Learn everything you need to know about creating a profit and loss statement for self employed individuals. Download our customizable template and get started today!

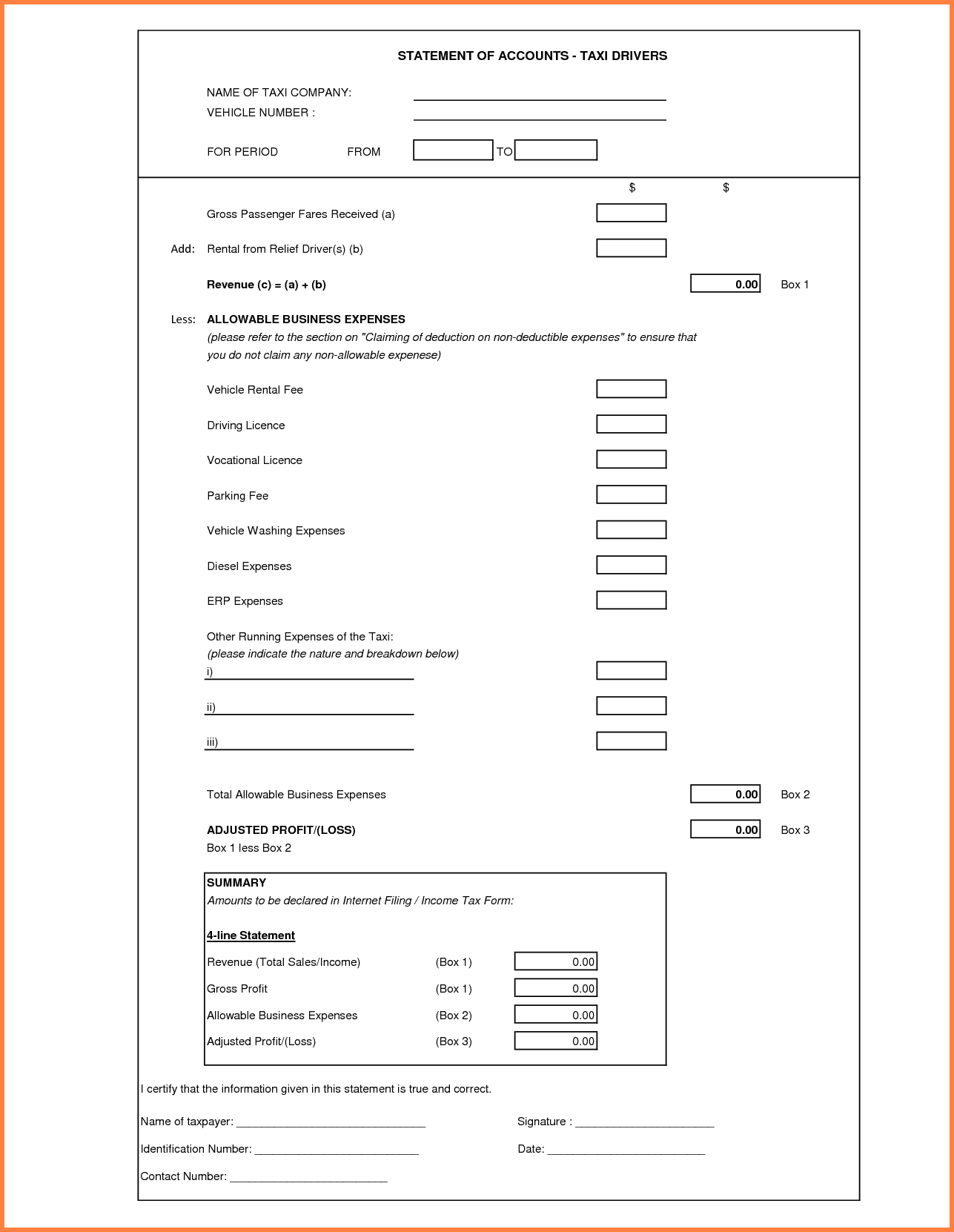

If you are self-employed, keeping track of your finances is crucial for the success of your business. One of the most important financial documents you should create is a profit and loss statement. This document shows your revenue, expenses, and profits over a specific period. With this information, you can make informed decisions about your business and plan for the future.

In this article, we will provide you with a comprehensive guide on creating a profit and loss statement for self-employed individuals. We will also provide you with a customizable template that you can use to create your own statement.

Understanding the Components of a Profit and Loss Statement

Before we dive into the details of creating a profit and loss statement, let’s first understand the components of this document.

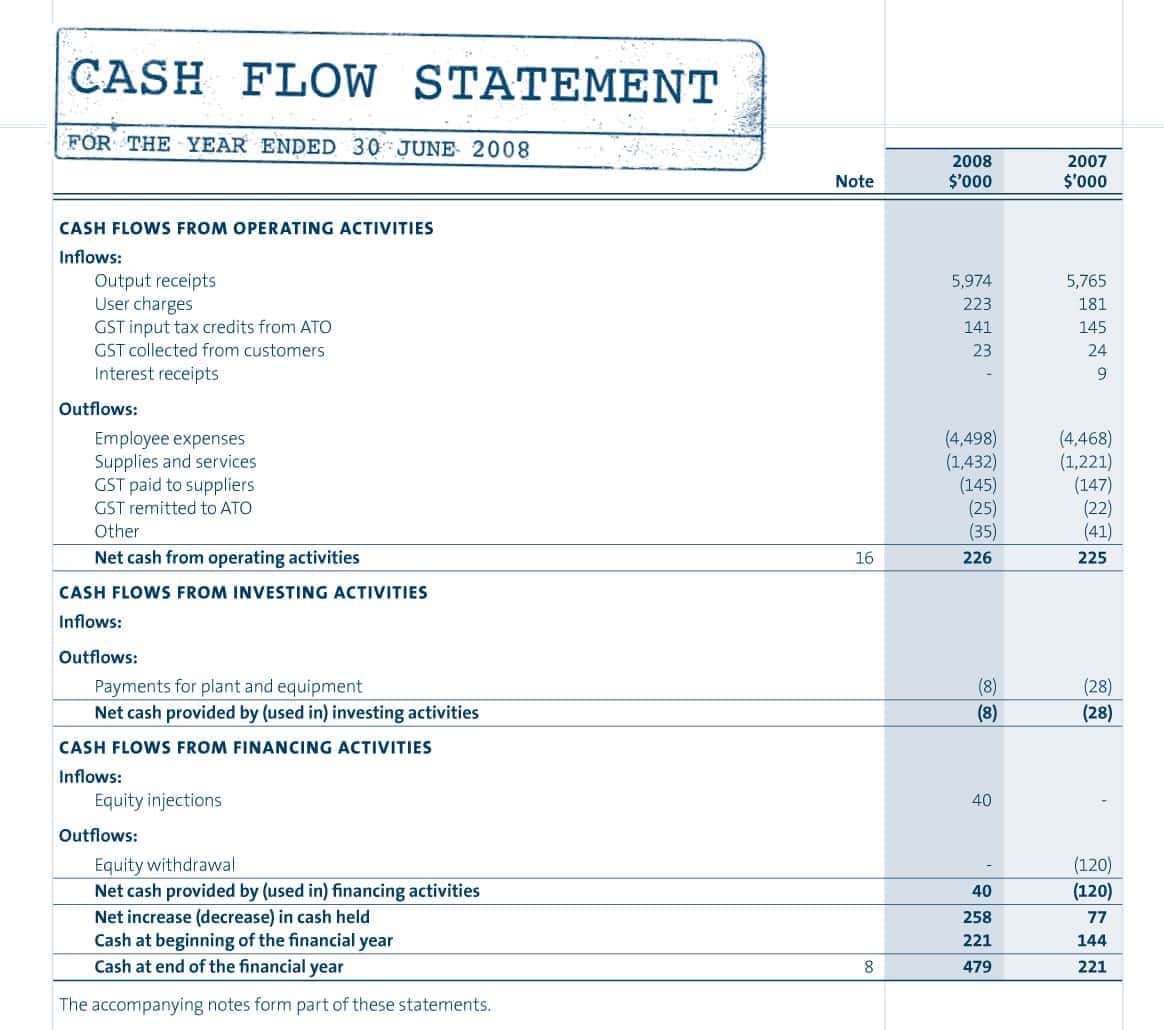

Revenue: This refers to the total amount of money you have earned during a specific period.

Cost of Goods Sold: If you sell products, this refers to the cost of the materials used to make those products. If you provide services, this refers to the cost of providing those services.

Gross Profit: This is your revenue minus your cost of goods sold.

Operating Expenses: These are the expenses you incur to run your business, such as rent, utilities, marketing expenses, and office supplies.

Net Profit: This is your gross profit minus your operating expenses. It represents the profit you have earned after deducting all your expenses.

Creating Your Profit and Loss Statement

Now that you understand the components of a profit and loss statement, it’s time to create your own. Here are the steps to follow:

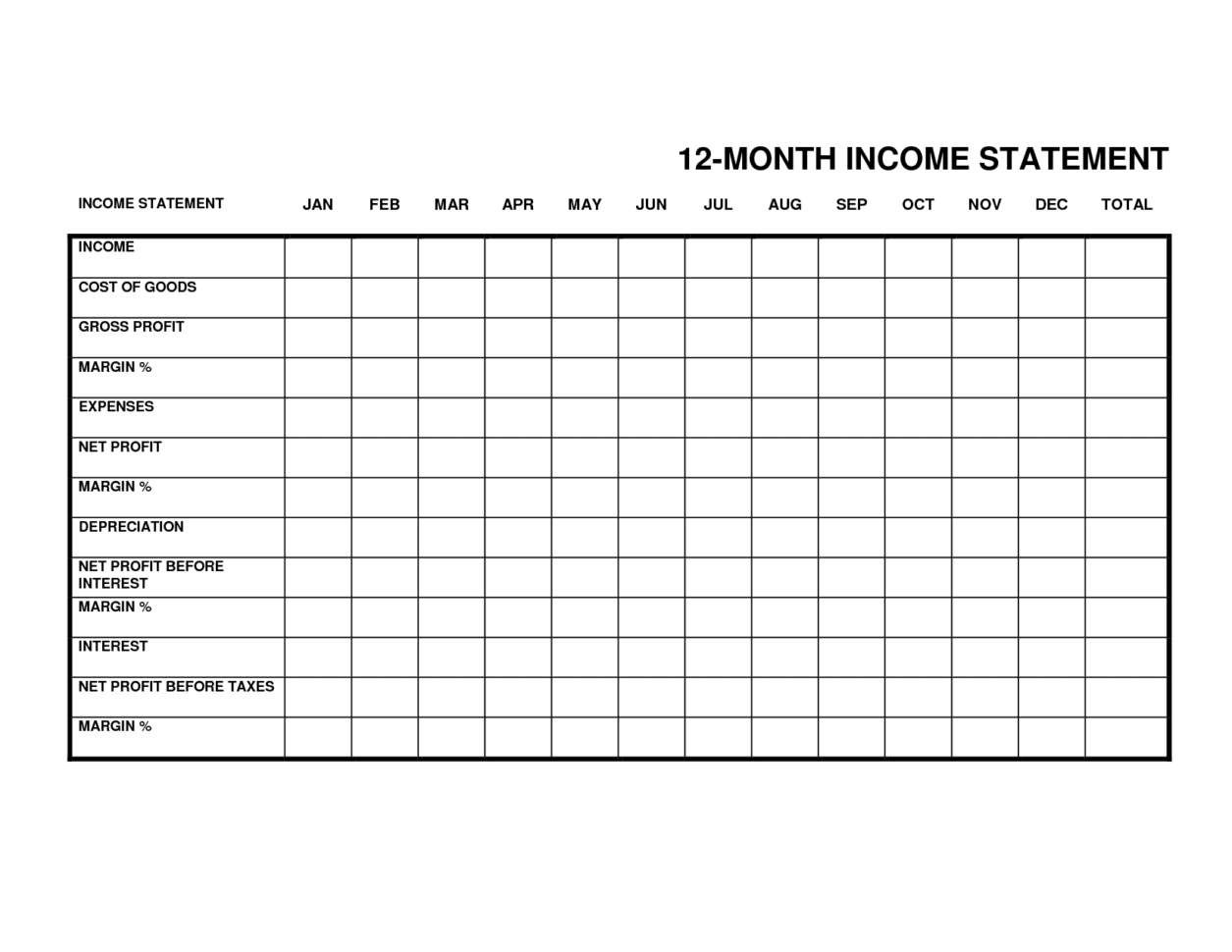

Step 1: Choose a time period for your statement. This could be a month, a quarter, or a year, depending on your preference.

Step 2: Gather your financial records, including your income and expense statements.

Step 3: Calculate your revenue by adding up all the money you have earned during the chosen time period.

Step 4: Calculate your cost of goods sold. If you sell products, this would include the cost of materials used to make those products. If you provide services, this would include the cost of providing those services.

Step 5: Calculate your gross profit by subtracting your cost of goods sold from your revenue.

Step 6: Calculate your operating expenses by adding up all the expenses you incurred to run your business during the chosen time period.

Step 7: Calculate your net profit by subtracting your operating expenses from your gross profit.

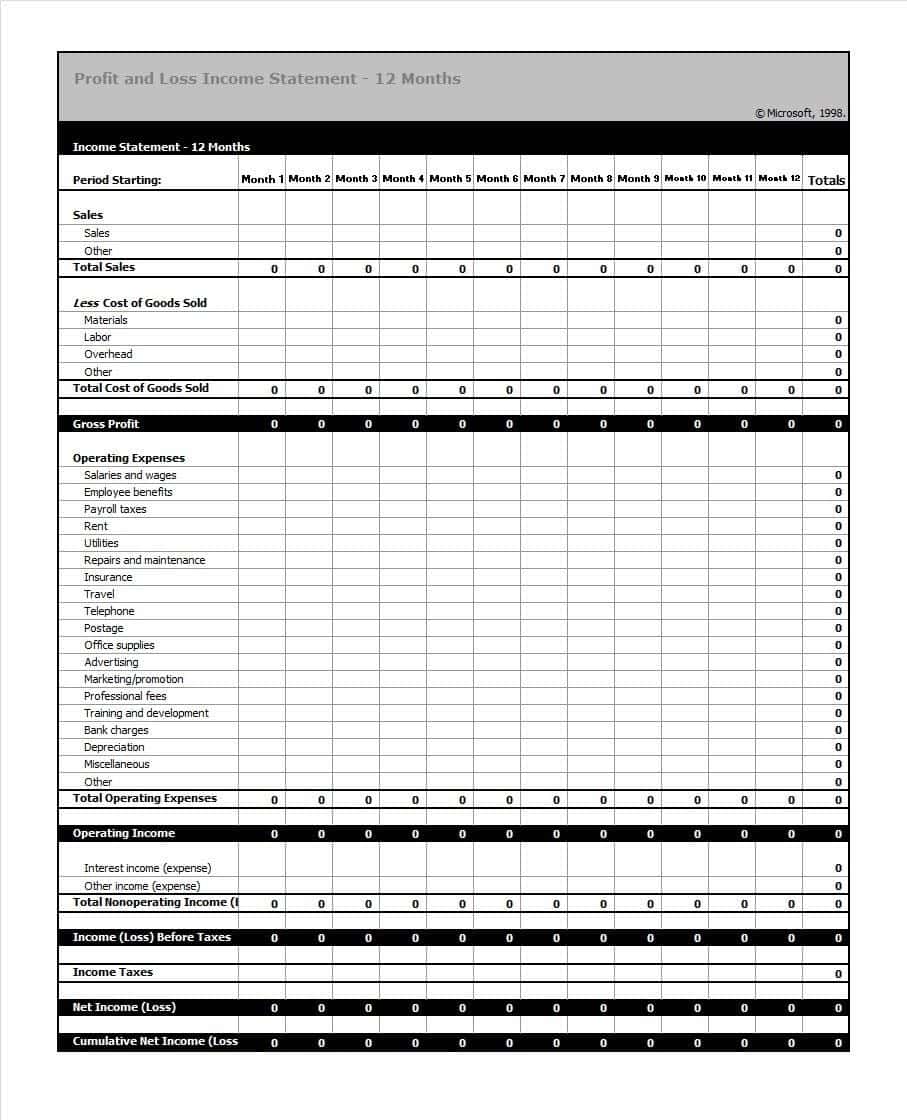

Step 8: Fill in the details in the profit and loss statement template provided below.

Tips for Creating a Comprehensive Profit and Loss Statement

To ensure that your profit and loss statement is accurate and comprehensive, here are a few tips to keep in mind:

- Categorize your expenses

It’s important to categorize your expenses so that you can easily track where your money is going. Common categories include rent, utilities, marketing expenses, office supplies, and travel expenses. - Be thorough

Make sure you include all your revenue and expenses in your statement. If you forget to include any expenses, your net profit will be inaccurate. - Keep accurate records

To create an accurate profit and loss statement, you need to keep accurate records of your finances. Make sure you keep all your receipts and invoices organized so that you can easily refer to them when creating your statement. - Use a template

Using a template can make the process of creating a profit and loss statement much easier. You can customize the template to fit your specific needs and save time in the process.

Conclusion

Creating a profit and loss statement is an essential part of managing your finances as a self-employed individual. By understanding the components of this document and following the steps outlined above, you can create an accurate and comprehensive statement that will help you make informed decisions about your business.

In addition to the profit and loss statement template provided, there are also many online tools and software programs that can assist you in creating your statement. These tools can help streamline the process and ensure that your statement is accurate and comprehensive.

By taking the time to create a profit and loss statement for your self-employed business, you will have a better understanding of your financial situation and be able to make informed decisions about the future of your business. So, download the template, follow the steps outlined above, and take control of your finances today!