Understanding Your Small Business: The Profit and Loss Statement Demystified

Running a small business can be exhilarating and rewarding, but it also comes with its fair share of challenges, especially when it comes to financial management. As a small business owner, keeping a close eye on your finances is paramount to ensuring sustainability and growth. One key financial document that every small business owner should be familiar with is the Profit and Loss Statement, often referred to as the P&L statement.

What is a Profit and Loss Statement?

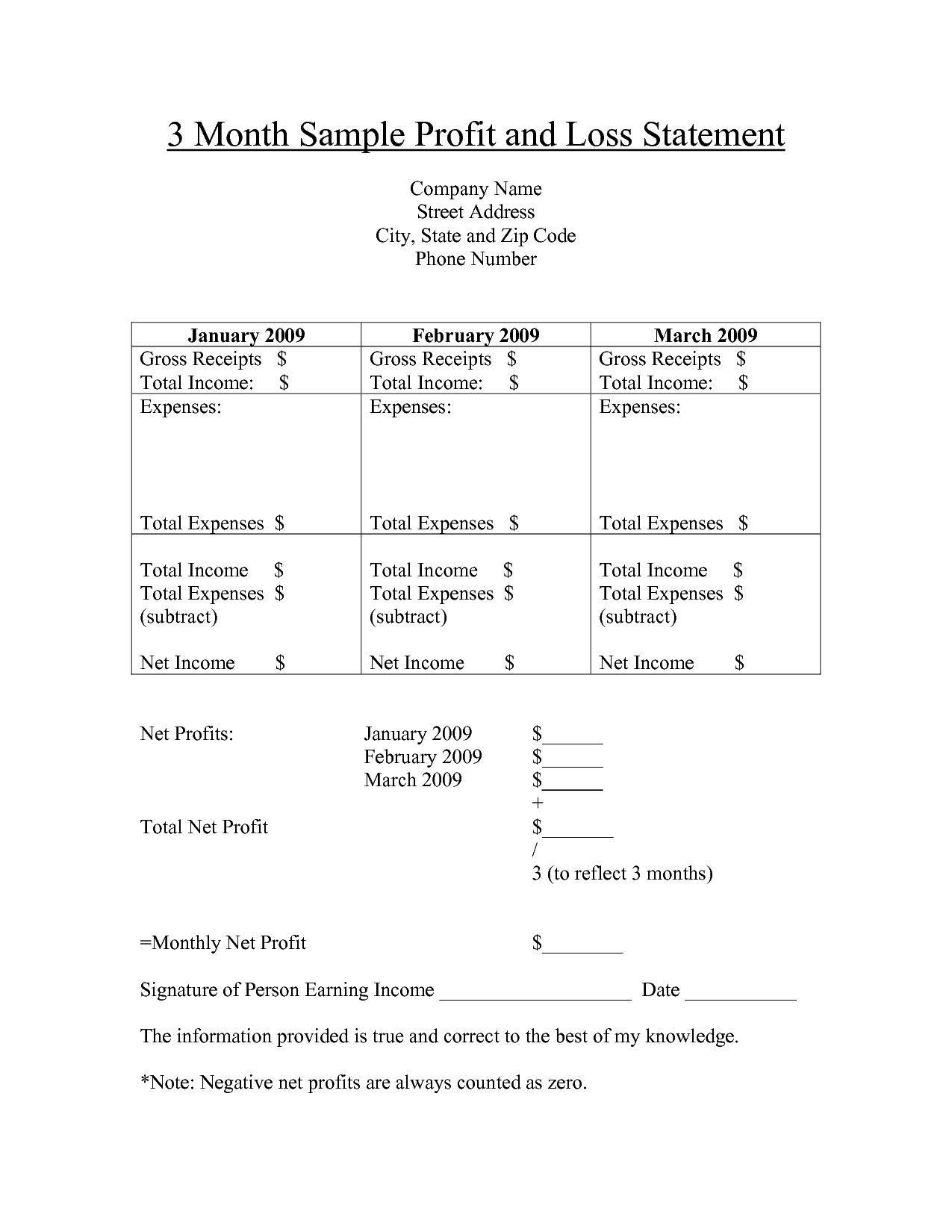

Simply put, a Profit and Loss Statement provides a snapshot of your business’s financial performance over a specific period. It outlines the revenue generated, expenses incurred, and ultimately, the profit or loss incurred by your business during that time frame. This document is invaluable for assessing the health of your business and making informed decisions to drive profitability.

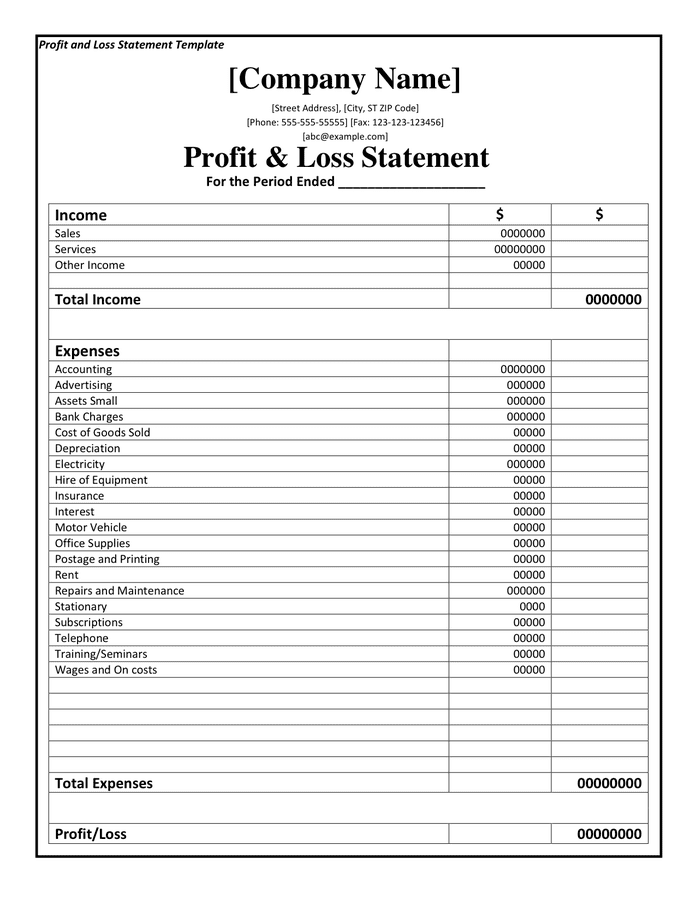

Components of a Profit and Loss Statement

- Revenue

This section details the total income generated by your business through sales, services, or any other sources. It’s essential to categorize revenue streams to gain insights into which areas of your business are driving growth. - Cost of Goods Sold (COGS)

COGS includes all the direct costs associated with producing goods or delivering services. This may include raw materials, labor costs, and manufacturing overhead. Calculating COGS accurately is crucial for determining gross profit margins. - Gross Profit

Gross profit is the difference between total revenue and the cost of goods sold. It reflects the profitability of your core business operations before factoring in other expenses. - Operating Expenses

Operating expenses encompass all the costs incurred in running your business, excluding COGS. This includes expenses such as rent, utilities, salaries, marketing, and administrative costs. - Net Profit (or Loss)

Net profit is the final figure obtained by subtracting operating expenses from gross profit. It indicates the overall profitability of your business after accounting for all costs.

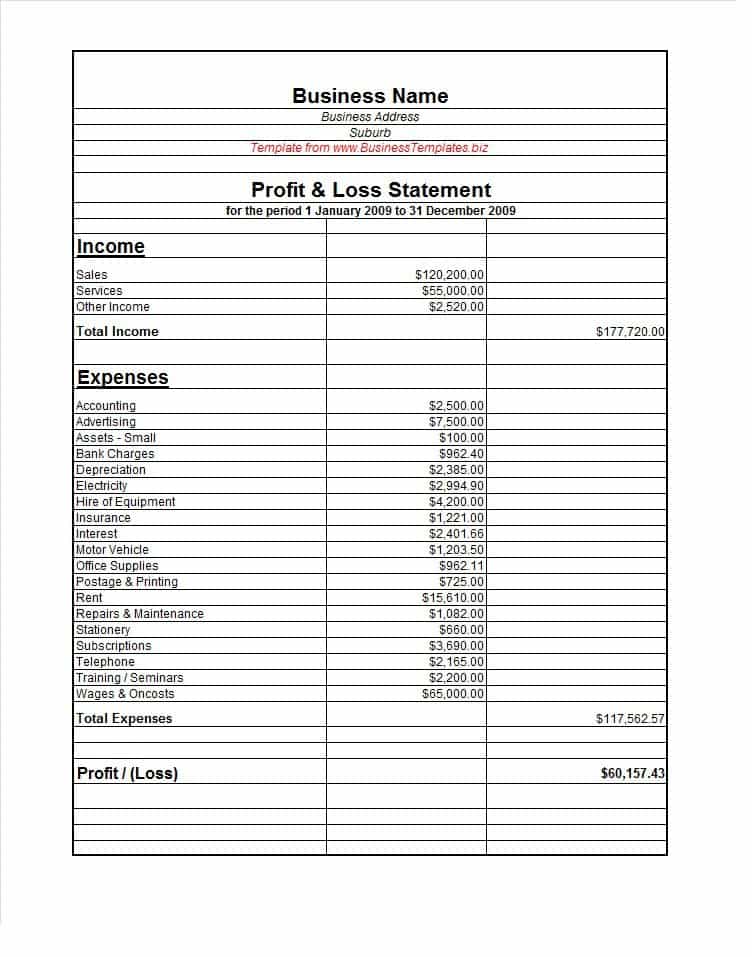

Example of Profit and Loss Statement for Small Business

Let’s delve into an illustrative example of a Profit and Loss Statement for a hypothetical small business, “Green Leaf Café”:

| Category | Amount |

|---|---|

| Revenue | $50,000 |

| Cost of Goods Sold | $15,000 |

| Gross Profit | $35,000 |

| Operating Expenses | |

| – Rent | $5,000 |

| – Utilities | $1,500 |

| – Salaries | $12,000 |

| – Marketing | $3,000 |

| – Miscellaneous | $2,500 |

| Total Operating Expenses | $24,000 |

| Net Profit (Before Tax) | $11,000 |

Interpreting the Example

In this example, Green Leaf Café generated $50,000 in revenue over the specified period. After deducting the $15,000 cost of goods sold, the café achieved a gross profit of $35,000. However, after factoring in operating expenses totaling $24,000, the net profit before tax stands at $11,000.

Key Takeaways for Small Business Owners

- Monitor Revenue Streams

Identify and prioritize revenue streams that contribute the most to your business’s bottom line. - Control Costs

Keep a close watch on expenses and look for areas where costs can be trimmed without compromising quality or service. - Analyze Profit Margins

Understanding gross and net profit margins can help you assess the efficiency and profitability of your business operations. - Forecast and Plan

Utilize Profit and Loss Statements to forecast future financial performance and make informed strategic decisions.

Leveraging Technology for Financial Management

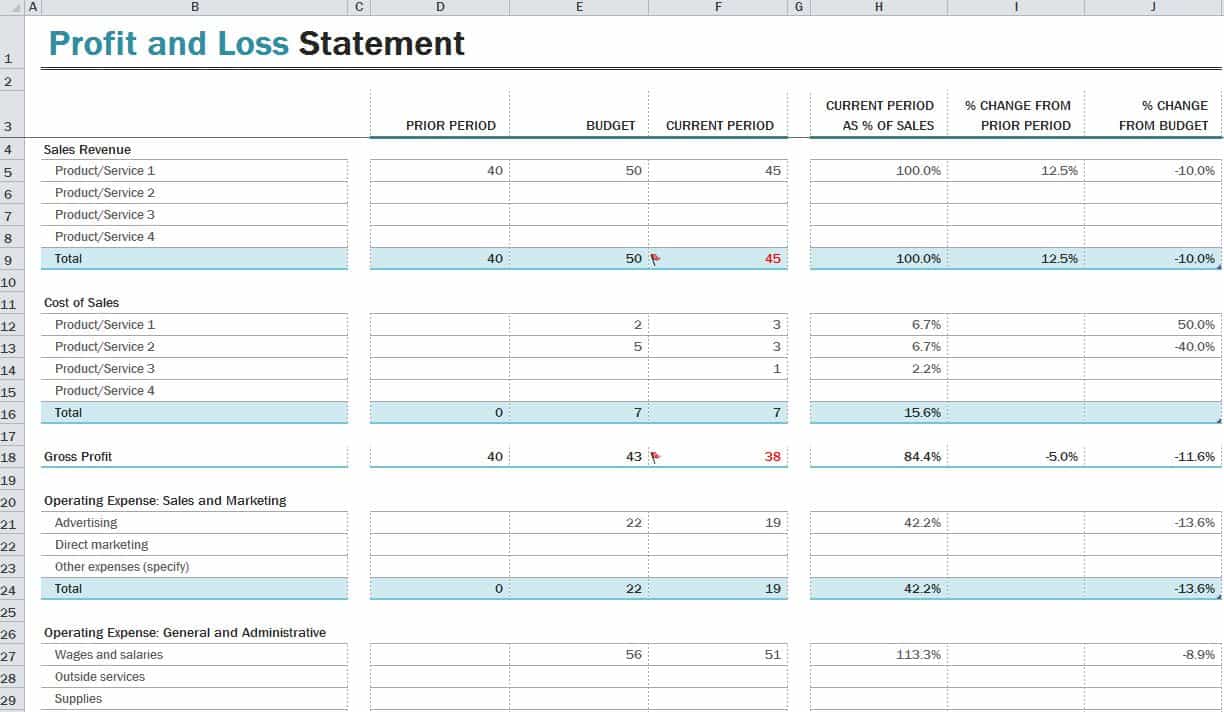

In today’s digital age, small business owners have access to a myriad of tools and software solutions designed to streamline financial management processes. From accounting software like QuickBooks and Xero to budgeting apps such as Mint and Wave, leveraging technology can greatly simplify the task of creating and analyzing Profit and Loss Statements.

Automating Data Entry and Reporting

Gone are the days of manually inputting data and laboriously preparing financial reports. With the help of accounting software, you can automate the process of recording transactions, categorizing expenses, and generating Profit and Loss Statements with just a few clicks. This not only saves time but also reduces the likelihood of errors and ensures greater accuracy in your financial records.

Real-Time Insights and Analysis

One of the key advantages of using technology for financial management is the ability to access real-time insights into your business’s financial performance. Many accounting platforms offer customizable dashboards and reporting tools that allow you to track key metrics, monitor trends, and make data-driven decisions on the fly. By staying informed about your business’s finances in real-time, you can quickly identify areas of opportunity or concern and take proactive steps to optimize performance.

Integration with Other Business Tools

Another benefit of modern accounting software is its ability to integrate seamlessly with other business tools and applications. Whether it’s syncing transaction data from your bank accounts, linking with inventory management systems, or connecting with customer relationship management (CRM) software, integration capabilities can streamline workflows and provide a holistic view of your business operations. This interconnected ecosystem of tools enables you to make more informed decisions and drive efficiency across your organization.

Embracing Cloud-Based Solutions

Cloud-based accounting software offers unparalleled flexibility and accessibility for small business owners. With data stored securely in the cloud, you can access your financial records anytime, anywhere, and from any device with an internet connection. This level of convenience allows you to stay on top of your finances whether you’re in the office, on the go, or working remotely. Additionally, cloud-based solutions often come with automatic updates and backups, ensuring that your financial data is always up-to-date and protected against loss or corruption.

Conclusion: Empowering Small Business Owners for Success

In conclusion, the landscape of financial management for small businesses has been revolutionized by advancements in technology. By embracing digital tools and leveraging the power of automation, real-time insights, integration, and cloud-based solutions, small business owners can gain a competitive edge in managing their finances effectively. Whether you’re a seasoned entrepreneur or just starting out, investing in the right technology can unlock new opportunities for growth, profitability, and long-term success.

Take the Next Step

Ready to take your small business to the next level? Explore the myriad of technology solutions available and discover how they can empower you to achieve your financial goals. From accounting software to cloud-based platforms, there’s a wealth of resources at your fingertips to help you streamline processes, gain actionable insights, and drive success in your business endeavors.

Harness the power of technology and embark on a journey towards financial mastery and business excellence today!

This article is aimed at providing small business owners with a comprehensive understanding of Profit and Loss Statements and how they can use this financial tool to drive success in their ventures. It offers clear explanations, practical examples, and actionable insights to empower readers in their financial management endeavors.