Accounts Receivable Report Sample provides businesses with insights into their outstanding customer invoices. In this article, we’ll explore the key metrics and analysis techniques to help you better understand your business’s financial health.

If you’re a business owner or an accounting professional, you’re likely familiar with the importance of accounts receivable management. Accounts receivable refers to the money owed to your business by your customers for products or services rendered. Managing accounts receivable is crucial to ensure that your business maintains a healthy cash flow and that your outstanding invoices are paid on time.

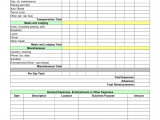

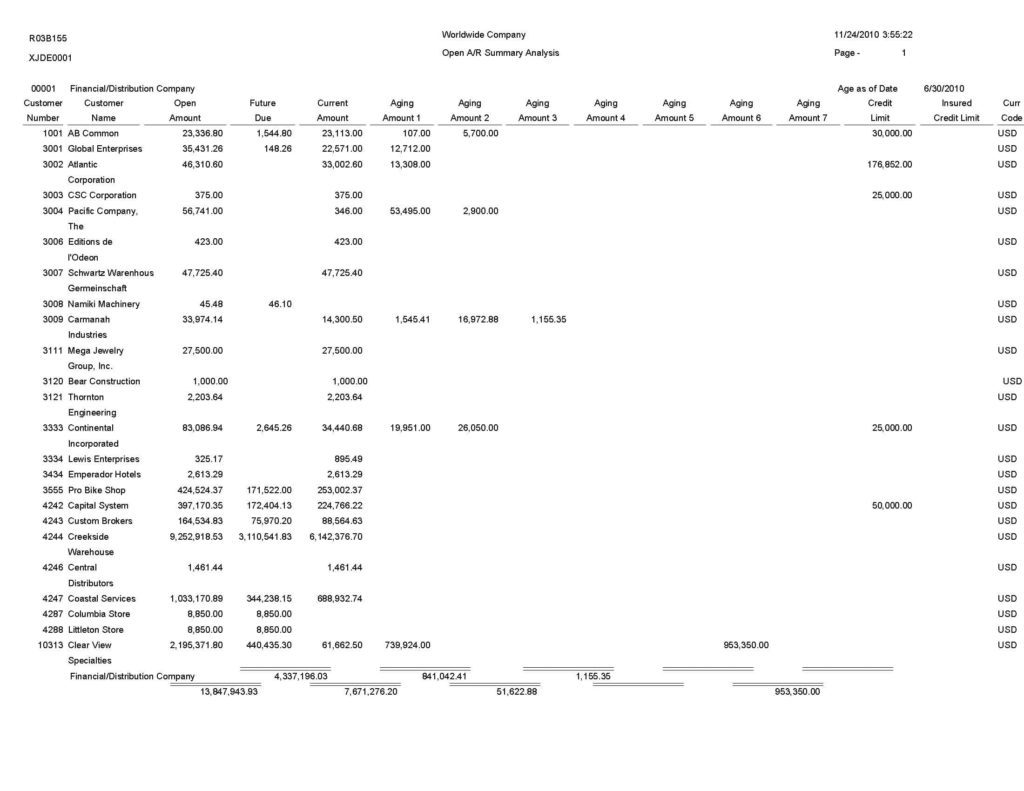

One of the key tools in managing accounts receivable is the accounts receivable report. An accounts receivable report provides a detailed breakdown of outstanding customer invoices, including the amounts owed, the due dates, and the customers who owe them. In this article, we’ll explore the key metrics and analysis techniques used in an accounts receivable report sample.

Days Sales Outstanding (DSO)

One of the most important metrics in an accounts receivable report sample is Days Sales Outstanding (DSO). DSO measures the average number of days it takes for your customers to pay their outstanding invoices. A high DSO indicates that your customers are taking longer to pay their invoices, which can impact your business’s cash flow. A low DSO, on the other hand, means that your customers are paying their invoices promptly, which is good news for your business’s financial health.

To calculate DSO, divide the total accounts receivable by the total sales over a specific period and multiply the result by the number of days in that period. For example, if your business had $100,000 in accounts receivable and $1,000,000 in sales over a 30-day period, your DSO would be 3 days.

Accounts Receivable Aging

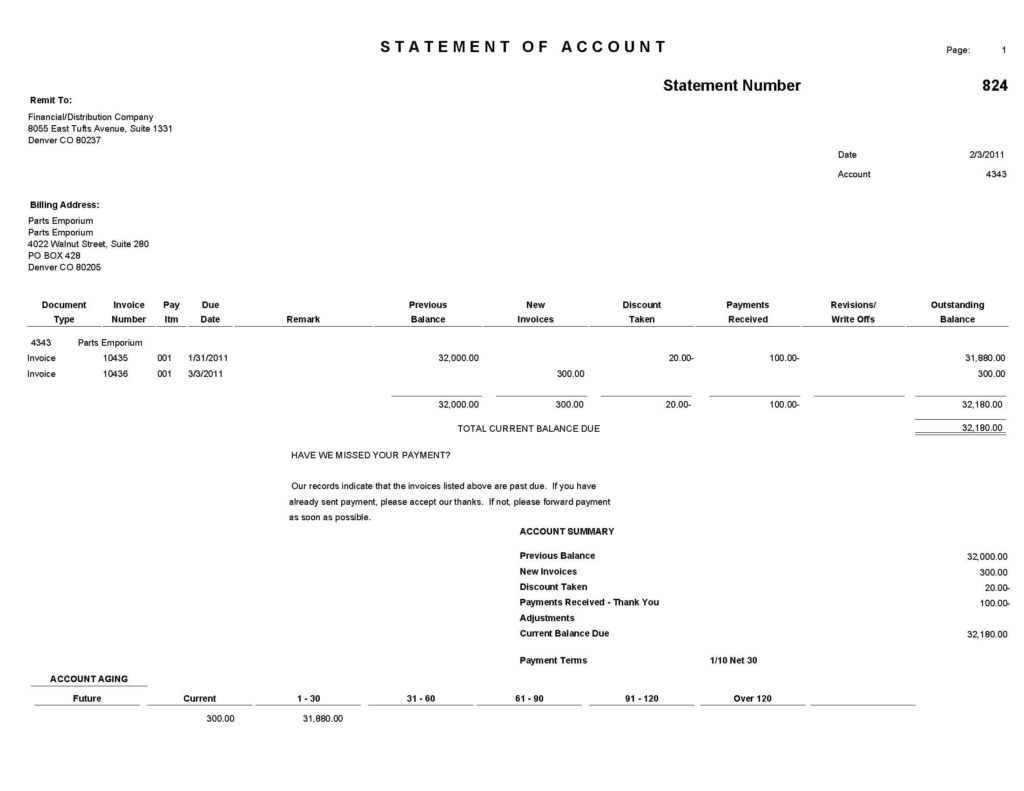

Another important metric in an accounts receivable report sample is Accounts Receivable Aging. This metric provides a breakdown of outstanding invoices by the number of days they’ve been outstanding. Typically, accounts receivable aging is broken down into 30-day increments, such as 0-30 days, 31-60 days, 61-90 days, and 91+ days.

Accounts receivable aging can help you identify which invoices are outstanding and for how long. This information can help you prioritize collections efforts and ensure that you’re following up with customers who have outstanding invoices.

Bad Debt Expense

Bad debt expense is another important metric in an accounts receivable report sample. Bad debt expense refers to the amount of money that your business is unlikely to collect from outstanding customer invoices. Bad debt expense can occur for a variety of reasons, such as customer bankruptcy or insolvency.

To calculate bad debt expense, you’ll need to estimate the percentage of outstanding invoices that are unlikely to be collected and multiply that percentage by the total accounts receivable. Bad debt expense is an important metric to track as it can impact your business’s financial health and profitability.

Conclusion

Managing accounts receivable is a crucial part of any business’s financial health. An accounts receivable report sample provides businesses with valuable insights into their outstanding customer invoices, including key metrics such as DSO, accounts receivable aging, and bad debt expense. By tracking these metrics and analyzing the data, businesses can better manage their cash flow and ensure that their outstanding invoices are paid on time.

In addition to tracking the key metrics in an accounts receivable report sample, there are several analysis techniques that businesses can use to gain deeper insights into their financial health. One such technique is trend analysis.

Trend analysis involves analyzing data over a period of time to identify patterns and trends. By analyzing trends in accounts receivable, businesses can gain insights into their customers’ payment patterns and identify any potential issues early on. For example, if a particular customer is consistently paying their invoices late, trend analysis can help identify this pattern, allowing the business to take proactive measures to address the issue.

Another analysis technique is ratio analysis. Ratio analysis involves comparing different financial ratios to gain insights into a business’s financial health. For example, the accounts receivable turnover ratio compares the total amount of credit sales to the average accounts receivable balance over a period of time. A high accounts receivable turnover ratio indicates that customers are paying their invoices promptly, while a low ratio may indicate issues with collections or customer creditworthiness.

Finally, businesses can use benchmarking to compare their accounts receivable performance to industry standards. By benchmarking against similar businesses, businesses can gain insights into their relative performance and identify areas for improvement. For example, if a business’s DSO is higher than the industry average, benchmarking can help identify potential issues with collections or customer creditworthiness.

In conclusion, an accounts receivable report sample is a valuable tool for businesses to manage their accounts receivable and maintain a healthy cash flow. By tracking key metrics such as DSO, accounts receivable aging, and bad debt expense, businesses can gain insights into their financial health and identify potential issues early on. In addition, analysis techniques such as trend analysis, ratio analysis, and benchmarking can provide deeper insights and help businesses identify areas for improvement.