A mileage expense report template can help streamline your travel expenses, making it easy to track your business expenses accurately. Here’s how to create a comprehensive mileage expense report template.

Are you tired of manually calculating and organizing your travel expenses for work-related trips? A mileage expense report template can help streamline the process, making it easier to track and manage your business expenses accurately.

Creating a comprehensive mileage expense report template can take a bit of time upfront, but it can save you a lot of time and effort in the long run. Here are some key steps to follow when creating your mileage expense report template:

Determine Your Mileage Reimbursement Rate

Before you start creating your mileage expense report template, you need to determine your mileage reimbursement rate. This rate is usually set by your employer or company, and it may vary depending on the location, distance traveled, and mode of transportation.

Record Essential Information

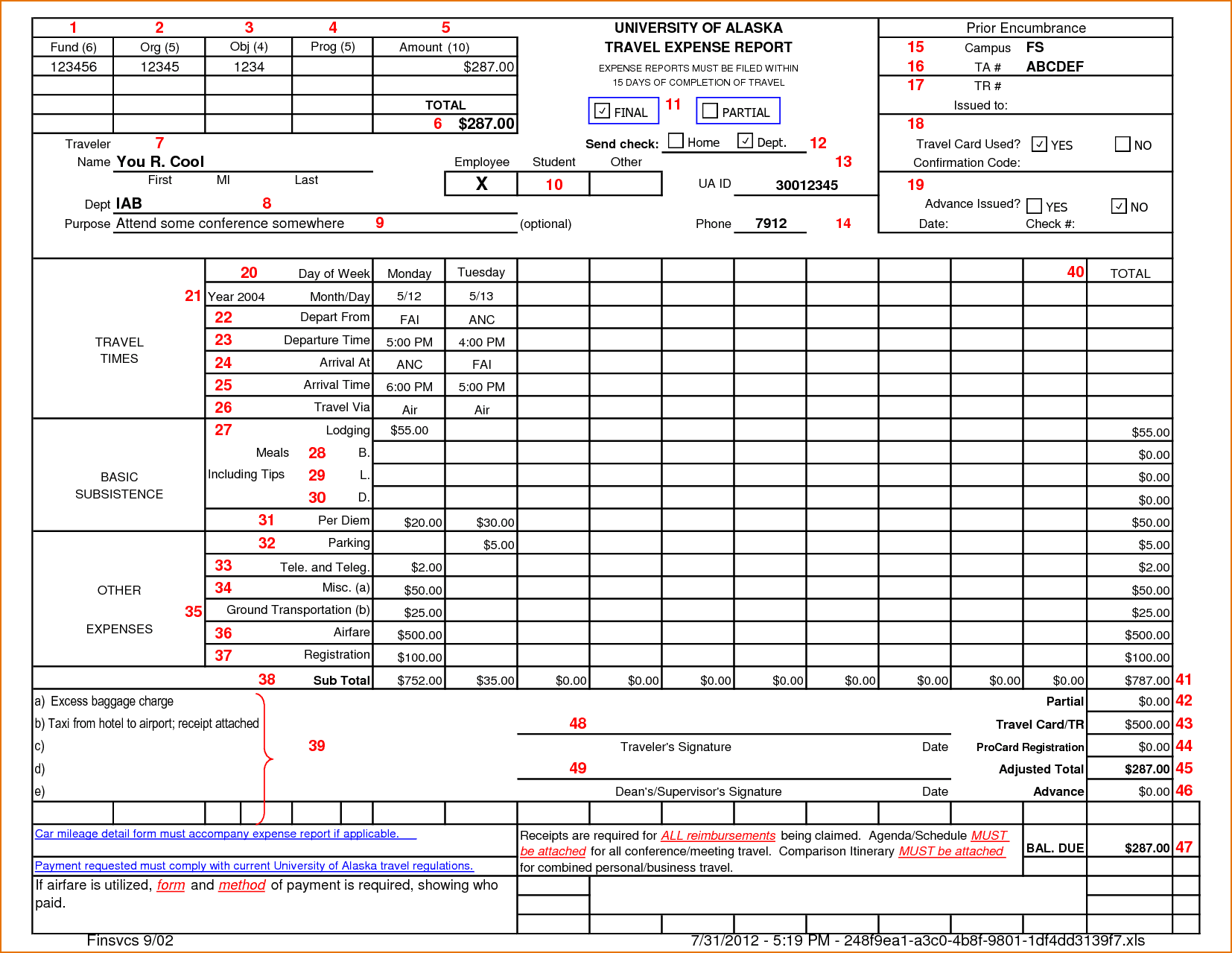

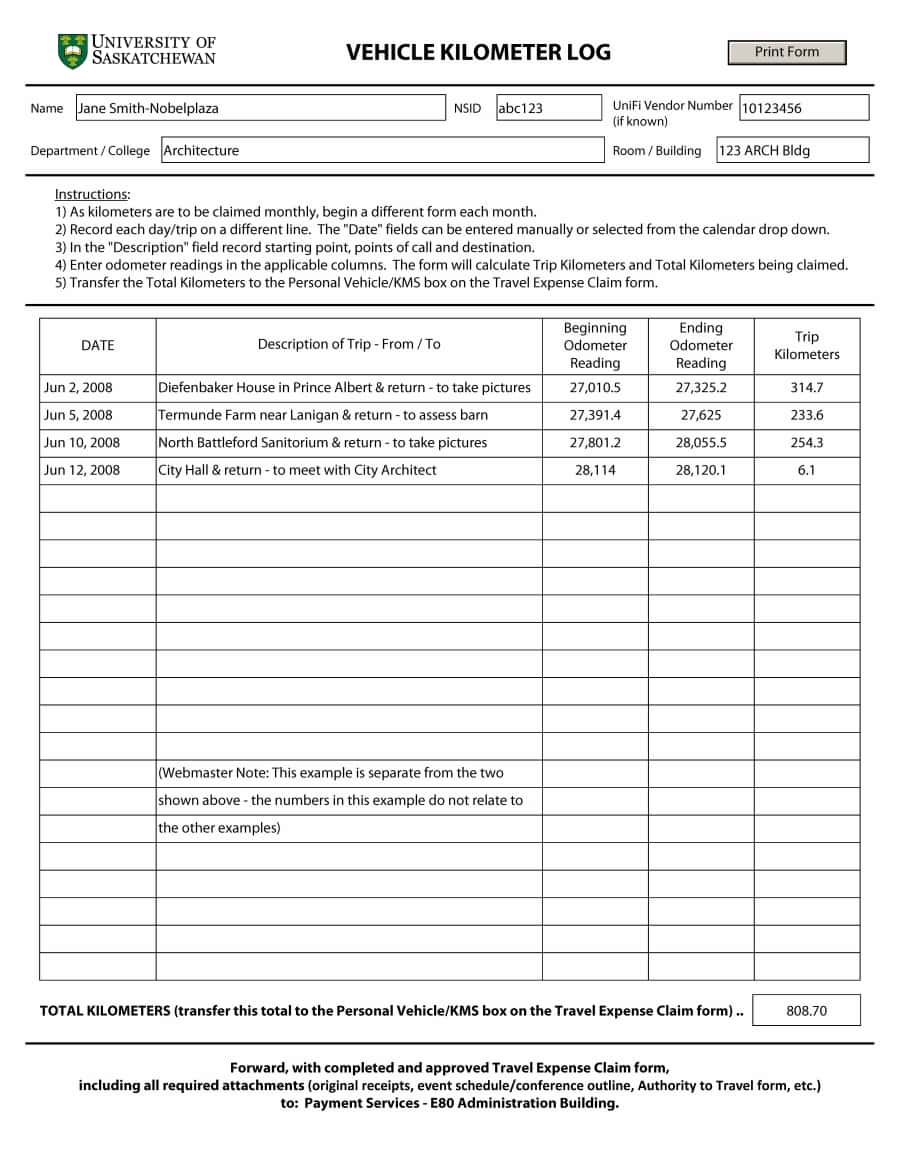

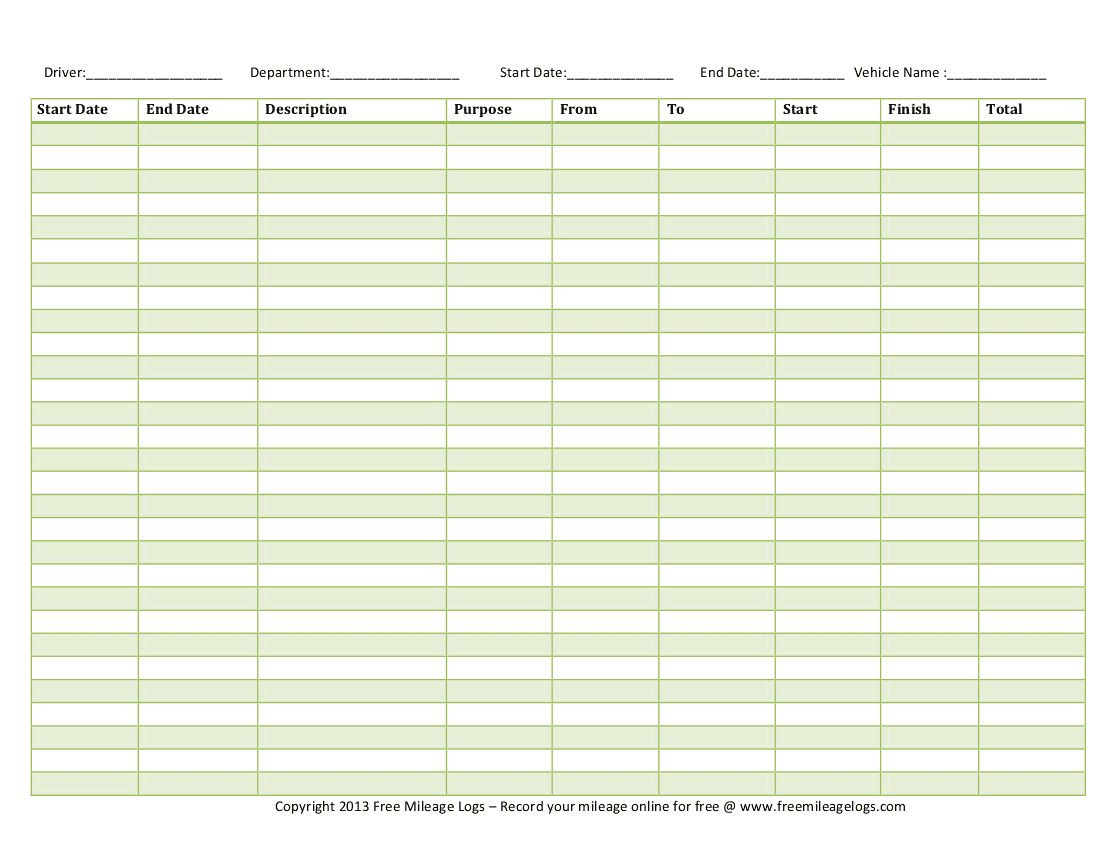

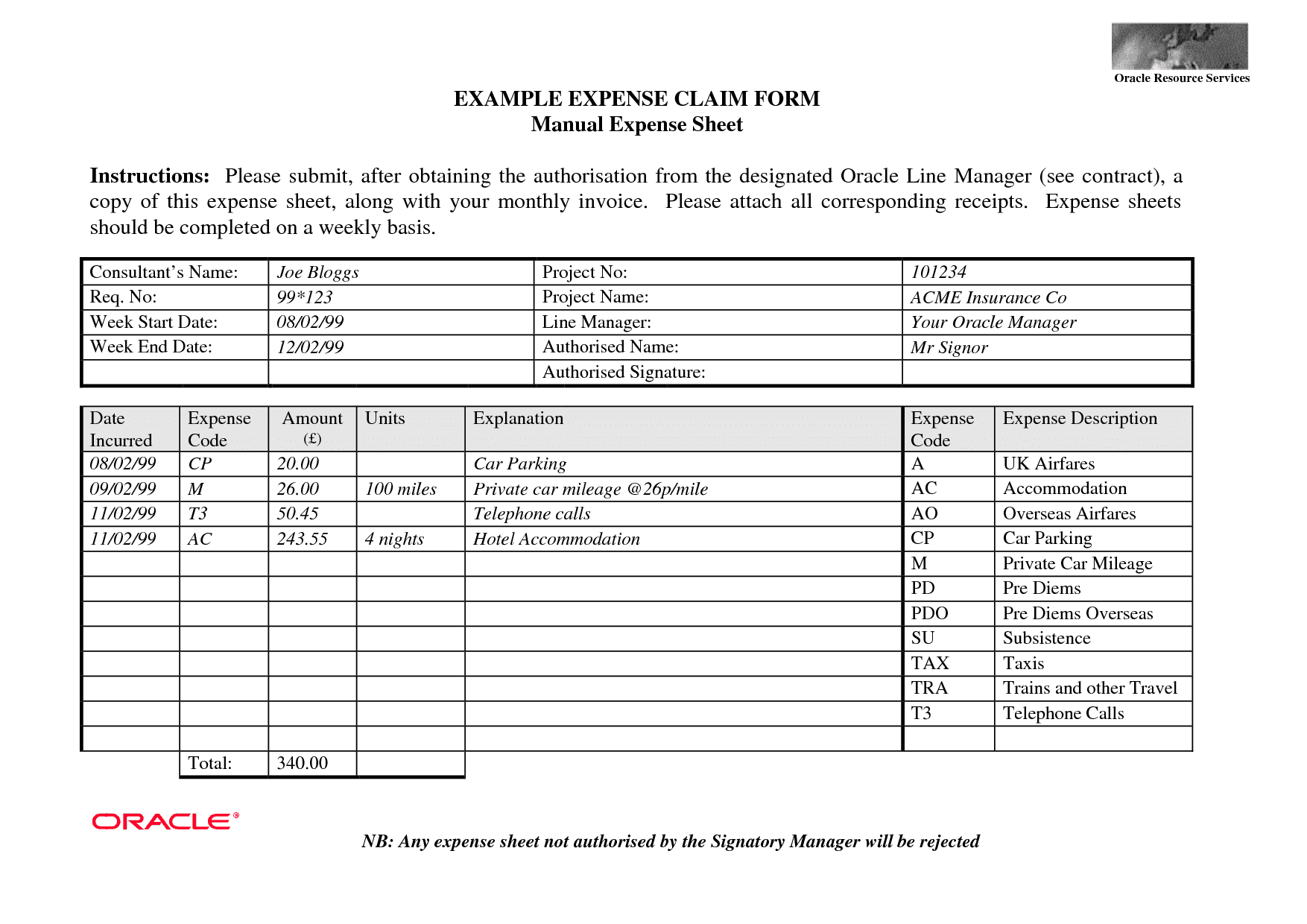

Your mileage expense report template should include the date of the trip, the starting and ending locations, the purpose of the trip, and the total number of miles traveled. You can also include any tolls, parking fees, or other related expenses.

Use a Standard Format

To make your mileage expense report template easier to use and understand, it’s best to follow a standard format. This can include using tables, charts, or other visual aids to organize your information.

Keep Track of Your Receipts

In addition to tracking your mileage, you should also keep track of any related receipts or invoices, such as gas receipts or parking fees. This can help ensure that your expense report is accurate and complete.

Review and Submit Your Report

Once you’ve completed your mileage expense report template, take the time to review it carefully for accuracy and completeness. You can then submit your report to your employer or accounting department for reimbursement.

Creating a comprehensive mileage expense report template can take a bit of effort upfront, but it can save you a lot of time and hassle in the long run. By following these key steps, you can create a template that works for your specific needs and helps you stay on top of your travel expenses.

To make the process of creating your mileage expense report template even easier, you can also consider using an online template or software program. There are a variety of options available, some of which are free, while others may require a fee.

Using an online template or software program can help automate the process of tracking your mileage and other expenses, and can provide you with a more streamlined and efficient way to manage your business expenses.

When selecting a mileage expense report template, be sure to choose one that is tailored to your specific needs and industry. For example, if you work in the transportation industry, you may need to track additional information such as vehicle maintenance and repair costs.

Ultimately, creating a comprehensive mileage expense report template is an essential part of managing your business expenses effectively. By taking the time to set up a template that works for you, you can save time, reduce errors, and ensure that you are accurately tracking and reporting your expenses.