Monthly Retirement Planning Worksheet Answers: A Guide to Planning Your Retirement

Retirement planning is essential for everyone, regardless of age or income level. Whether you are starting your career or nearing the end of it, planning for retirement is crucial to ensure you have the financial resources to support your lifestyle after retirement. Monthly retirement planning worksheet answers can help you plan your retirement and make sure you are financially secure.

What is a Monthly Retirement Planning Worksheet?

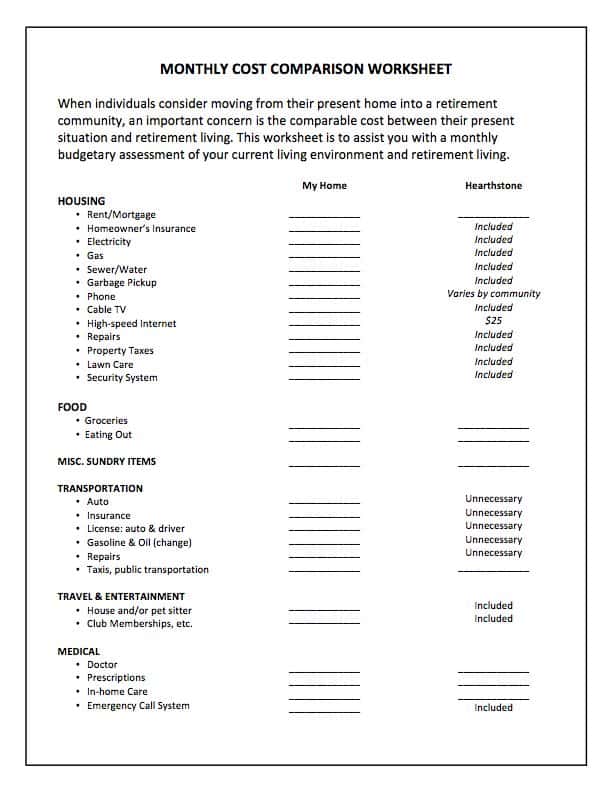

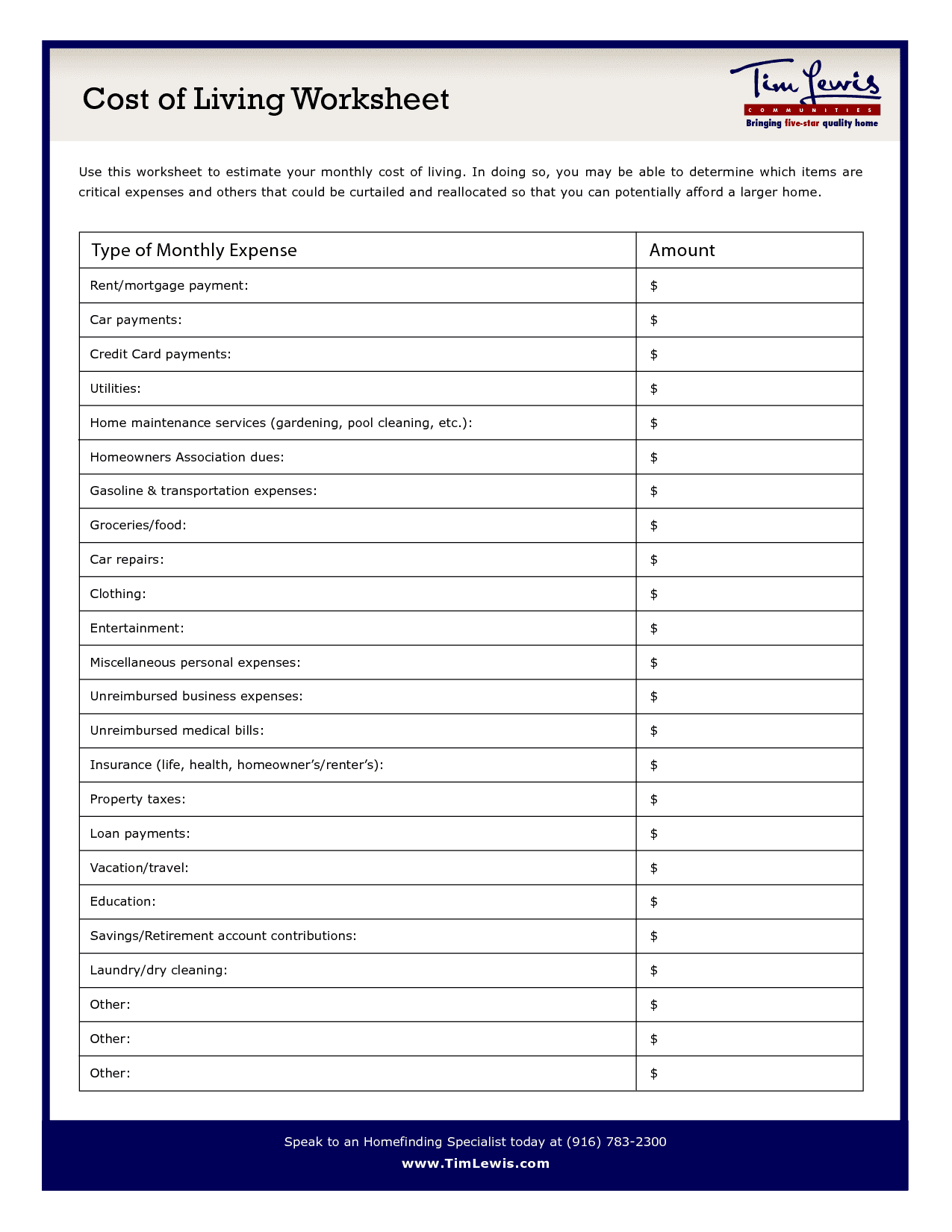

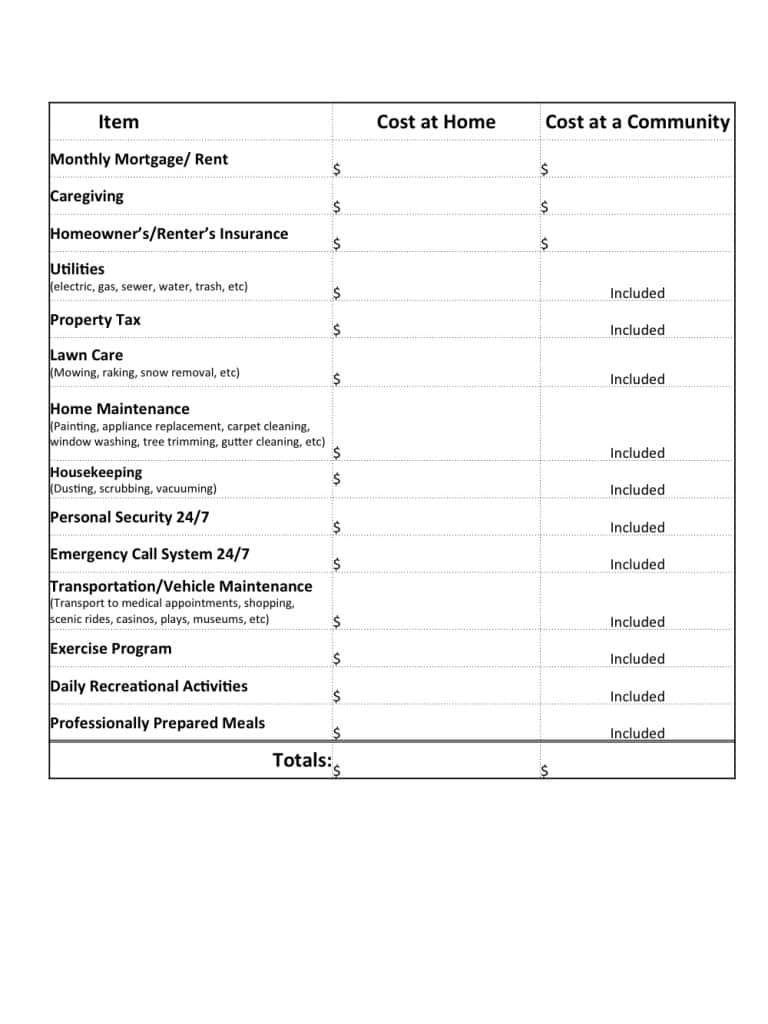

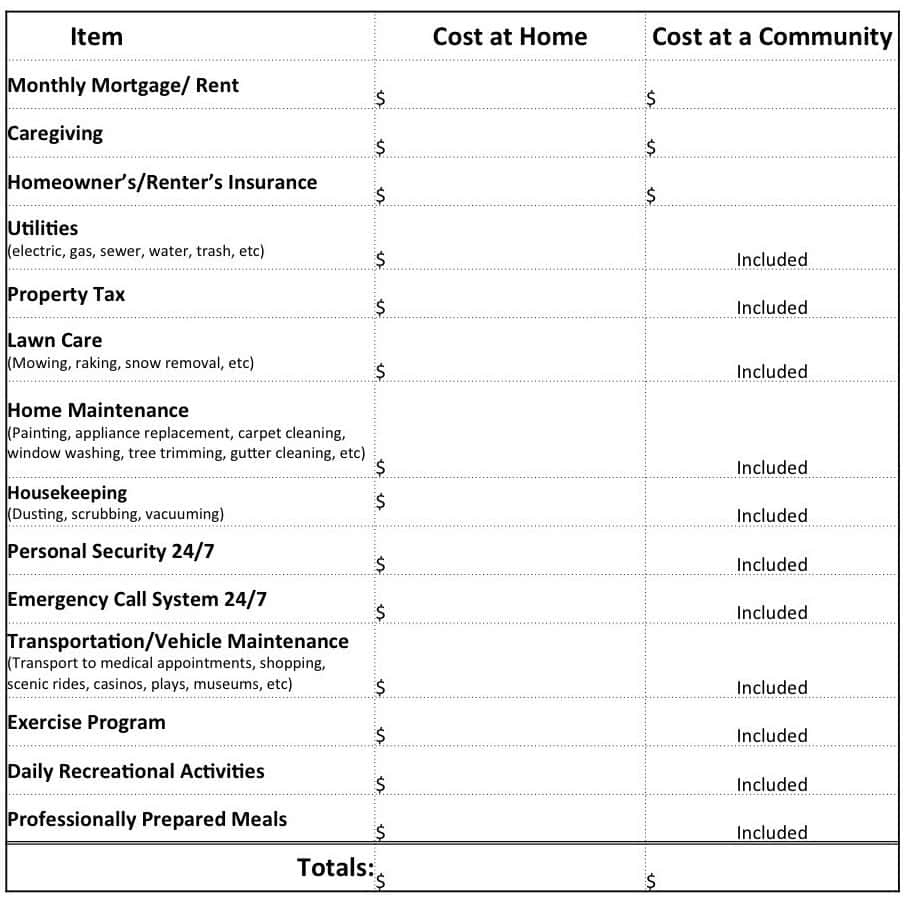

A monthly retirement planning worksheet is a tool that helps you assess your current financial situation and create a plan for your retirement. The worksheet typically includes sections that help you determine your current income, expenses, and assets. It also includes sections that help you set retirement goals, calculate your retirement income needs, and estimate your retirement savings.

Why Use a Monthly Retirement Planning Worksheet?

Using a monthly retirement planning worksheet can be very helpful because it helps you understand your current financial situation and make informed decisions about your retirement. The worksheet provides a clear picture of your current income, expenses, and assets, which can help you identify areas where you can save more money.

Additionally, a retirement planning worksheet helps you set realistic retirement goals and create a plan to achieve them. By using the worksheet, you can estimate your retirement income needs and determine how much you need to save each month to achieve your goals.

Monthly Retirement Planning Worksheet Answers

To help you get started on your retirement planning journey, we have compiled some common questions and answers related to monthly retirement planning worksheet answers.

- What should be included in a monthly retirement planning worksheet?A monthly retirement planning worksheet should include the following sections:

- Current Income: This section should include all sources of income, including salary, investment income, and any other sources of income.

- Current Expenses: This section should include all current expenses, including mortgage or rent payments, utilities, insurance, groceries, and any other expenses.

- Assets: This section should include all assets, including savings accounts, retirement accounts, investments, and any other assets.

- Retirement Goals: This section should include your retirement goals, such as the age at which you want to retire and the lifestyle you want to maintain after retirement.

- Retirement Income Needs: This section should include your estimated retirement income needs, including how much you will need to cover your expenses and any additional expenses you may have.

- Retirement Savings: This section should include your current retirement savings, as well as how much you need to save each month to achieve your retirement goals.

- How can I estimate my retirement income needs?

To estimate your retirement income needs, you should first determine your estimated retirement expenses. This includes your basic living expenses, such as housing, food, and healthcare, as well as any additional expenses you may have, such as travel or hobbies. Once you have estimated your expenses, you can then calculate how much retirement income you will need each month to cover those expenses.

- How much should I save for retirement each month?

The amount you should save for retirement each month depends on several factors, including your current income, retirement goals, and estimated retirement income needs. As a general rule, financial experts recommend saving at least 10-15% of your income for retirement. However, the exact amount you should save will vary based on your individual circumstances.

- Can I use a retirement planning worksheet if I am already retired?

Yes, you can use a retirement planning worksheet even if you are already retired. The worksheet can help you assess your current financial situation and make informed decisions about how to manage your retirement income.

Conclusion

Retirement planning is essential for everyone, and a monthly retirement planning worksheet can be a valuable tool in creating a solid retirement plan. By using the worksheet, you can assess your current financial situation, set realistic retirement goals, estimate your retirement income needs, and determine how much you need.

Retirement planning can be an overwhelming and daunting task, especially when you’re not sure where to start. Thankfully, there are various tools and resources available to help make the process more manageable, such as monthly retirement planning worksheet answers.

A monthly retirement planning worksheet is a tool that can help you keep track of your expenses, income, and savings goals. It provides a framework for you to develop a retirement plan that suits your lifestyle, preferences, and financial situation. By answering questions on the worksheet, you can gain a clearer understanding of your current retirement savings and what steps you need to take to achieve your financial goals.

One of the benefits of using a monthly retirement planning worksheet is that it allows you to identify your expenses accurately. It can be easy to underestimate your expenses or forget about certain expenses when planning for retirement. A monthly worksheet helps you track your expenses each month and ensure that you have accounted for everything.

Another benefit of using a monthly retirement planning worksheet is that it helps you calculate how much you need to save each month to reach your retirement goals. By inputting your current savings, expected income, and retirement goals, the worksheet can provide you with a realistic estimate of how much you need to save each month to achieve your desired retirement lifestyle.

When looking for monthly retirement planning worksheet answers, it’s important to find a template that suits your needs. Many financial institutions, including banks, offer free worksheets that you can download and use. Additionally, there are many online resources that provide retirement planning tools and worksheets. These resources can be a great way to get started on your retirement planning journey.

To get the most out of your monthly retirement planning worksheet, it’s essential to be honest and realistic with your answers. Avoid inflating your income or underestimating your expenses, as this can lead to unrealistic expectations and goals. Additionally, make sure to update your worksheet regularly to reflect changes in your financial situation or retirement goals.

In conclusion, monthly retirement planning worksheet answers can be a valuable tool in helping you plan for a comfortable and financially secure retirement. By accurately tracking your expenses, income, and savings goals, you can create a personalized plan that suits your needs and lifestyle. With the right tools and resources, you can feel confident about your retirement future.