The most important aspect of a business today is the ability to track your business expenses, assets, and revenues. When you use a spreadsheet program to keep track of all of your transactions, it allows you to be in control of your finances. It is very easy to use this tool with Microsoft Excel.

As you get older, it becomes harder to calculate things so when you can calculate them it is always better. You never know what the future holds when you are not there to monitor every dollar you spend on items you do not need. With tracking spreadsheets, you can see everything you need to know about your finances before you spend any of it. With an accounting spreadsheet, you can track any type of expense including income and expense taxes.

One of the best ways to find out how much your business expenses are is to start tracking your business expenses with a spreadsheet. You may be surprised at how much you are spending when you first start using these spreadsheets. However, you will quickly realize how easy it is to use when you learn to properly use it. You will be amazed at the amount of information you can access to keep track of all your transactions.

Many people who need help managing their finances are using a cost estimator to help them track and manage their finances. Since these are similar to spreadsheets but are pre-calculated for you, it saves you time when you are trying to find out how much your bills are and how much you have left over for the month. This saves you the trouble of needing to go through the math on your own.

If you want to make your business expenses a little easier to track, you can create a business expense planner which is very similar to a spreadsheet. You can also create invoices that are formatted differently to help you identify the items that need to be tracked. It will also help you save time and money when you are attempting to maintain your finances.

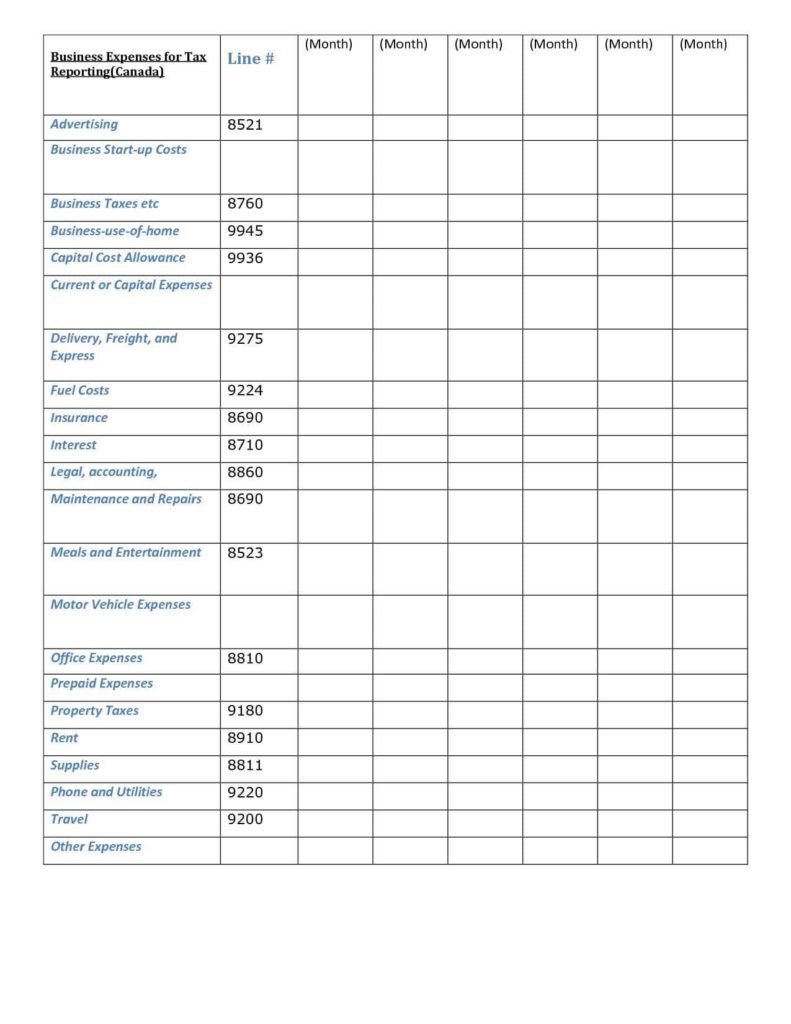

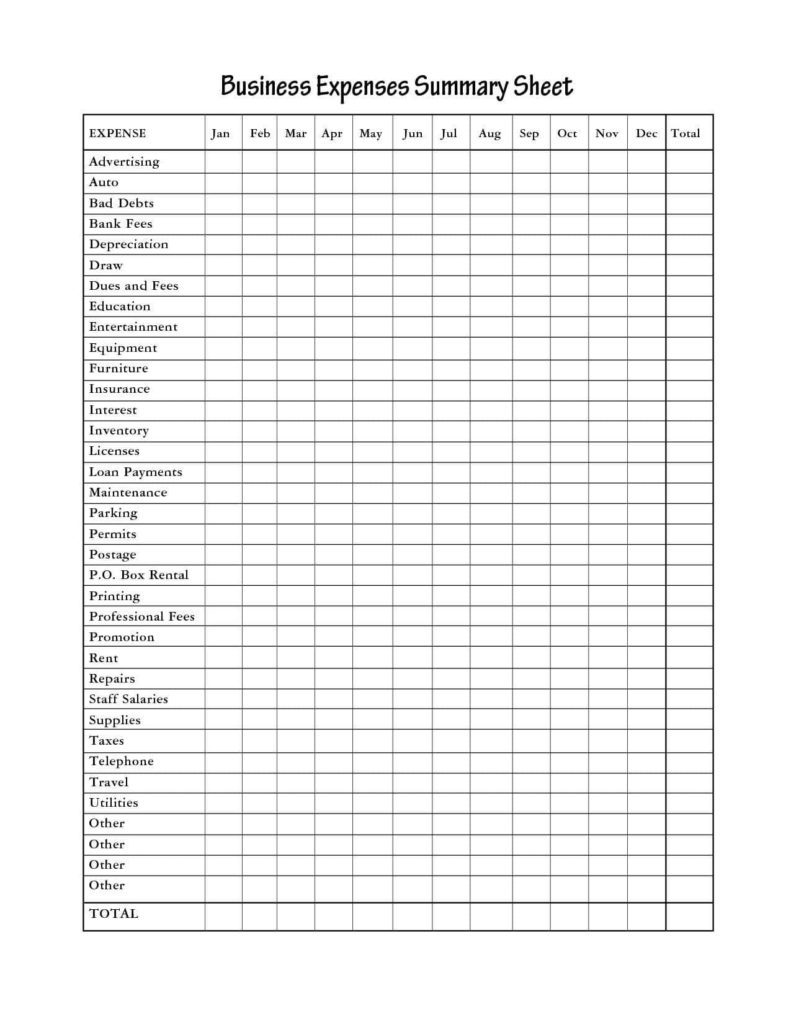

Another way to track your expenses is to create an expense sheet. This is similar to what is referred to as a tracking expense sheet, however, it is not pre-calculated like a cost estimator. This is a great way to track everything from payroll to order placement.

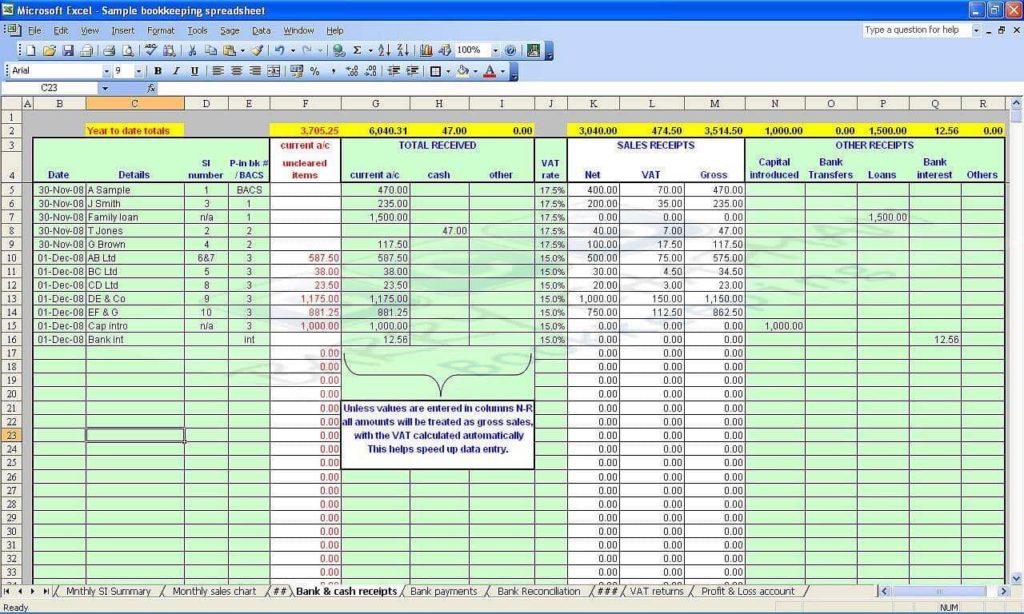

It is a good idea to create a cash flow chart for each month so you can keep track of your business sales. You will need to make sure that you use this type of sheet as an outline, but if you have a real operating expense program, then you can create your own financial summary. Once you have created your financial summary, you can take inventory of the products you are selling, so you can see what you are really spending your time and money on.

If you are managing your business expenses, it is important to make sure that you are creating a proper budget and sticking to it. It can be difficult to keep up with your business expense when you do not have a solid budget. You will find that once you learn how to use spreadsheets, you will be able to create a financial summary and know where your money is going.