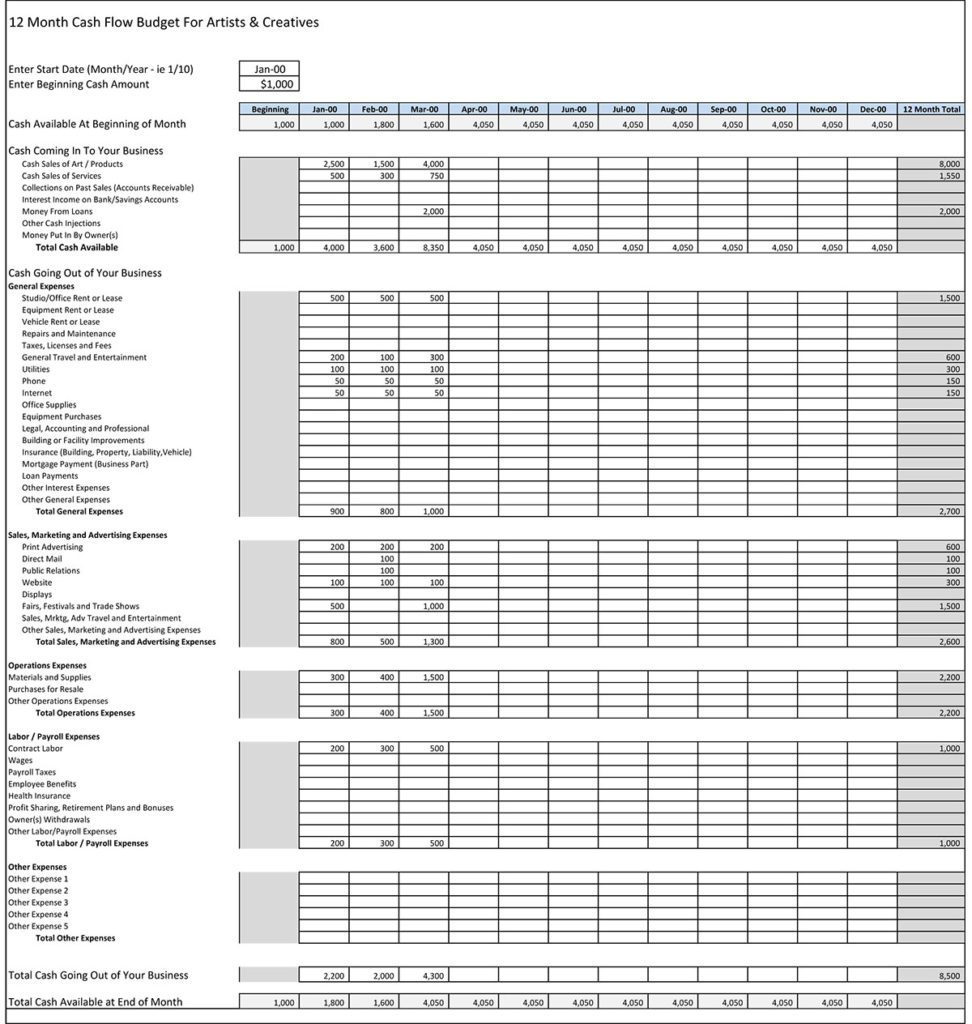

All too often, the greatest benefits of a spreadsheet are seen in income and expenses that are compiled by people who are not truly small business owners. Because of this, it is of the utmost importance that you find a way to protect yourself and your company’s true value.

When working with a large client list, it is necessary to use a spreadsheet that allows you to work with income and expenses while protecting your clients. An example of a spreadsheet that offers this is the Income and Expenses Spreadsheet Small Business. For the most part, this spreadsheet offers a number of helpful features that you may not have heard of before.

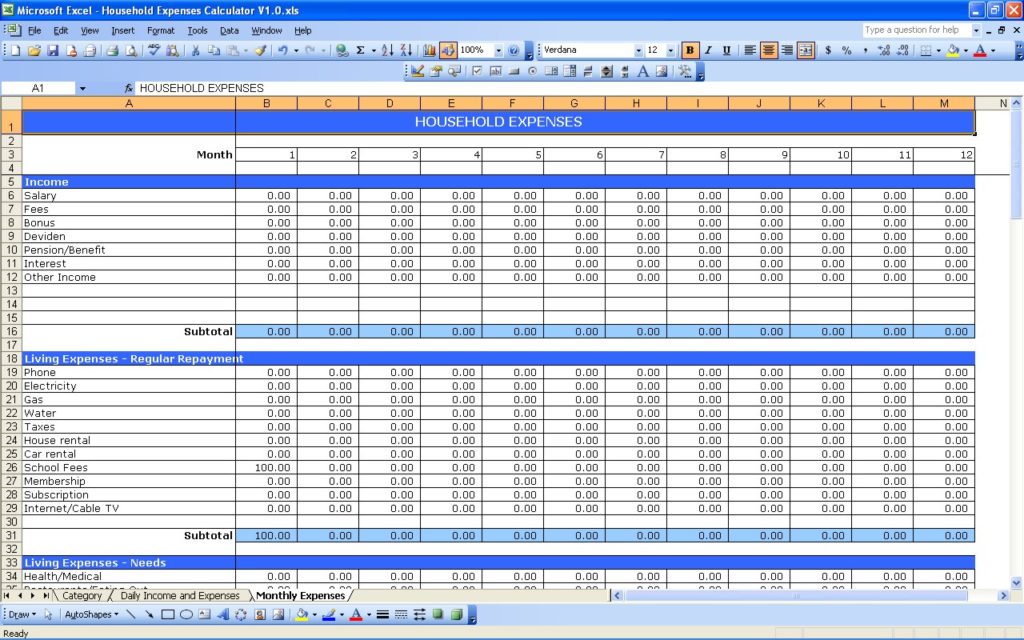

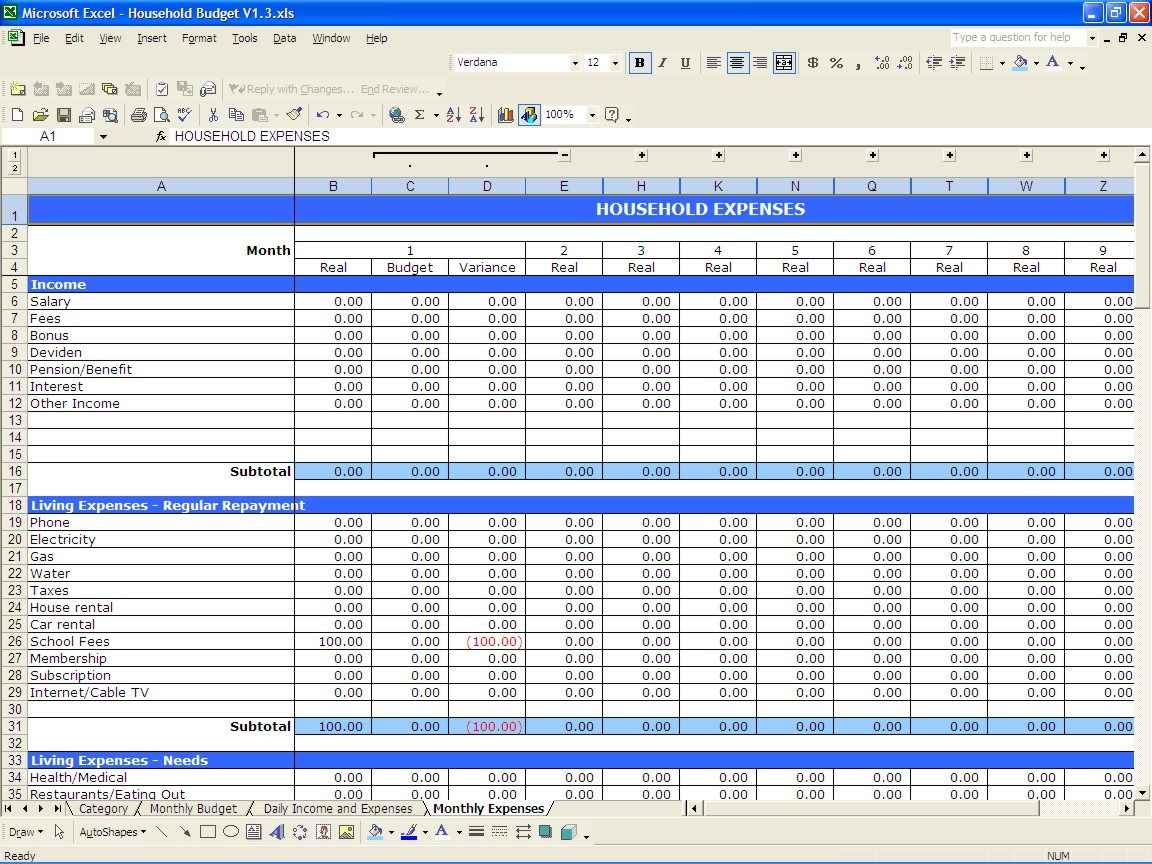

First, it includes an expense calculator, which means that you can easily calculate what you spend per transaction or project based on the size of your billable period. It is especially helpful if you have employees that can help you manage your bills, such as auditors or accountants. You can keep track of expenses for them, allowing you to see how well you are spending their time and help cut down on waste.

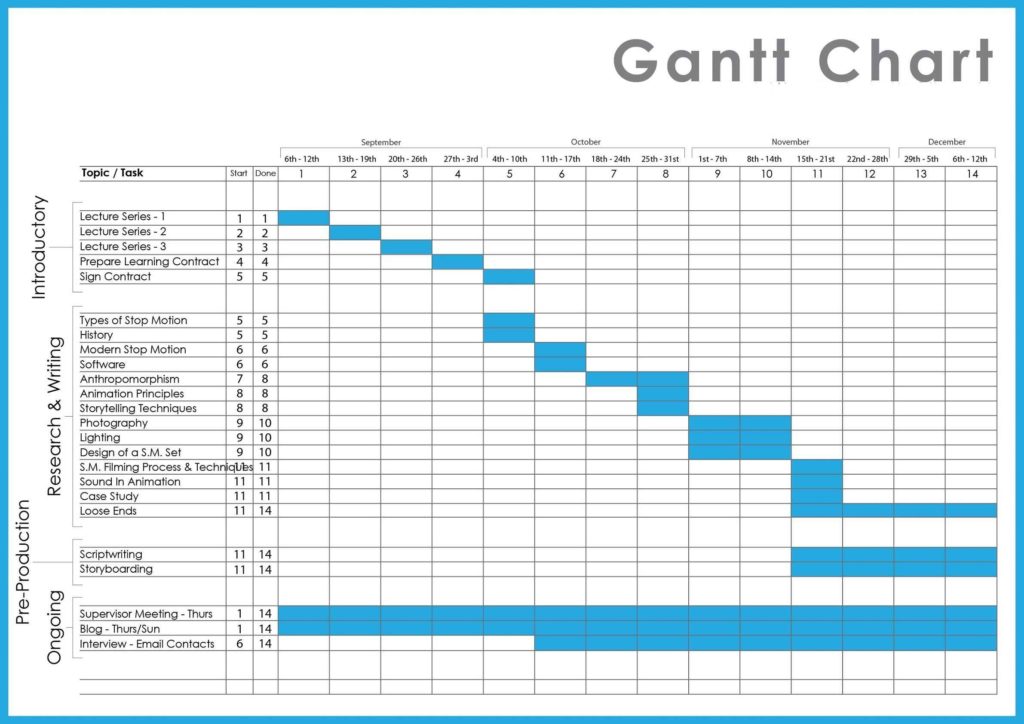

An important feature of this spreadsheet is its ability to work as a business notebook, which lets you create checklists and tags that work for your business. This helps keep track of items in your schedule, as well as helping to identify any items that need to be reevaluated before they go out on a project. You can do an item by item review, which can help eliminate any discrepancies that could result in cash out the next day.

In addition to the expense and inventory data that this spreadsheet provides, it also allows you to create a virtual work log, which is very useful for companies that do an annual audit. Using a virtual work log allows you to track everything that you do, making it easier to keep track of project changes, goals, and deadlines. The spreadsheet also has a specific section for making financial records, which makes it easier to keep tabs on all of your money transactions.

One important thing to note is that you do not need to worry about losing your work when you transfer to another program. Because it is used for the purpose of tracking income and expenses, the Income and Expenses Spreadsheet Small Business is always running. Any changes made are automatically saved, and any files are completely safe, so it should be the first spreadsheet you choose if you have a large client base.

This spreadsheet can also help you manage your client list, which can help you ensure that you are meeting your financial obligations to your clients. This will also make it easier to find clients that need a particular service, such as accounting services, medical billing services, or retail consulting services.

An important benefit of this spreadsheet is that it gives you the ability to set and meet goals, since the data is laid out exactly the way you need it. The result is that you can easily compare your past results to what you have scheduled for the future. Since it is customizable, the data you gather in your spreadsheet can be tailored to your specific needs.