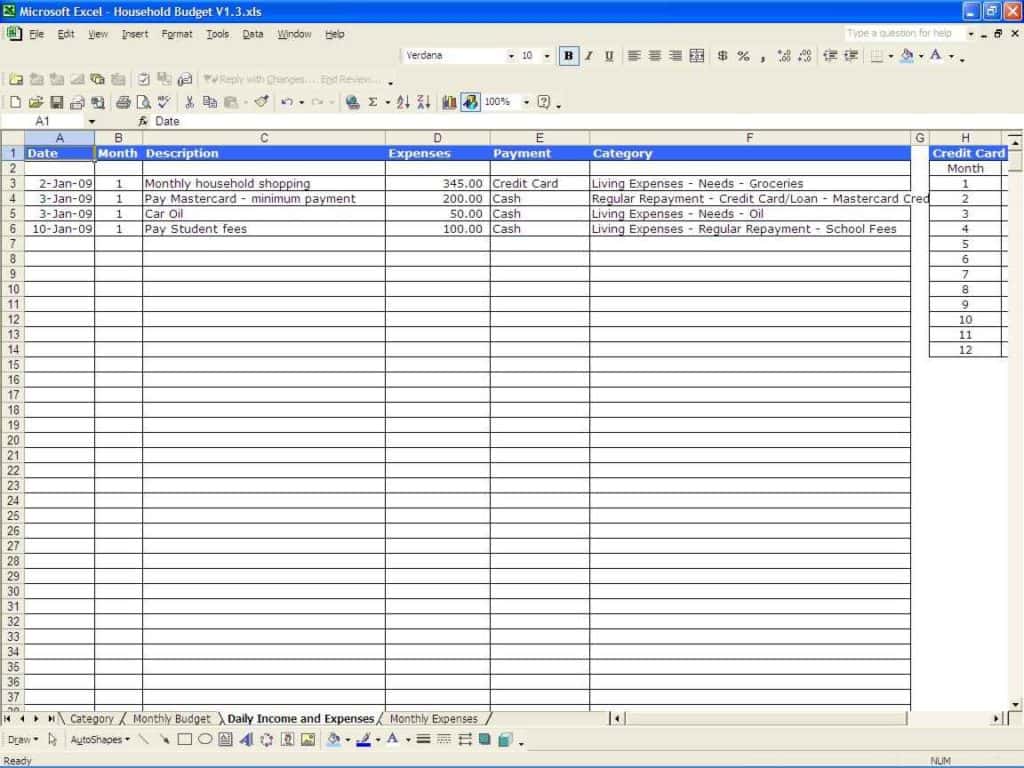

Step 2: Create a spreadsheet

The next step is to create a spreadsheet in a program like Microsoft Excel or Google Sheets. Start by creating columns for each category of expenses and rows for each month of the year. You may also want to include a column for the total amount of each expense.

Step 3: Add your expenses

Once you have your spreadsheet set up, you can start adding your expenses. Enter the amount of each expense in the appropriate column for the month it was incurred. Be sure to include all expenses, no matter how small they may seem.

Step 4: Track your expenses

As you add your expenses to the spreadsheet, be sure to keep track of them throughout the year. This will help you to stay on top of your finances and ensure that you don’t overspend.

Step 5: Review your expenses regularly

At the end of each month, review your expenses to see where you can cut costs or make adjustments. This will help you to stay on track and ensure that you are meeting your financial goals.

Tips and Best Practices:

- Keep your spreadsheet up-to-date on a regular basis to avoid any discrepancies in your finances.

- Use color coding or highlighting to make it easy to read and analyze your spreadsheet.

- Keep track of your receipts and invoices to ensure that you have accurate information for your spreadsheet.

- Use formulas to calculate your expenses automatically, such as SUM, AVERAGE, and COUNT.

- Keep a backup copy of your spreadsheet to avoid losing any important financial data.

Conclusion

Creating an example of business expenses spreadsheet can help you to manage your finances effectively and make informed decisions about your business. By following the steps outlined in this article and implementing the tips and best practices, you can create a spreadsheet that works for your business and helps you to achieve your financial goals.

Furthermore, having a detailed record of your business expenses can also help you during tax season. It can make it easier for you or your accountant to prepare and file your taxes, as well as provide a clear picture of your business’s financial health.

In addition to tracking your expenses, you may also want to use your spreadsheet to create a budget for your business. This can help you to set financial goals and ensure that you are allocating your resources effectively. By tracking your expenses and sticking to your budget, you can avoid overspending and stay on track towards achieving your business objectives.

Another benefit of using a spreadsheet to track your expenses is that it can help you to identify areas where you may be able to save money. For example, if you notice that your office supply expenses are higher than you anticipated, you may be able to find more affordable alternatives or negotiate better deals with your suppliers.

In conclusion, creating an example of business expenses spreadsheet is an essential task for any small business owner. It can help you to track and manage your finances effectively, make informed decisions about your business, and stay on track towards achieving your financial goals. By following the steps and tips outlined in this article, you can create a spreadsheet that works for your business and provides you with the financial insights you need to succeed.