Dive into the world of financial management with a Profit and Loss Sheet Example. Learn how to track your business’s performance and make informed decisions.

In the dynamic realm of business, managing finances effectively is a paramount necessity. To navigate the intricate web of revenue, expenses, and profitability, one essential tool at your disposal is the Profit and Loss Sheet. In this article, we’ll delve into the intricacies of financial management by exploring a Profit and Loss Sheet Example. This comprehensive guide will help you gain a deeper understanding of how this tool works and how it can steer your business toward success.

Understanding the Profit and Loss Sheet

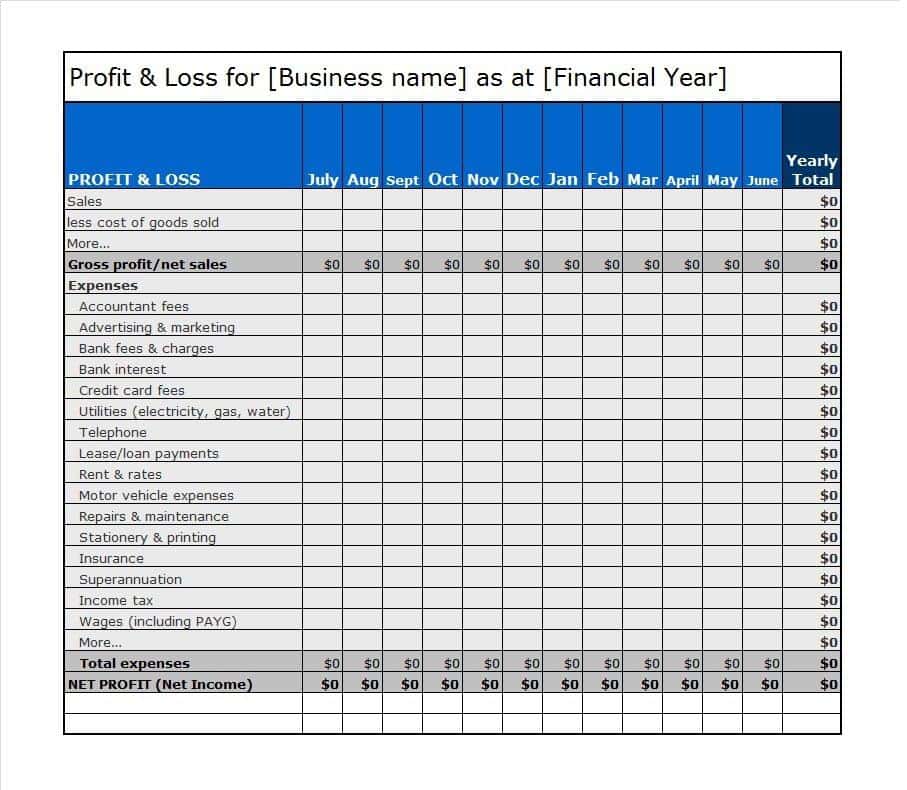

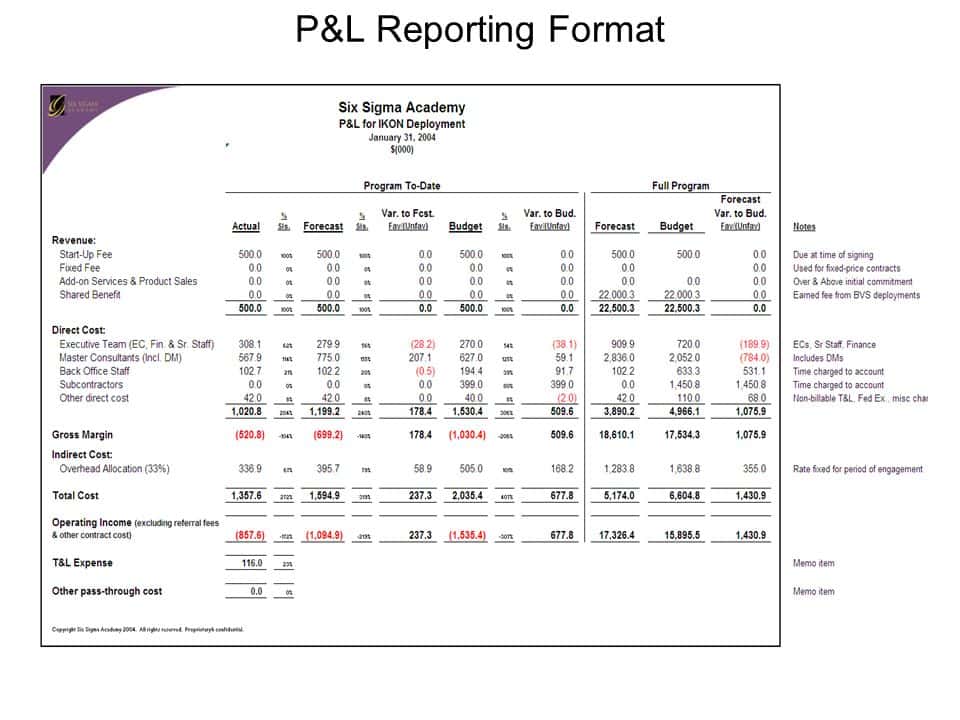

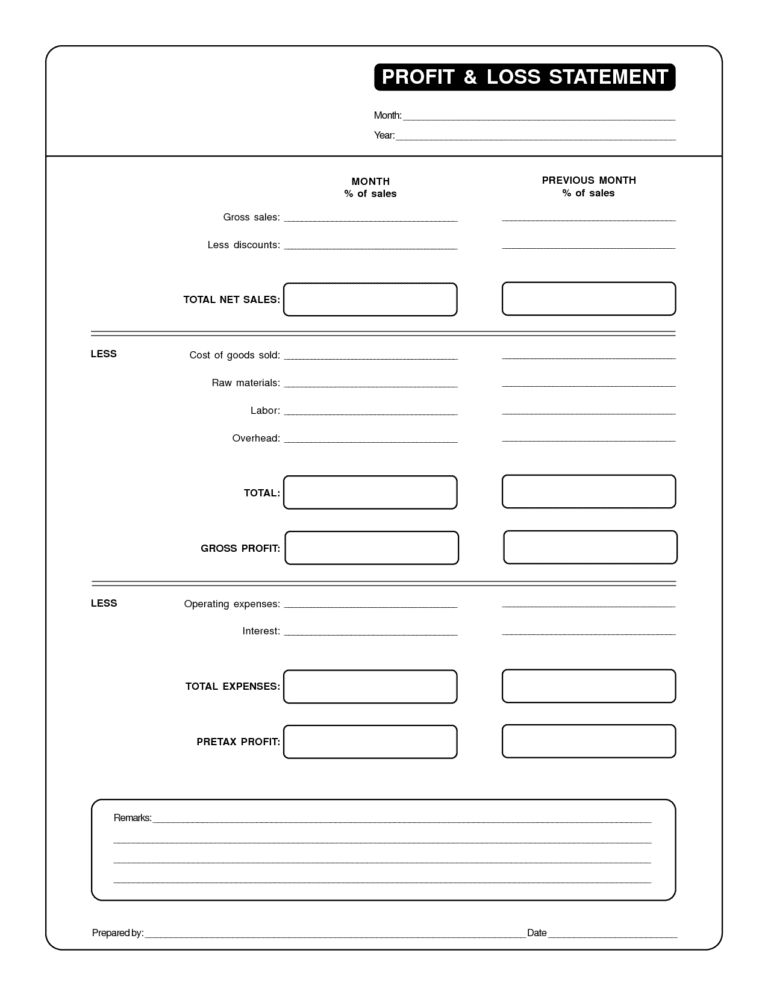

A Profit and Loss Sheet, often referred to as an Income Statement, is a financial document that provides a snapshot of a business’s financial performance during a specific period. It is a vital component of financial reporting, allowing you to evaluate your business’s profitability and make informed decisions. Now, let’s break down the key components of this important document.

1. Revenue (Income)

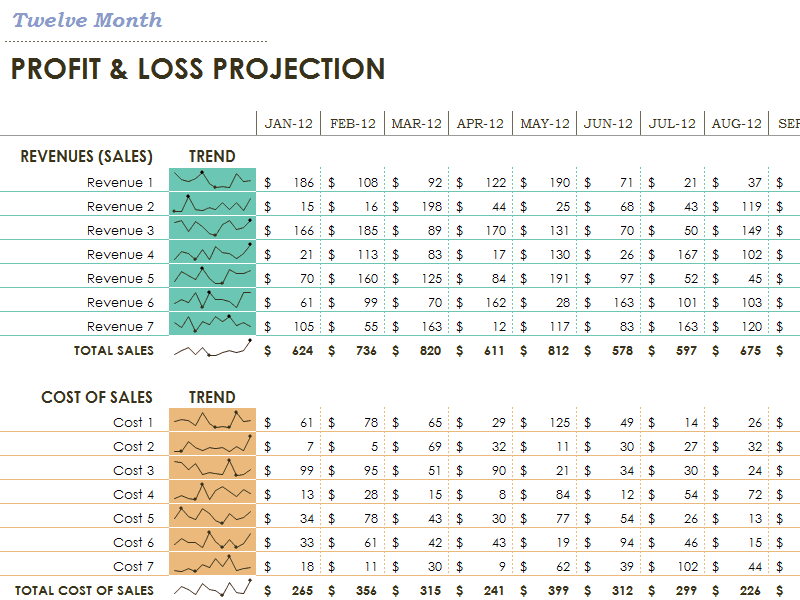

Revenue represents the total income generated by your business within a given timeframe. This can include sales, service fees, interest, and any other source of income. In our Profit and Loss Sheet Example, we’ll illustrate how to categorize and calculate your total revenue.

2. Cost of Goods Sold (COGS)

The Cost of Goods Sold encompasses the direct costs associated with producing or delivering your product or service. In the example, we’ll guide you on how to calculate COGS and understand its impact on your overall profitability.

3. Gross Profit

Gross profit is the difference between your total revenue and the cost of goods sold. It’s a crucial metric for assessing your core business operations’ profitability. We’ll show you how to calculate this in our example.

4. Operating Expenses

Operating expenses are all the costs incurred while running your business, such as rent, utilities, salaries, and marketing expenses. We’ll provide an illustrative breakdown of these expenses in our example.

5. Operating Income (Operating Profit)

Operating income is your gross profit minus operating expenses. This figure tells you how profitable your core business activities are.

6. Other Income and Expenses

These include non-operating income and expenses, like interest income, interest expenses, or gains/losses from investments. We’ll show you how to incorporate these into your Profit and Loss Sheet Example.

7. Net Income (Profit or Loss)

The net income is the final result, indicating whether your business made a profit or incurred a loss during the period in question. It’s the bottom line that determines your financial success.

Why Is a Profit and Loss Sheet Important?

A Profit and Loss Sheet Example is more than just a piece of paper filled with numbers. It’s a powerful tool that helps you make informed decisions about your business. Here’s why it’s so crucial:

- Financial Assessment

By regularly preparing and analyzing your Profit and Loss Sheet, you can assess your business’s financial health. It allows you to identify areas of strength and weakness. - Budgeting and Planning

Your Profit and Loss Sheet helps in creating realistic budgets and financial forecasts. With this information, you can plan for the future with greater confidence. - Investor and Lender Confidence

When seeking investments or loans, potential investors and lenders often request your Profit and Loss Sheet. Having a well-organized example can instill confidence in them. - Tax Reporting

It’s essential for tax purposes as it summarizes your business’s income and expenses, simplifying the process of filing taxes. - Strategic Decision-Making

The data in your Profit and Loss Sheet empowers you to make strategic decisions, such as pricing adjustments, cost-cutting measures, or expanding your operations.

Creating Your Profit and Loss Sheet Example

To create a Profit and Loss Sheet, you’ll need to gather financial data for a specific period, typically monthly, quarterly, or annually. You can use accounting software like QuickBooks, Excel, or other dedicated tools to streamline the process. Our example will guide you through setting up a basic template and populating it with your data.

Conclusion

In the ever-evolving landscape of business, mastering financial management is a non-negotiable skill. A Profit and Loss Sheet Example is your compass in this financial journey, helping you steer your business towards profitability and success. Whether you’re a small business owner, an aspiring entrepreneur, or a seasoned financial professional, understanding the nuances of this essential document can be the key to unlocking financial prosperity.

So, embrace the power of the Profit and Loss Sheet and start making data-driven decisions that lead to financial success. Your business’s future is in your hands, and with the right knowledge, you can make it a profitable one.