In the journey toward financial stability, finding effective tools to manage and alleviate debt is crucial. One such powerful resource that often goes overlooked is the Offer In Compromise Worksheet. This invaluable document serves as a cornerstone for individuals seeking relief from tax debt, providing a structured approach to negotiate with the IRS. In this guide, we will delve into the intricacies of the Offer In Compromise Worksheet, uncovering its potential to transform your financial landscape.

Understanding the Offer In Compromise Worksheet

The Offer In Compromise (OIC) is a program offered by the IRS that allows qualifying individuals to settle their tax debt for less than the total amount owed. At the heart of this program is the Offer In Compromise Worksheet, a meticulously crafted document that acts as a roadmap for applicants. This worksheet is designed to calculate a fair and reasonable offer based on your financial situation.

Navigating the Worksheet Sections

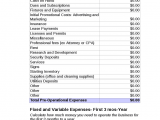

- Income Details

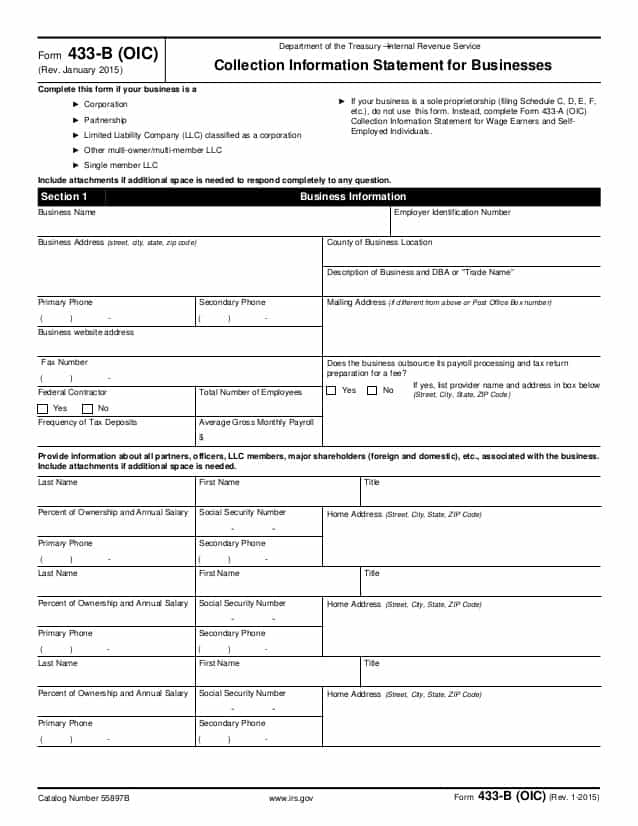

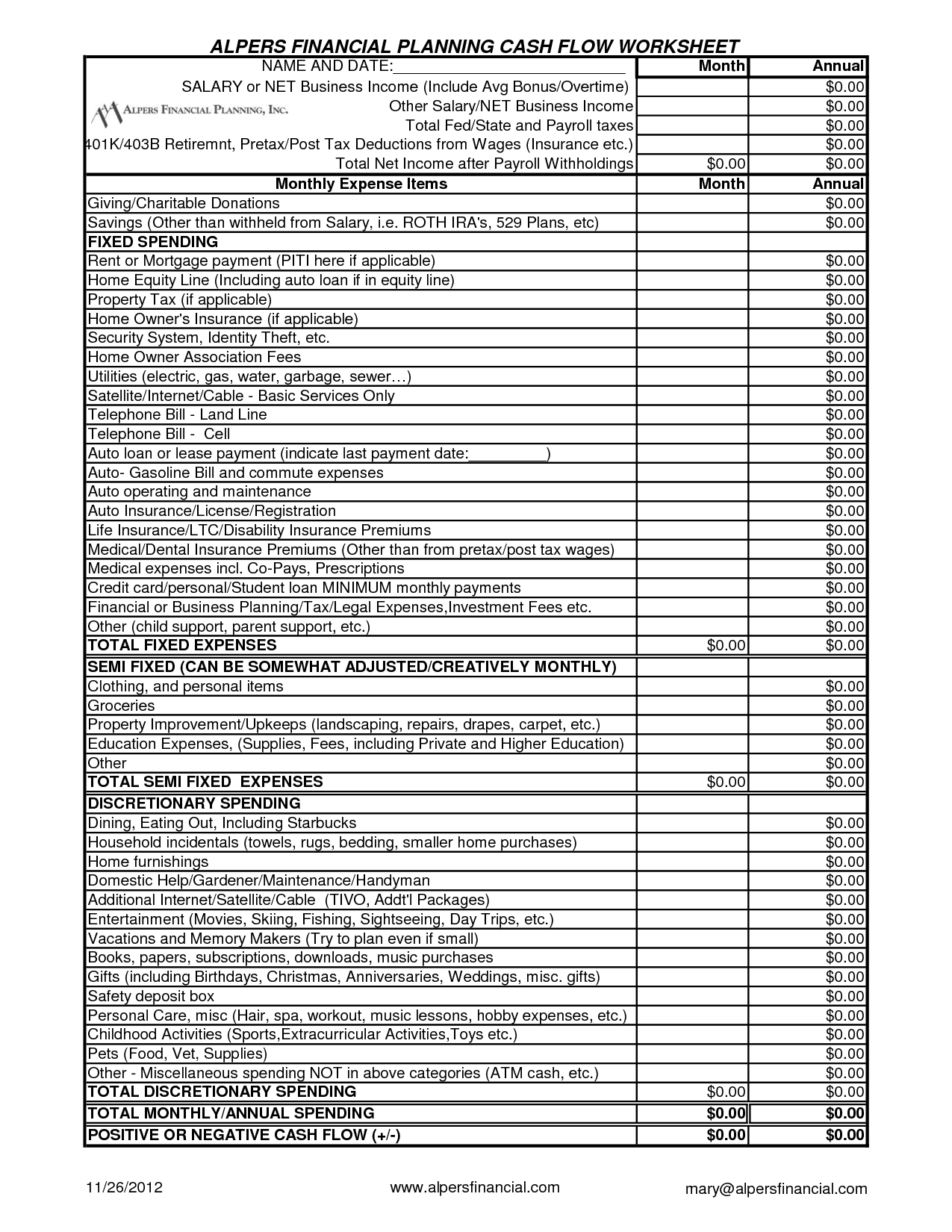

The first section of the worksheet requires a comprehensive overview of your income. This includes wages, self-employment income, and any additional sources of financial support. Accurate reporting is essential to ensure a fair assessment of your ability to repay. - Expenses Breakdown

Understanding your living expenses is vital in determining your disposable income. The worksheet prompts you to list your monthly expenditures, covering everything from housing costs to transportation and health insurance. - Asset Evaluation

The IRS considers your assets when assessing your ability to pay off your debt. The worksheet guides you through detailing your assets, such as real estate, vehicles, and bank accounts. - Future Income Projections

Anticipating changes in your financial situation is crucial. The worksheet prompts you to provide details about any expected increase in income, ensuring transparency in your application.

Tips for Maximizing the Impact of Your Offer In Compromise Worksheet

- Accuracy is Key

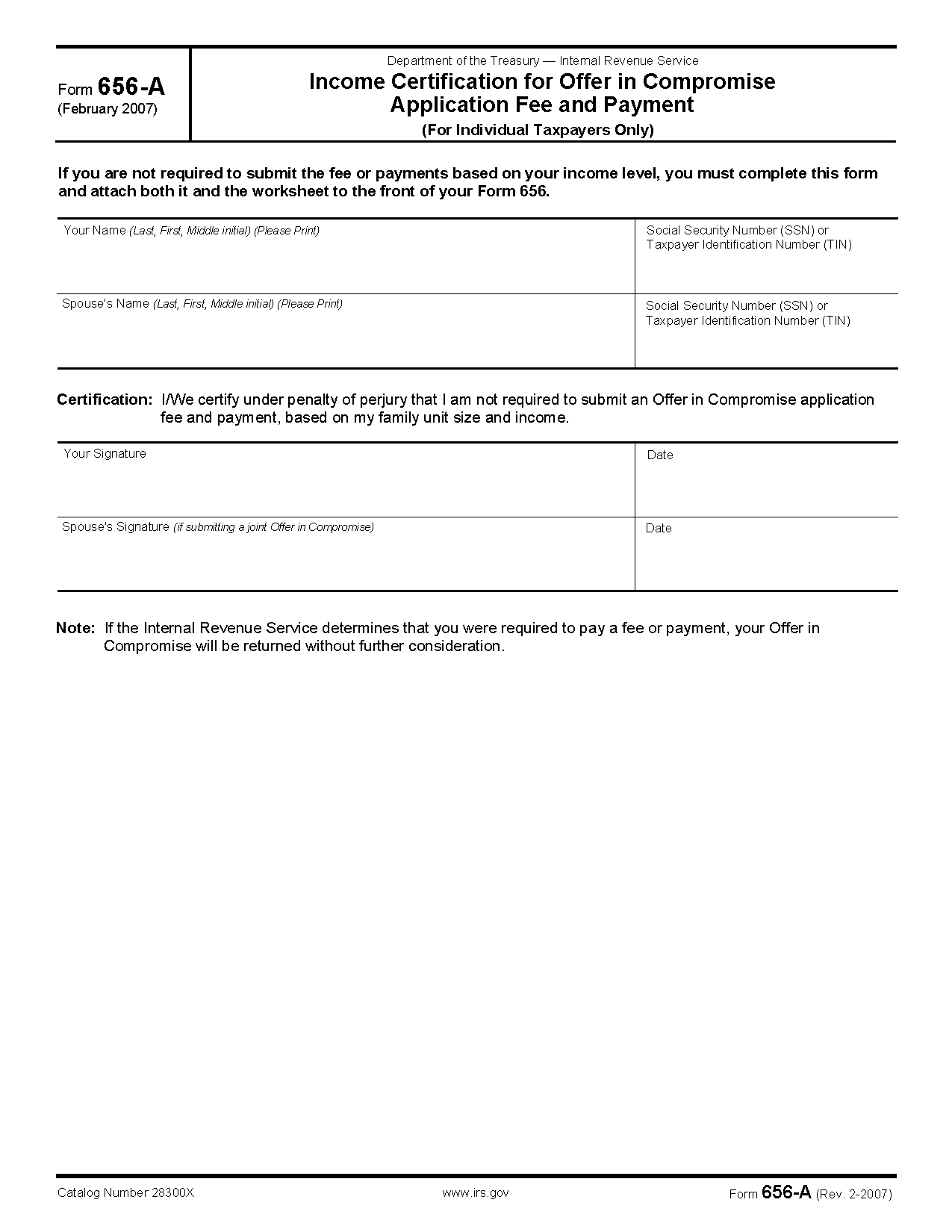

Provide precise and up-to-date information on the worksheet. Inaccuracies can lead to delays in processing or even rejection of your offer. - Thorough Documentation

Support your application with thorough documentation. Backup documents, such as pay stubs, bank statements, and tax returns, can strengthen your case. - Consult a Professional

Navigating the intricacies of tax debt can be challenging. Seeking guidance from a tax professional can significantly enhance your chances of success. - Negotiation Strategies

Craft a compelling narrative for your financial situation. Clearly articulate why your offer should be accepted, emphasizing any unique circumstances that support your case.

The Path to Financial Freedom

Completing the Offer In Compromise Worksheet marks the beginning of your journey towards financial freedom. By demonstrating your true financial picture, you present a compelling case for the IRS to consider your offer. Remember, the IRS aims to work with individuals facing genuine financial hardship, and the Offer In Compromise Worksheet is your tool to showcase your situation accurately.

Beyond the Worksheet: Empowering Your Financial Comeback

Having meticulously filled out your Offer In Compromise Worksheet, you’ve taken the first stride towards resolving your tax debt. However, the journey doesn’t end there. Here are some additional steps to fortify your financial position:

1. Submission and Patience:

Once your Offer In Compromise Worksheet is complete, submit it to the IRS along with the required application fee. Be patient during the review process, as it may take several months for the IRS to assess your case.

2. Open Communication:

Maintain open communication with the IRS throughout the process. Respond promptly to any requests for additional information, ensuring a smooth and transparent exchange.

3. Exploring Other Options:

While the Offer In Compromise is a potent tool, it’s not the only solution. Investigate other available options, such as setting up a monthly installment plan, to find the approach that best aligns with your financial capabilities.

4. Financial Education:

Use this period to enhance your financial literacy. Understand the factors that led to your tax debt and implement strategies to avoid similar pitfalls in the future. Consider seeking financial counseling to receive personalized advice.

5. Budgeting and Saving:

Develop a realistic budget that allows you to meet your financial obligations while gradually building savings. Having an emergency fund can serve as a safety net, preventing future financial setbacks.

6. Credit Rebuilding:

As you work towards resolving your tax debt, focus on rebuilding your credit. Timely payments on other debts and responsible financial behavior contribute positively to your credit score.

7. Celebrating Progress:

Acknowledge and celebrate small victories along the way. Whether it’s successfully adhering to your budget or receiving positive feedback from the IRS, recognizing progress can fuel your determination to overcome financial challenges.

Conclusion: A New Financial Chapter

Embarking on the path to financial recovery requires courage, dedication, and strategic planning. The Offer In Compromise Worksheet is a pivotal tool that can pave the way for a brighter financial future. By approaching this process with transparency and diligence, you not only position yourself for debt relief but also gain valuable insights into managing your finances more effectively.

Remember, financial setbacks are not the end of your story but rather an opportunity for a new beginning. With the right mindset and proactive steps, you can reclaim control over your financial destiny. Utilize the resources available, stay informed, and, most importantly, believe in your ability to overcome financial challenges. Your journey towards lasting financial freedom starts with the decision to take action today.