In the hustle and bustle of modern life, managing finances can often feel like a daunting task. From monthly bills to unexpected expenses, it’s easy to feel overwhelmed by the sheer complexity of it all. However, there’s a simple yet powerful tool that can help you take control of your finances and pave the way to financial freedom: the Bill Budget Template.

Understanding the Importance of Budgeting

Before delving into the specifics of a Bill Budget Template, let’s take a moment to understand why budgeting is crucial. Budgeting is essentially a roadmap for your finances, allowing you to track income, expenses, and savings with precision. By creating and sticking to a budget, you gain a clear understanding of where your money is going and where adjustments can be made.

Introducing the Bill Budget Template

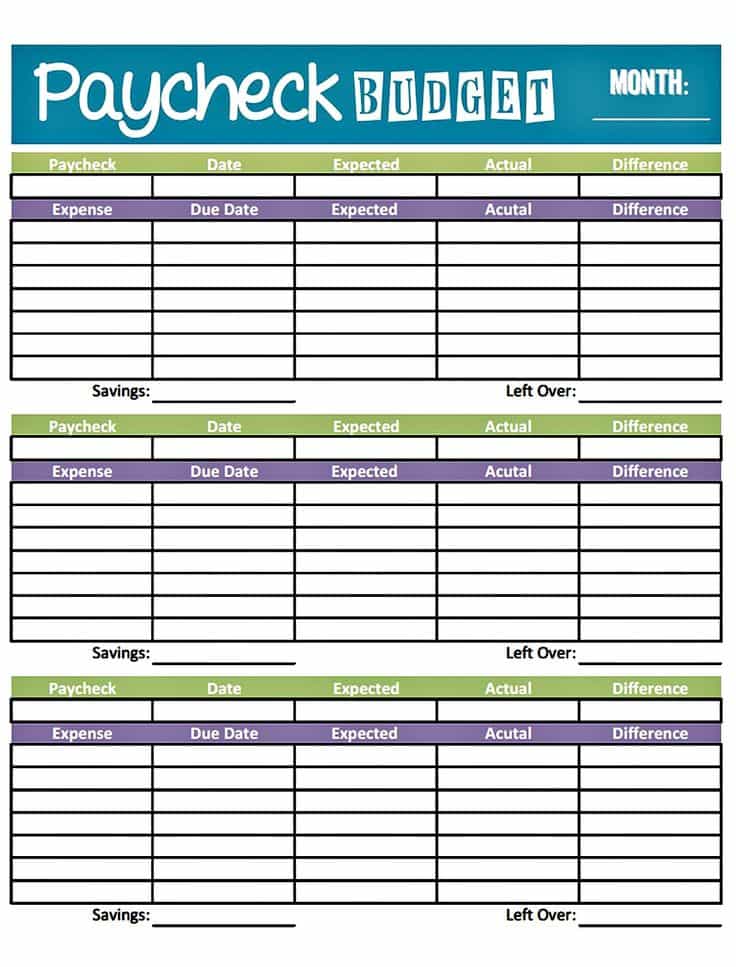

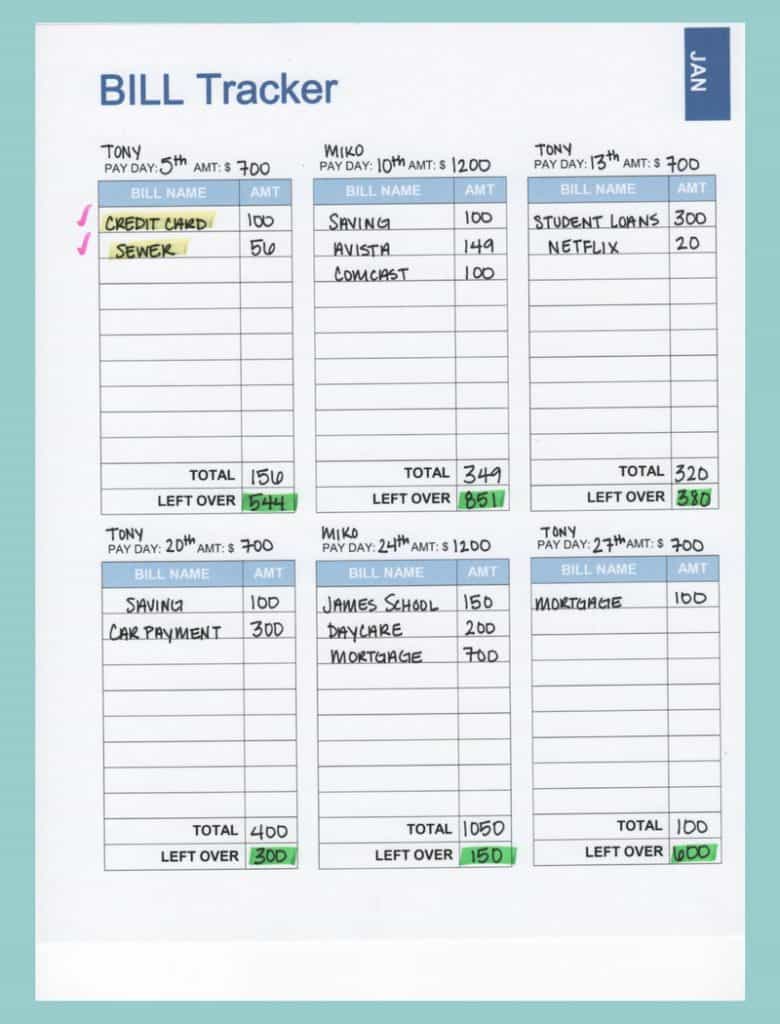

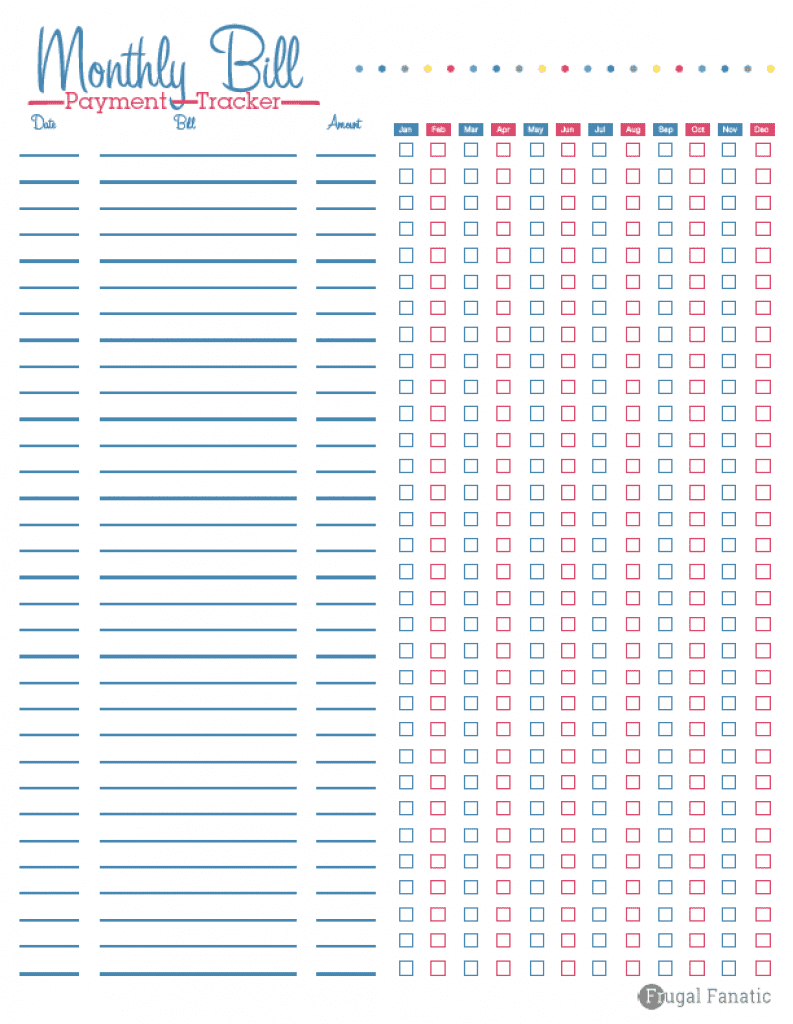

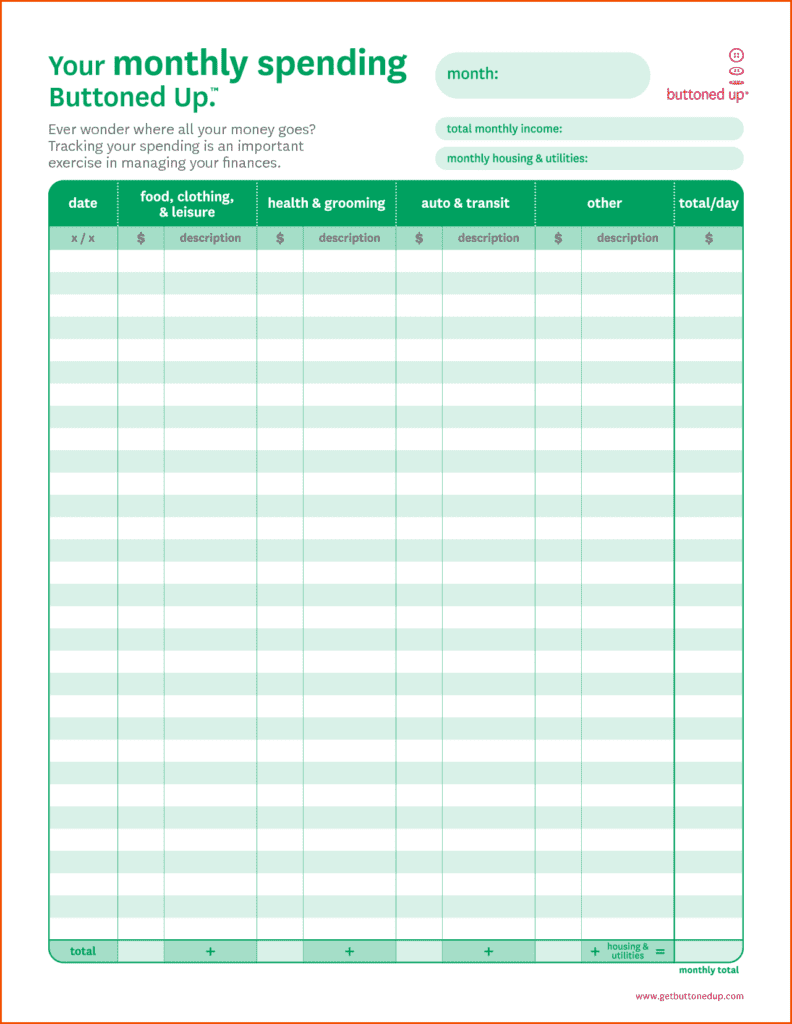

At its core, a Bill Budget Template is a customizable spreadsheet designed to help you track your monthly bills and expenses. It provides a comprehensive overview of your financial obligations, allowing you to allocate funds accordingly and avoid unnecessary surprises.

Key Features of a Bill Budget Template:

- Organization

A well-designed template categorizes expenses, making it easy to see where your money is going each month. Common categories include rent/mortgage, utilities, groceries, transportation, and entertainment. - Automation

Many Bill Budget Templates come with built-in formulas that automatically calculate totals and balances, saving you time and effort. - Flexibility

Templates can be tailored to suit your individual needs and financial goals. Whether you’re a student on a tight budget or a seasoned professional looking to save for retirement, there’s a template out there for you.

How to Use a Bill Budget Template Effectively

Using a Bill Budget Template is simple, but maximizing its effectiveness requires diligence and discipline. Here are some tips to help you make the most of this powerful tool:

- Gather Information

Start by gathering information about your monthly bills and expenses. This includes fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment. - Input Data

Once you have your information gathered, input it into the template. Be sure to update the template regularly to reflect any changes in your financial situation. - Track Spending

Use the template to track your spending throughout the month. This will help you stay on top of your finances and identify areas where you may need to cut back. - Review Regularly

At the end of each month, take some time to review your budget and assess your progress. Are you staying within your budget? Are there any areas where you overspent? Use this information to make adjustments as needed.

Embracing Financial Freedom

Imagine a life where you no longer stress about overdue bills or unexpected expenses. Picture yourself confidently navigating your finances, knowing exactly where every dollar is allocated. This vision can become your reality with the help of a Bill Budget Template.

Overcoming Common Budgeting Challenges

While budgeting is undeniably beneficial, many individuals struggle to stick to a budget consistently. Here are some common challenges and how a Bill Budget Template can help you overcome them:

- Lack of Visibility

Without a clear overview of your finances, it’s easy to lose track of where your money is going. A Bill Budget Template provides a visual representation of your income and expenses, giving you greater visibility and control. - Difficulty Tracking Expenses

Keeping track of every expense manually can be tedious and time-consuming. With a Bill Budget Template, you can easily input your expenses and let the template do the calculations for you, saving time and reducing the likelihood of errors. - Impulse Spending

It’s all too easy to give in to impulse purchases, especially when you’re not keeping a close eye on your finances. A Bill Budget Template encourages mindful spending by forcing you to consider how each purchase fits into your overall budget.

Empowering Financial Literacy

Beyond its practical benefits, using a Bill Budget Template can also help improve your financial literacy. By actively engaging with your finances and analyzing your spending habits, you’ll gain valuable insights into your financial behavior and make more informed decisions in the future.

Conclusion

In today’s fast-paced world, financial management is more important than ever. Whether you’re saving for a major purchase, planning for retirement, or simply striving for financial stability, a Bill Budget Template can be a game-changer. By providing clarity, organization, and control, this powerful tool empowers you to take charge of your finances and achieve your long-term goals.

So why wait? Download your free Bill Budget Template today and embark on your journey toward financial freedom. With dedication, discipline, and the right tools at your disposal, the possibilities are endless. Take the first step today and reclaim control of your financial future.