Learn how to create a comprehensive employee expense reimbursement policy sample that can streamline your company’s financial processes and ensure fair reimbursement for all employees.

One of the most significant expenses for any company is employee expenses. Whether it is travel, entertainment, or other business-related expenses, employees often incur costs that need to be reimbursed by the company. To manage these expenses effectively, it is important to have a clear and comprehensive employee expense reimbursement policy in place.

In this article, we will provide you with a guide to creating an effective employee expense reimbursement policy sample. We will cover the key elements that should be included in the policy and provide you with some tips on how to ensure that it is implemented effectively.

What is an Employee Expense Reimbursement Policy Sample?

An employee expense reimbursement policy sample is a set of guidelines that outlines how employees can claim expenses and what expenses are eligible for reimbursement. It ensures that employees are reimbursed fairly for business-related expenses and helps to streamline the company’s financial processes.

Key Elements of an Employee Expense Reimbursement Policy Sample

- Eligible Expenses

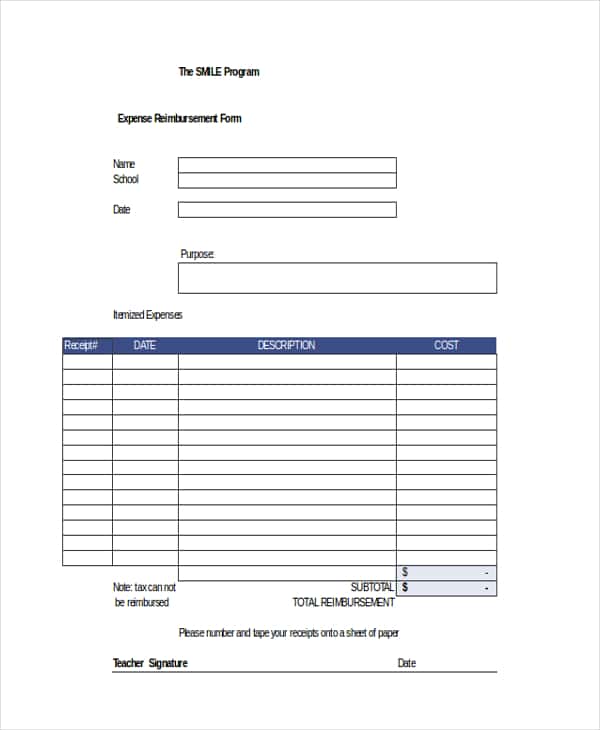

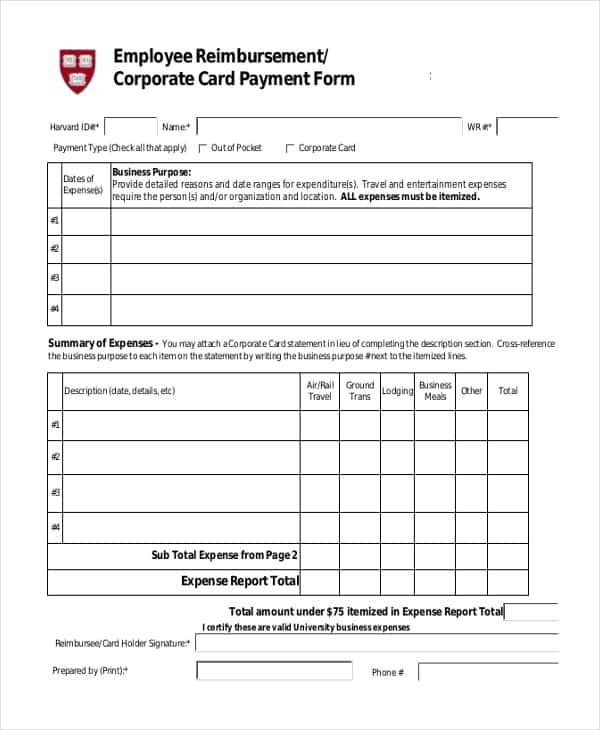

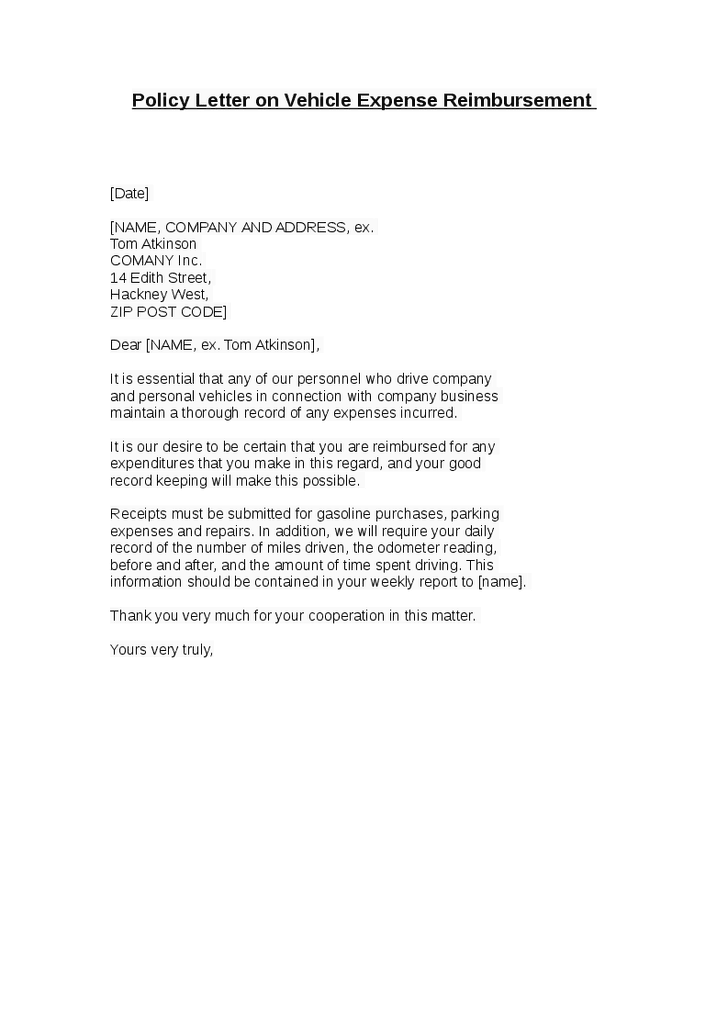

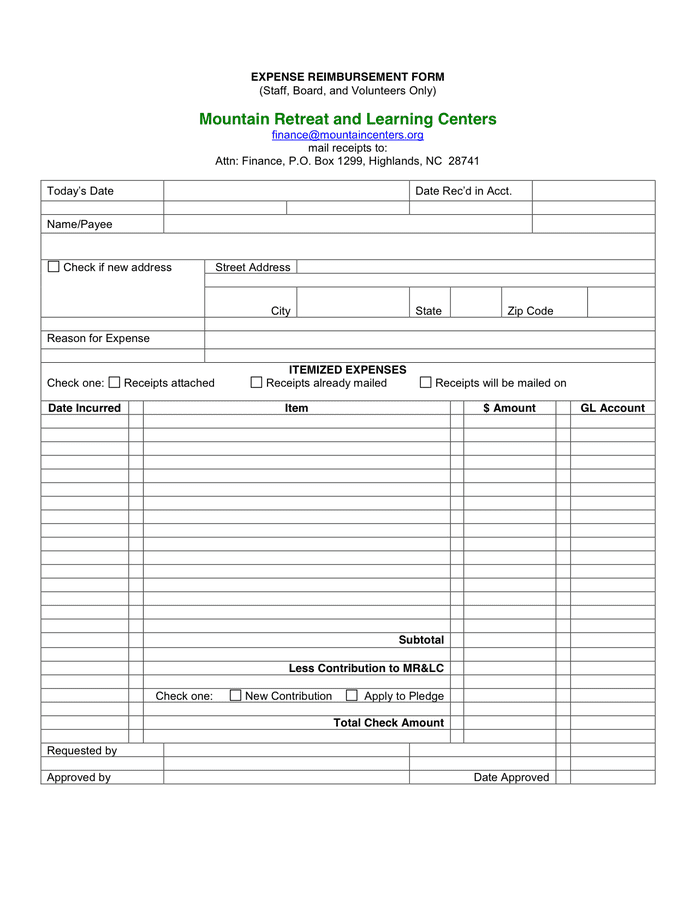

The policy should clearly define what expenses are eligible for reimbursement. This can include travel expenses, meals, entertainment, and other business-related expenses. - Documentation Requirements

The policy should outline the documentation requirements for expense reimbursement. This can include receipts, invoices, and other supporting documentation. - Approval Process

The policy should define the approval process for expense reimbursement. This can include who is responsible for approving expenses, the timeline for approval, and any other relevant details. - Payment Process

The policy should outline the payment process for expense reimbursement. This can include how employees will be reimbursed (e.g., through payroll or direct deposit) and the timeline for payment. - Policy Enforcement

The policy should outline the consequences of non-compliance with the policy, including disciplinary action if necessary.

Tips for Implementing an Employee Expense Reimbursement Policy Sample

- Communicate the Policy

Ensure that all employees are aware of the policy and understand how to use it. This can be done through training sessions, email reminders, or other communication channels. - Simplify the Process

Keep the expense reimbursement process as simple as possible. This can include using online tools to submit and track expenses, providing clear instructions, and streamlining the approval process. - Monitor Compliance

Regularly monitor compliance with the policy to ensure that it is being followed correctly. This can include reviewing expense reports, conducting audits, and providing feedback to employees. - Update the Policy

Regularly review and update the policy to ensure that it remains relevant and effective. This can include incorporating changes in tax laws, updating reimbursement rates, and adjusting approval processes as necessary.

Conclusion

Creating an effective employee expense reimbursement policy sample is essential for any company that wants to manage its expenses effectively and ensure fair reimbursement for all employees. By including the key elements outlined in this article and following the implementation tips provided, you can create a policy that is clear, simple, and effective.

Additionally, having an effective employee expense reimbursement policy sample can help to reduce the risk of fraud and misuse of company funds. It provides a clear framework for employees to follow and ensures that all expenses are reviewed and approved before reimbursement.

When creating your policy, it is important to consider the unique needs of your company and employees. For example, if your company has a lot of employees who travel frequently, you may need to include additional details on travel expenses and documentation requirements. Similarly, if your company has a complex approval process, you may need to provide more detailed guidance on how to navigate this process.

Overall, an effective employee expense reimbursement policy sample is an essential component of any company’s financial management strategy. By following the key elements outlined in this article and implementing the tips provided, you can create a policy that meets the needs of your company and employees and helps to ensure fair and transparent reimbursement for all business-related expenses.

In conclusion, it is recommended that every company establishes an employee expense reimbursement policy sample. This policy should clearly outline the eligible expenses, documentation requirements, approval process, payment process, and policy enforcement. Additionally, it is essential to communicate the policy effectively, simplify the process, monitor compliance, and update the policy regularly to ensure that it remains effective. By doing so, you can streamline your company’s financial processes and ensure fair reimbursement for all employees.