If you have a small business, one of the most important things that you can do to boost your revenue is to enter into a partnership or join an association with another business. A small business tax partnership, also known as a partnership, allows you to avoid a lot of costs by not paying capital gains taxes on any partnership profits. As a result, small business owners may be able to pass some of these costs onto their customers, allowing them to keep their prices low and their products fresh.

As well as avoiding capital gains, the advantages of tax partnerships go beyond simply cutting down on your taxes. These firms can also help you in other ways. Such as, it will allow you to use your good name, which is one of the main reasons why people start their own businesses.

Starting a business partnership requires a few steps, like, declaring the name of the firm, filing the taxes, and making an agreement with the partner, who will then pay all the required payments. In addition, a partnership will allow you to control the activities of both parties. As a result, you will be able to see where your money is being spent by both partners.

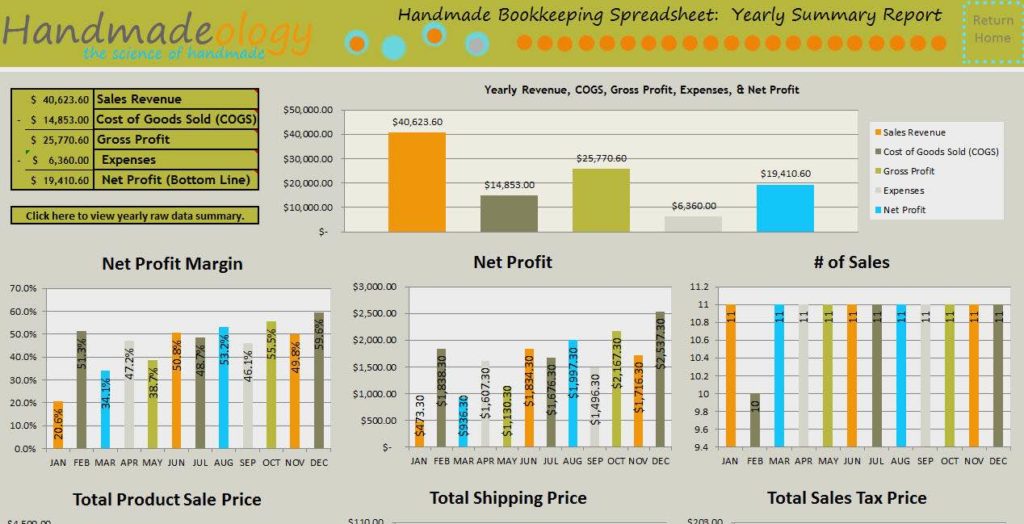

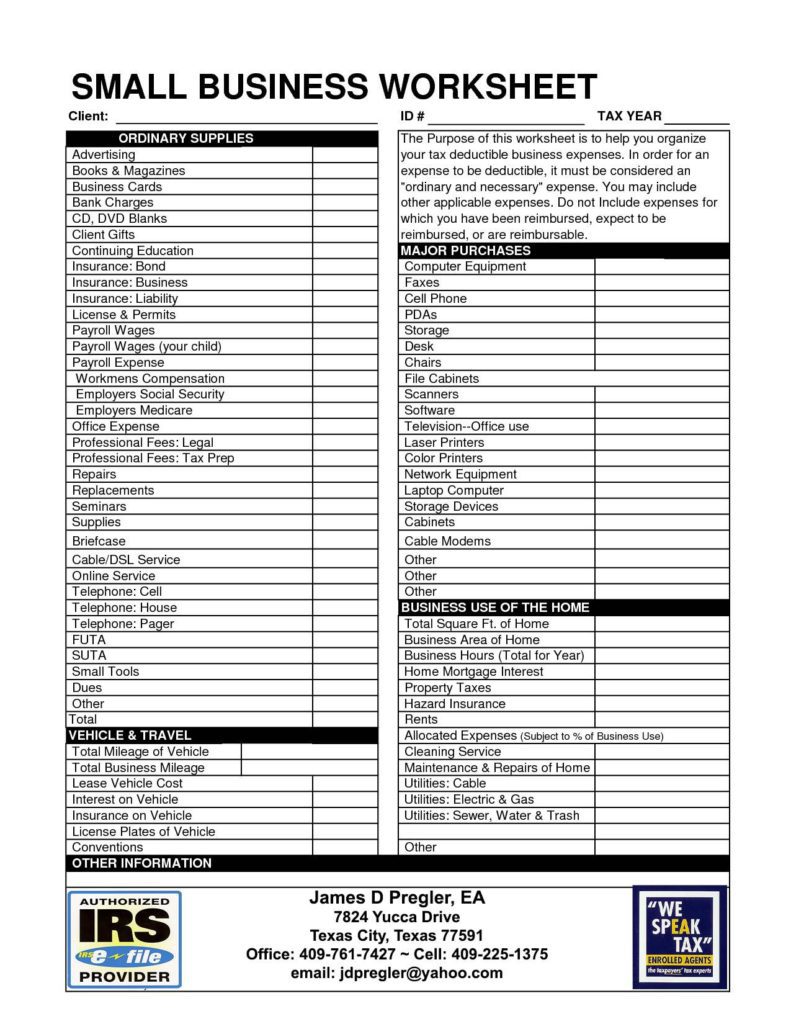

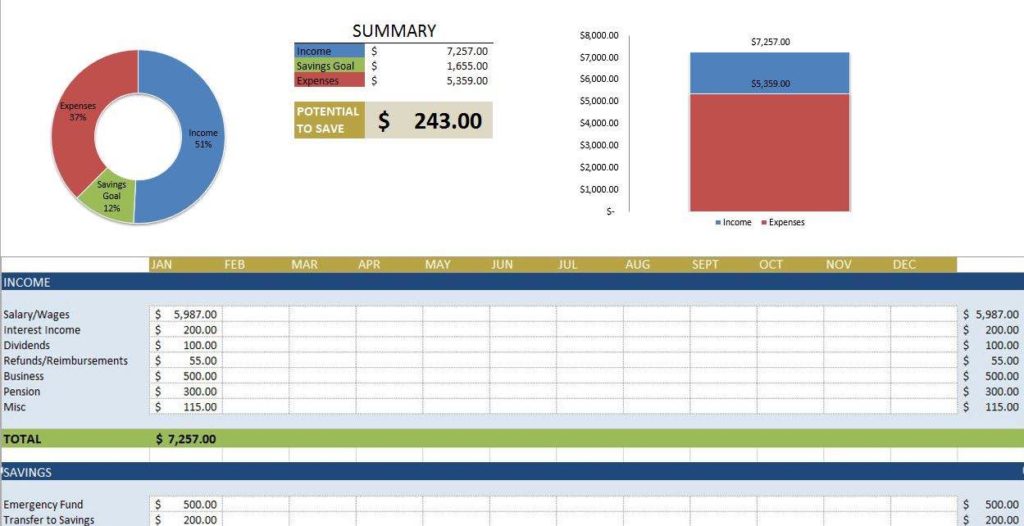

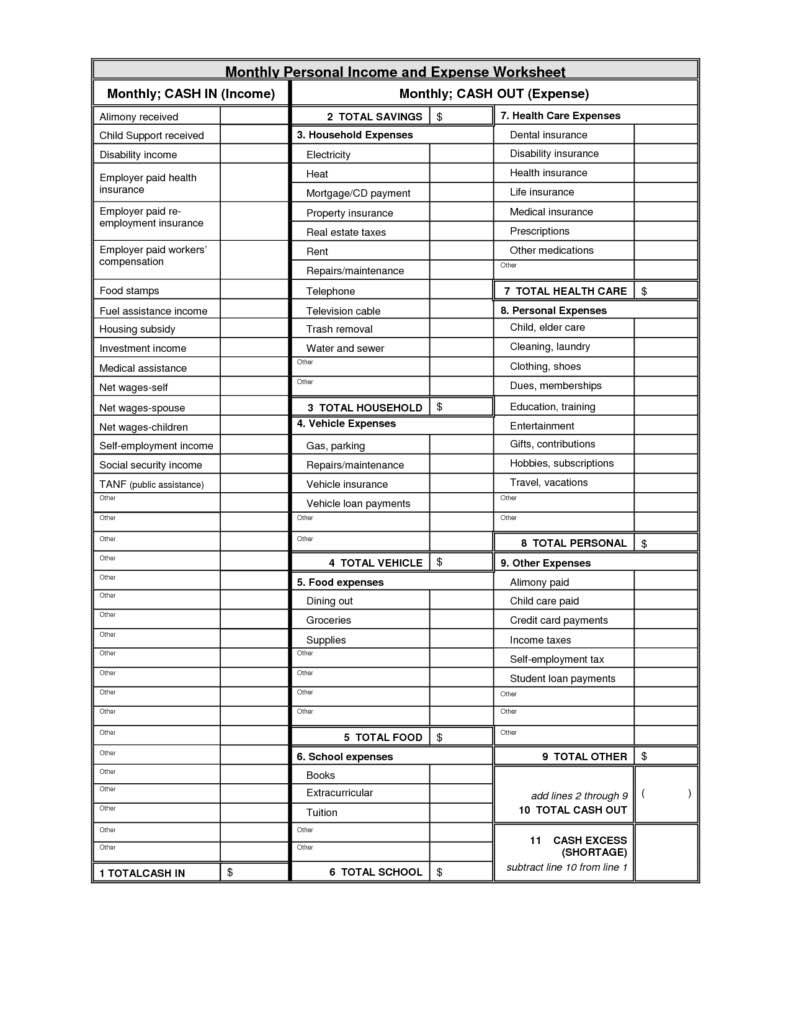

When entering into a new partnership, you should ensure that you have a small business tax spreadsheet for the partnership. This sheet will give you all the necessary information that you need to keep track of your profit and losses. You will also be able to keep track of your money and assets that you have received from the other partners.

It will also help you keep track of all the transactions that are related to the partner’s business income. This will enable you to properly calculate your business expenses. You will also be able to easily track your partners’ financial records and any other documents that may be relevant to the partnership.

In a business tax partnership, you can make payments directly to your partners. On the other hand, if you would like to receive some share of the profits from the business, you should first calculate the amount of profit you should have earned. Next, you should divide this number among all the partners that will have a direct financial stake in the partnership.

You should remember that this is a partnership. There are some common-law partnerships that are not included under the partnership. In such cases, the law states that the partnership has no other relationship with any other company except being a business.

In order to keep track of your financial documents, you should use a small-business tax spreadsheet that keeps track of all financial records. It also has the necessary tools to help you in organizing your files. Therefore, you will be able to manage your business easily, and your business income will always be visible.