An Income Tracking Spreadsheet allows you to manage your employee’s hourly wages. This software is most commonly used in the service industry. You can make a spreadsheet available for your employees to use so that they can get paid when they are working.

Many companies today allow their employees to make contributions to the company’s payroll each week. Some employers use payroll deductions to pay their employees. Others choose to keep a checkbook to record the employees’ hours worked. Still others use several methods of paying their employees.

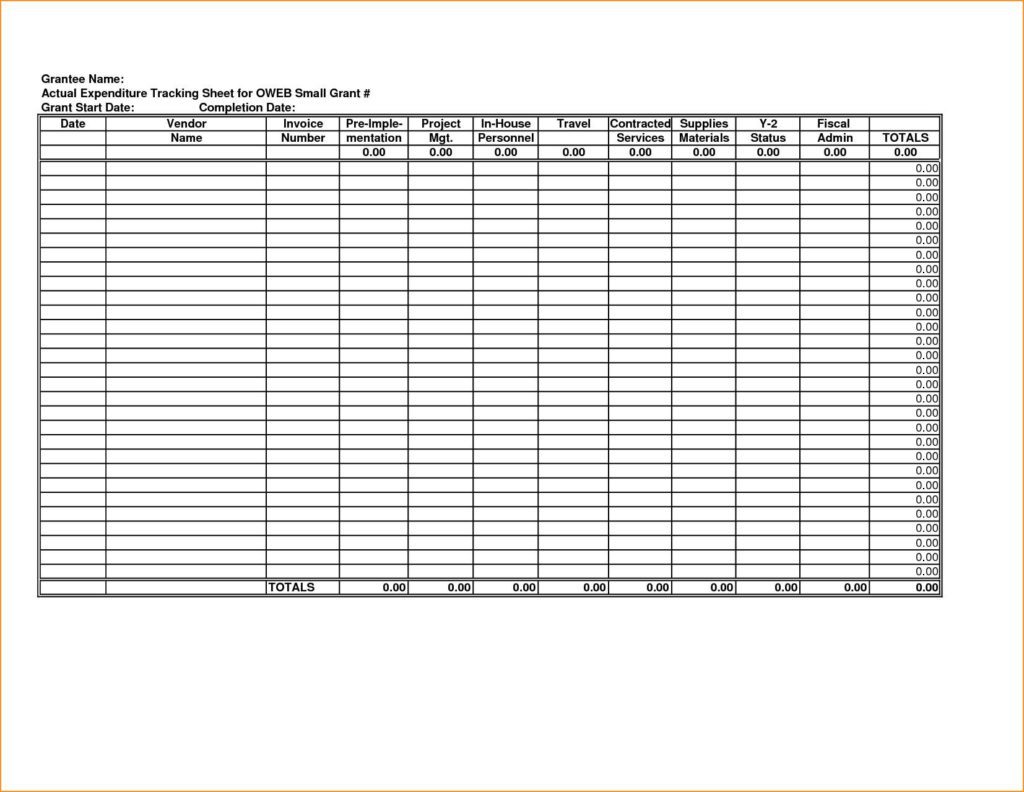

There are many reasons why it makes sense to include an Income Tracking Spreadsheets into your payroll system. First, you can set up the software to automatically deduct and pay employees who are working on Monday and Tuesday of every week. Second, the program will automatically calculate the hours worked for you.

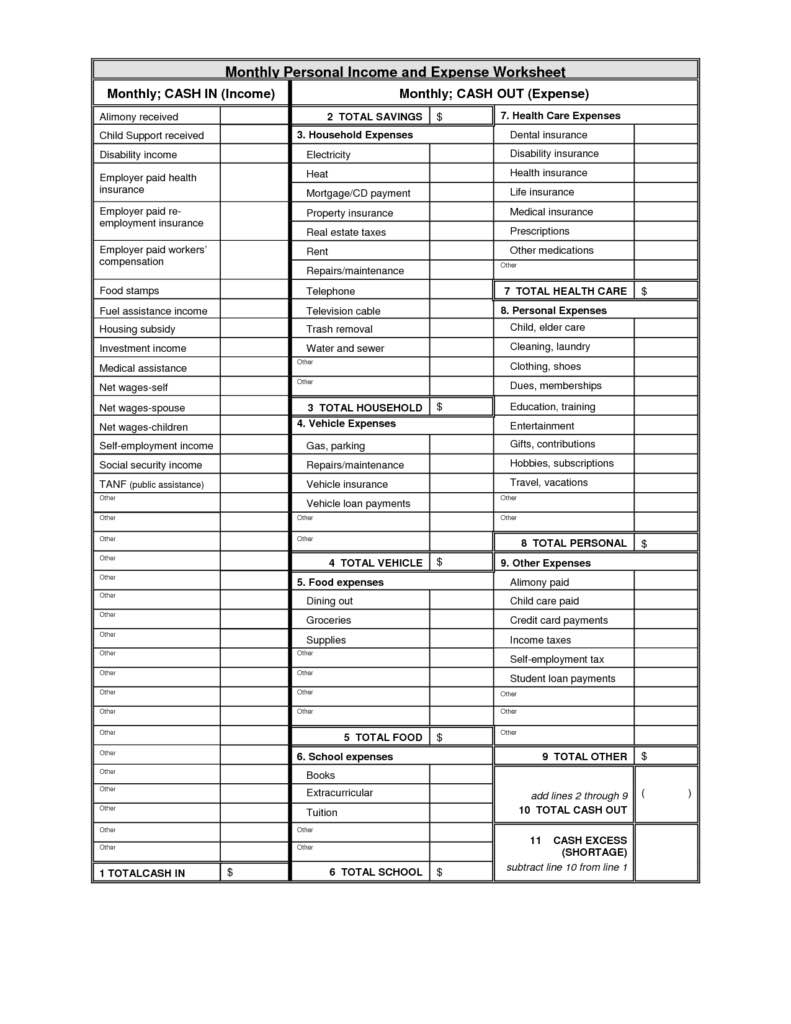

Once you have selected the number of hours that you would like to record on your company’s payroll each week, you can build a spreadsheet that will record the employee’s hours worked. This will help you to better control your payroll. The program will allow you to enter data in a format that can be easily understood by your software.

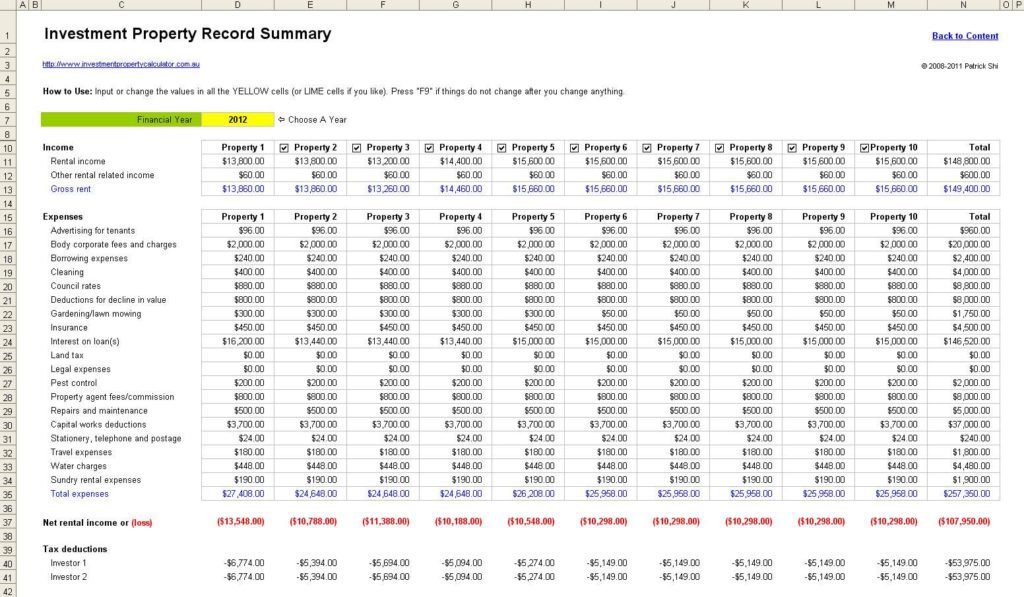

Then, if you want to review your financial year totals, you can simply select the spreadsheet on your computer and review the monthly totals. You will get the totals for the months you chose to view at a glance. Finally, the program can also be used to set an automatic payout for each employee when they have completed a certain number of hours worked.

Each time you make any changes to your Income Tracking Spreadsheets, it will be reflected instantly on your account. You can also determine which hours you would like to have paid automatically and which ones you would like to manually enter. This is especially important if you are using it to control a team of workers, because you can make sure that everyone is paid the correct amount of money based on his or her hours worked.

You can easily determine what hours an employee is actually working by looking at the spreadsheet. If there are too many hours written as working, then that employee will not receive the correct amount of money. If the hours are less than the agreed upon amount, then the employee will be paid the difference.

The many benefits of using an Income Tracking Spreadsheets are numerous. These programs can help to create more efficient processes and make tracking payroll easier. As you make the necessary adjustments to your company’s payroll, these programs can make it simpler to pay each employee appropriately.