The Pain of Income Tax Spreadsheet Templates

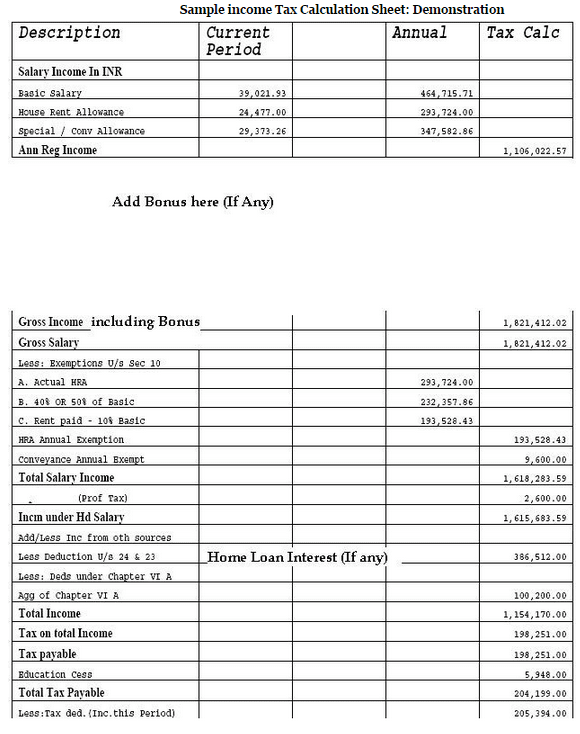

A spreadsheet is an ideal tool for preparing your personal come tax returns-or picking up some additional money by preparing different people’s returns. It has been updated to include 2018-19 tax rates. The tax planner spreadsheets permit you to carry out on-the-fly tax planning with minimal work.

Assuming you are the lone owner and you purchase business supplies with your own personal charge card or use a business check to cover a personal buy, you’re likely to have difficulty keeping an eye on how much money the business actually is making or losing throughout the year. Many people don’t but as a business operator, your personal net worth could be important. To sum up, although many small business owners have a vague idea about what their companies are worth, most are merely guessing and with time, wrong guesses can prove to be costly.

The Dirty Facts on Income Tax Spreadsheet Templates

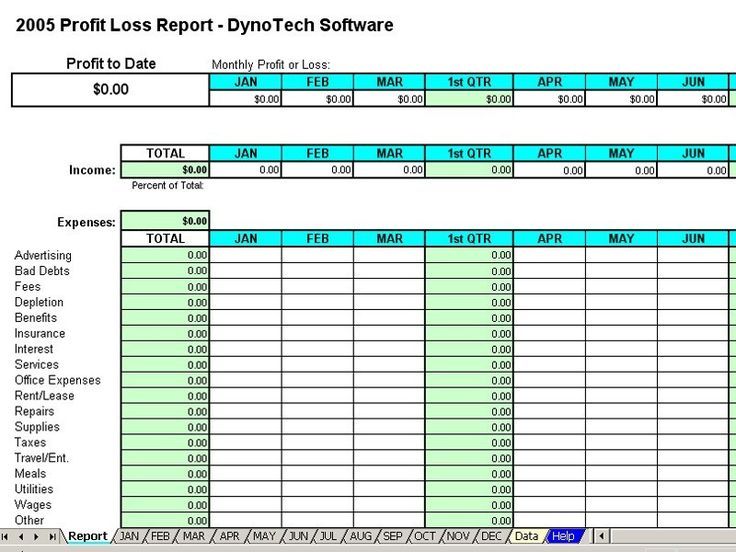

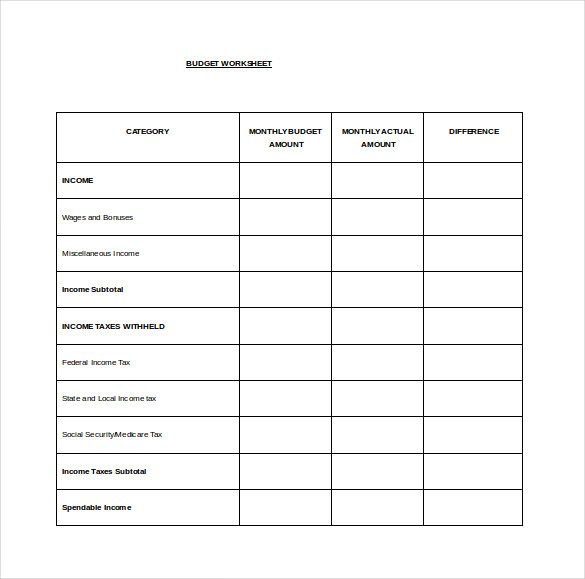

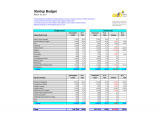

Calculate your organization startup costs employing the calculator below to figure out how much cash you’ll want to launch your company and run until it will become profitable. Being aware of what your company is worth is equally as crucial as knowing the worth of your house. To acquire an analysis of business value, small businesses may desire to engage an expert appraiser. Well, ideally when you have a little business, you’re logging your company expenses and income monthly.

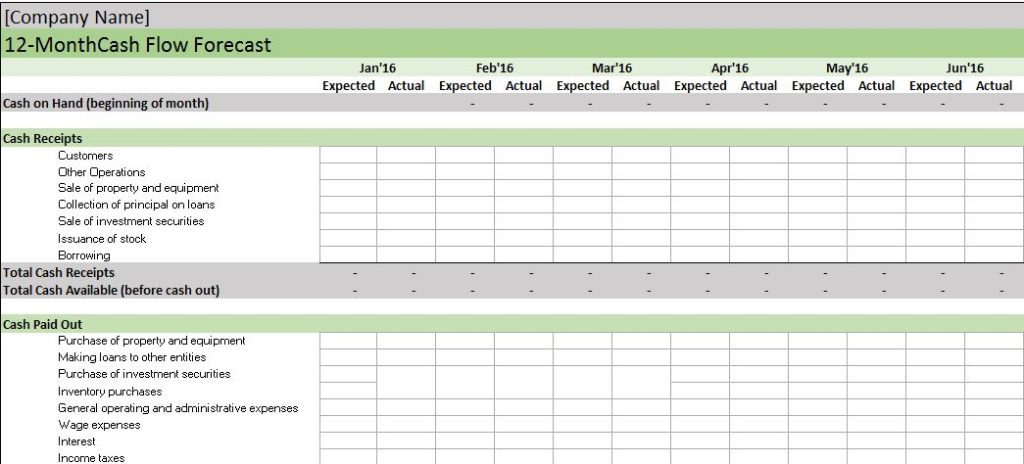

Even if your company is merely a part-time operation with few profits, you ought to have a separate checking account and separate credit card for the company. Although it is probably legally separate from your personal assets, a bank that considers giving you a business loan will likely ask for personal collateral if your business has little real value. Further by adopting a very simple accounting system the little business may use the bookkeeping spreadsheets to both manage financial control over the company and fill out the crucial job of reporting for tax purposes.

If your company revolves around something other individuals do as a pastime, and you get rid of money every year, you might have your business deductions disallowed. Though the company can be thought to be liquid and that receivables along with liabilities were maintained at a minimum, the reader of the balance sheet report will have to start looking in the operation of the company by securing a duplicate of the income statement. Growing businesses may have a similar issue. Whether you are beginning a new company, or you’re running an established business, mixing personal and company funds is a recipe for failure.

On occasion the price is low because a new small business owner isn’t taking into consideration the price of her or his own labor, or hasn’t accurately determined each of the costs that must be considered in setting prices. The cost to run a comprehensive small business valuation can vary from a couple thousand dollars up to $50,000 or more. Hobby expenses aren’t considered business costs, however, even in case you make some income from your hobby. The aggregate income is the overall quantity of income that’s generated by all individuals, businesses, and government in a particular country. Taxes don’t need to be taxing. For persons who pay estimated taxes, you won’t ever earn a payment that’s too large or too tiny.