Sample of Due Diligence Report: What You Need to Know

Due diligence is a critical process in any business deal or transaction, as it allows the parties involved to thoroughly evaluate the risks and benefits of the agreement. A due diligence report is a comprehensive document that outlines the findings of the due diligence process. In this article, we’ll take a closer look at what a sample of due diligence report entails, and why it’s important for businesses to conduct due diligence before entering into any agreements.

What is a Due Diligence Report?

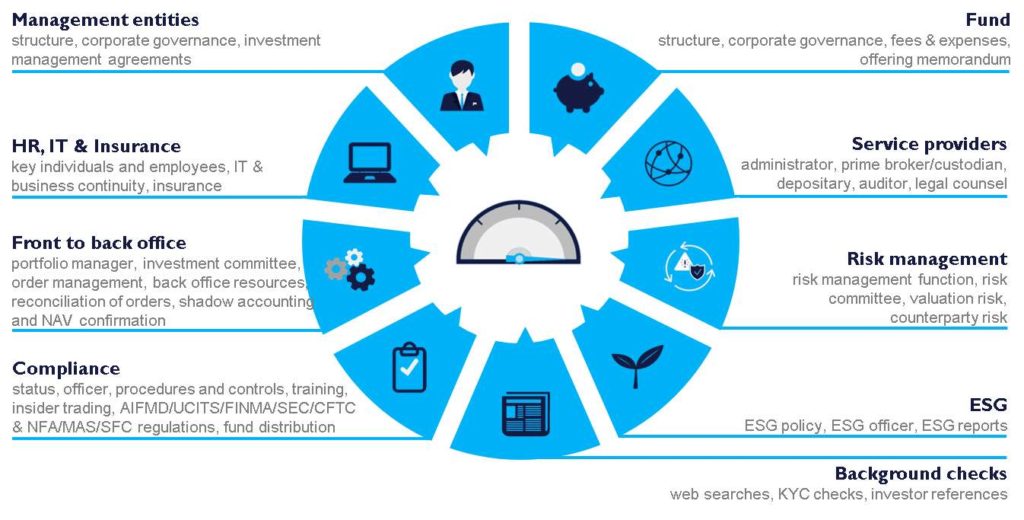

A due diligence report is a document that provides a detailed assessment of the potential risks and benefits of a business deal or transaction. It is typically prepared by a team of professionals who specialize in various aspects of the transaction, such as legal, financial, and operational due diligence. The report is designed to provide a comprehensive overview of the target company or asset, and to identify any potential issues or red flags that may impact the transaction.

What is Included in a Sample of Due Diligence Report?

A sample of due diligence report typically includes the following sections:

- Executive Summary: This section provides a brief overview of the transaction, and summarizes the key findings of the due diligence process.

- Business Overview: This section provides a detailed description of the target company or asset, including its history, organizational structure, products or services, market position, and key competitors.

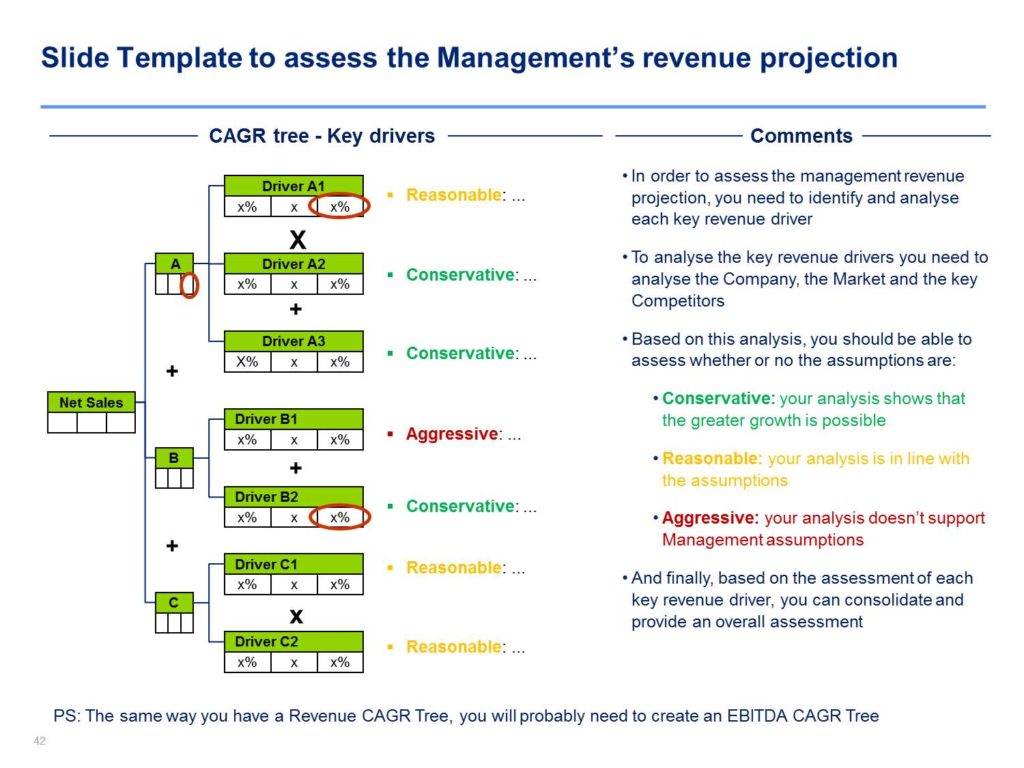

- Financial Information: This section provides an in-depth analysis of the target company’s financial performance, including its revenue, expenses, profitability, and cash flow. It may also include projections and forecasts for future performance.

- Legal and Regulatory Issues: This section outlines any legal or regulatory issues that may impact the transaction, such as pending lawsuits, regulatory violations, or environmental liabilities.

- Operational Due Diligence: This section assesses the target company’s operational processes and procedures, including its supply chain, manufacturing operations, and technology infrastructure.

- Human Resources: This section assesses the target company’s human resources practices, including its employment policies, benefits, and compensation.

- Conclusion and Recommendations: This section provides a summary of the key findings of the due diligence process, and makes recommendations for how to proceed with the transaction.

Why is Due Diligence Important?

Due diligence is an essential process for businesses that are considering entering into any agreements, such as mergers and acquisitions, joint ventures, or strategic partnerships. By conducting due diligence, businesses can identify potential risks and liabilities associated with the transaction, and assess the value and suitability of the target company or asset. This information can help businesses make informed decisions about whether or not to proceed with the transaction, and can also help them negotiate favorable terms.

In addition to assessing the risks and benefits of a transaction, due diligence can also help businesses identify opportunities for growth and improvement. For example, if the due diligence process uncovers operational inefficiencies or gaps in the target company’s product offerings, the acquiring company may be able to leverage its expertise and resources to help the target company improve its operations and grow its business.

Conclusion

A sample of due diligence report is a critical document that provides valuable insights into the target company or asset. By conducting due diligence, businesses can make informed decisions about whether or not to proceed with a transaction, and can also identify opportunities for growth and improvement. While the due diligence process can be time-consuming and expensive, the benefits of conducting thorough due diligence far outweigh the costs.

Due diligence reports are a crucial tool for businesses and investors when considering a potential investment or partnership. A sample of due diligence report can provide an overview of the contents that such a report should have.

The main objective of a due diligence report is to conduct a comprehensive review of a company’s financial and legal status, operations, management, and market position. This information is critical to help investors and businesses make informed decisions about whether or not to proceed with an investment or partnership.

The contents of a due diligence report can vary depending on the nature of the business and the type of investment being considered. However, a typical report will include several sections that cover the following topics:

- Executive Summary: This section provides a brief overview of the company and its key financial and operational metrics.

- Company Overview: This section provides a more detailed overview of the company’s history, mission, and products or services.

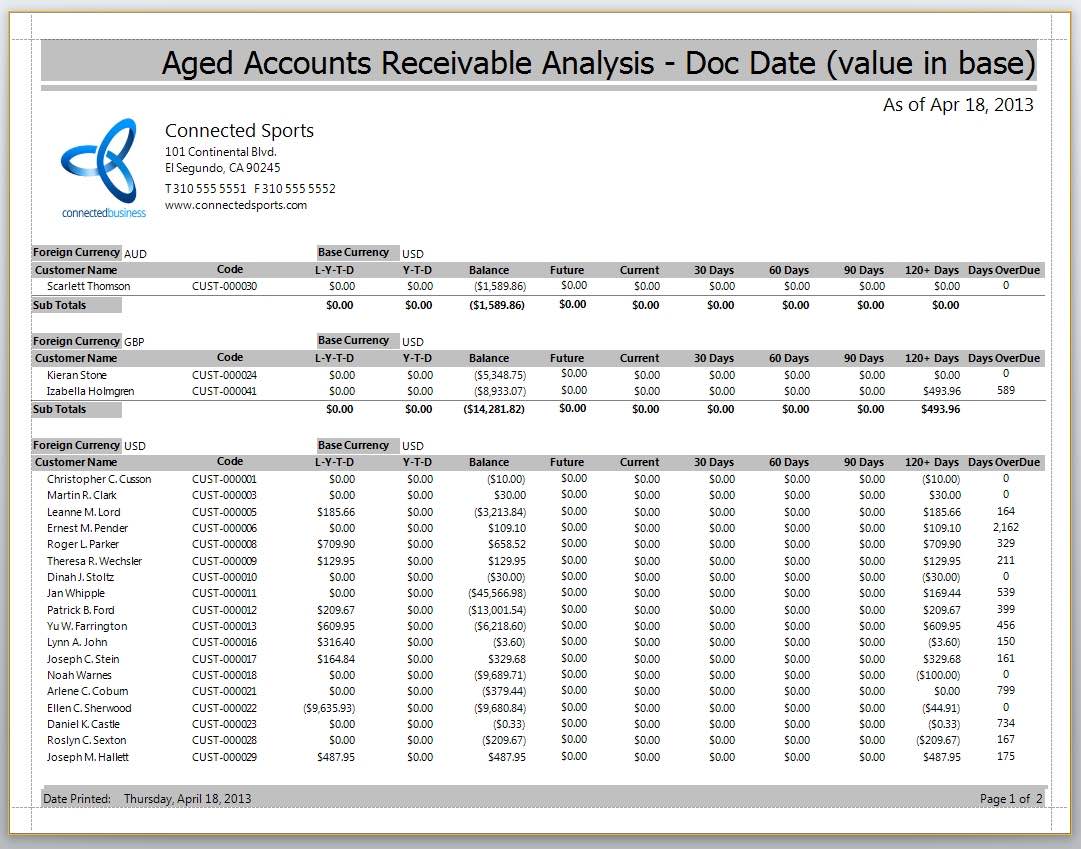

- Financial Information: This section includes financial statements and other financial data, such as cash flow statements, income statements, and balance sheets.

- Legal and Regulatory Information: This section includes information about the company’s legal structure, litigation history, and compliance with regulatory requirements.

- Operations: This section covers the company’s manufacturing processes, supply chain, and other operational details.

- Management: This section provides information about the company’s management team and their qualifications and experience.

- Market Position: This section includes information about the company’s market position, competition, and potential growth opportunities.

It’s important to note that a sample of due diligence report is just that – a sample. The actual report for a particular investment or partnership will likely be more detailed and tailored to the specific needs of the investors or businesses involved.

In conclusion, a sample of due diligence report can be a helpful resource for anyone considering an investment or partnership. By providing a template of the contents that such a report should have, it can help investors and businesses ensure that they are conducting a thorough and comprehensive review of the potential investment or partnership.