In the whirlwind of life, it’s easy to lose sight of our financial standing. Bills, loans, savings, investments – it can all become a tangled mess. But fear not, for there’s a beacon of hope amidst this chaos: the Free Personal Balance Sheet Template from Pruneyard Inn.

Understanding the Balance Sheet

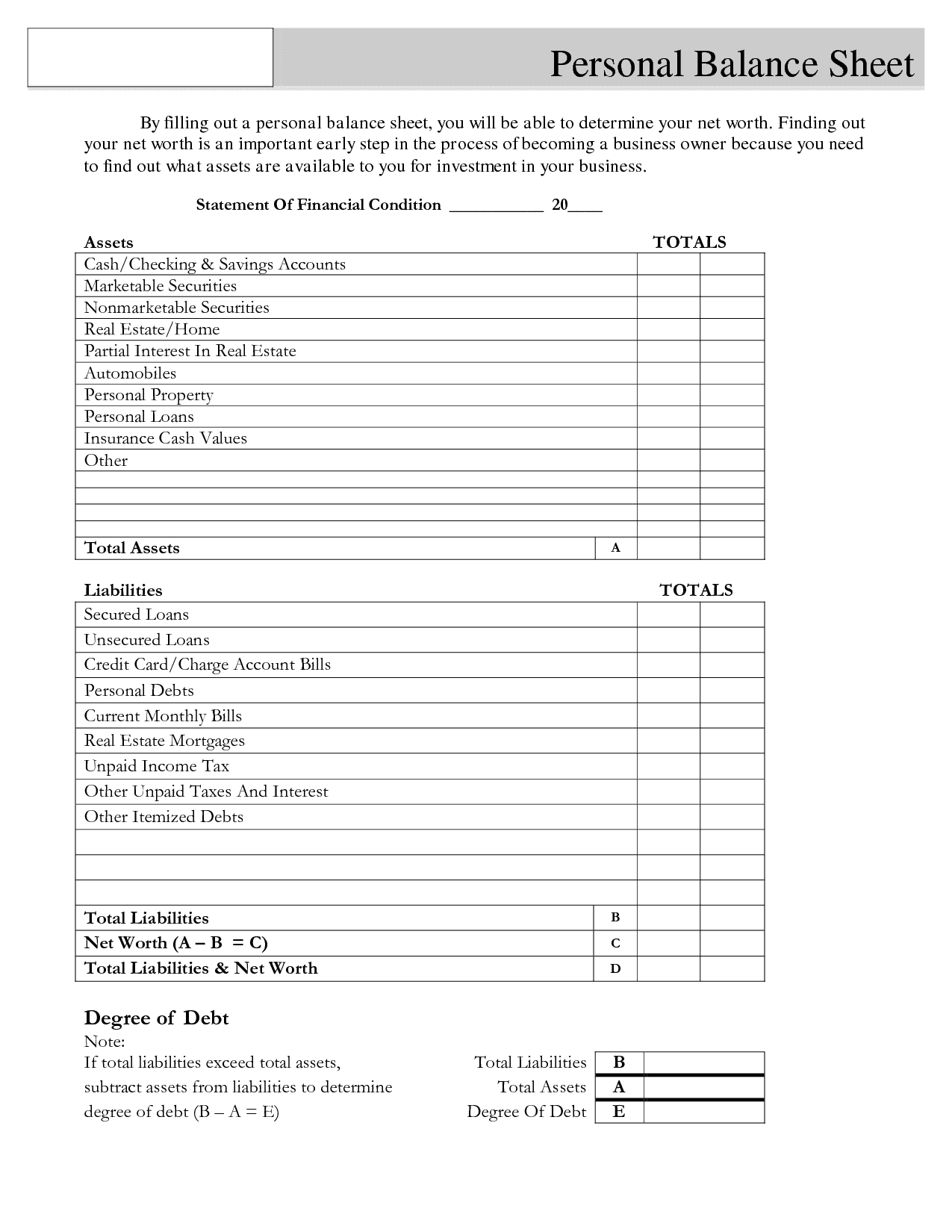

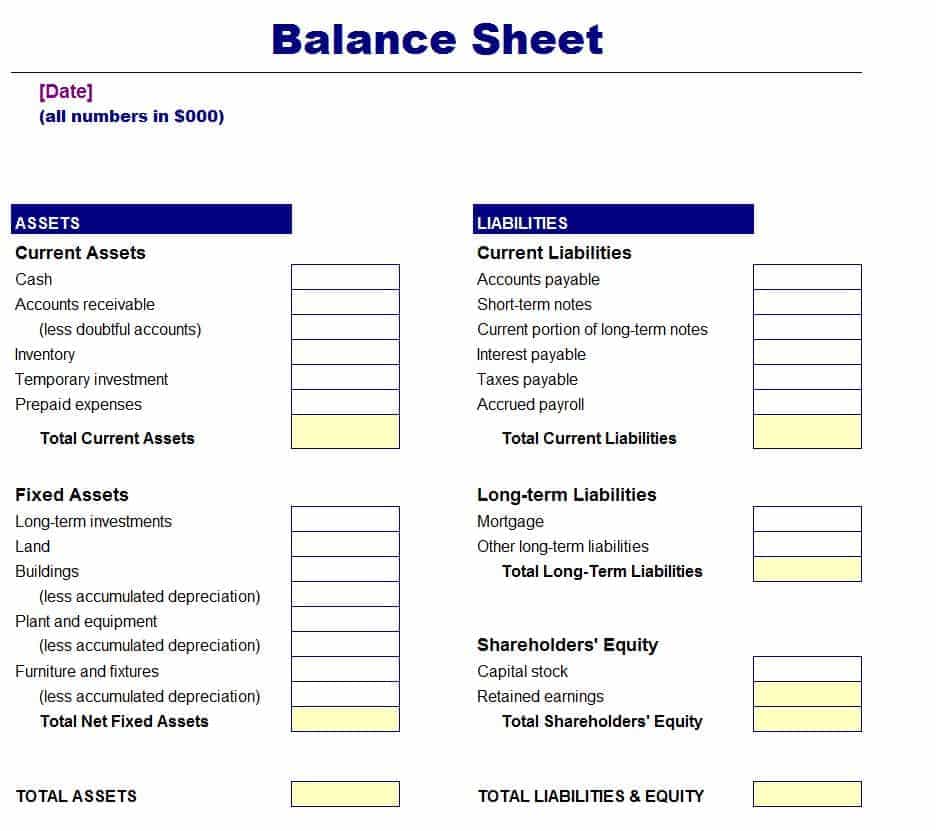

Before we delve into the wonders of our template, let’s grasp the essence of a balance sheet. Think of it as a financial snapshot, capturing your assets, liabilities, and net worth at a specific moment in time. It’s a crucial tool for assessing your financial health and planning for the future.

Why You Need a Personal Balance Sheet

Imagine driving without a map – you might end up lost or worse, in a financial ditch. A personal balance sheet serves as your financial GPS, guiding you towards your goals. It helps you:

1. Evaluate Your Net Worth:

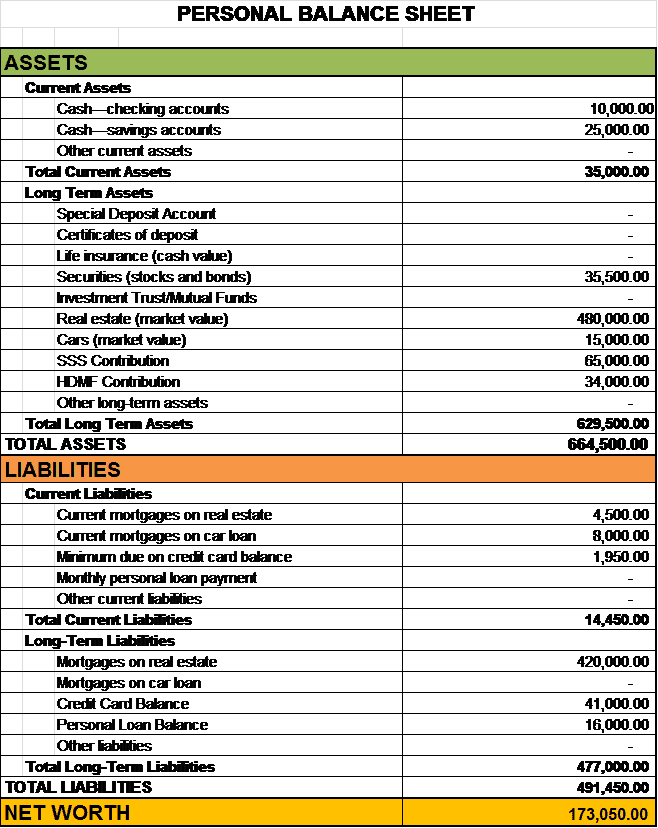

With our template, you can effortlessly tally up your assets (like savings, investments, and property) and subtract your liabilities (such as debts and loans). Voila! You have your net worth – a clear indicator of where you stand financially.

2. Track Financial Progress:

Watching your net worth grow is akin to seeing a plant flourish under your care. Our template lets you track changes over time, empowering you to make informed decisions and celebrate financial milestones.

3. Plan for the Future:

Retirement, education, dream vacations – whatever your aspirations, a balance sheet helps you chart a course to reach them. By understanding your current financial position, you can strategize and allocate resources wisely.

Introducing Our Free Personal Balance Sheet Template

At Pruneyard Inn, we understand the importance of simplicity and accessibility. That’s why we offer our Free Personal Balance Sheet Template – a user-friendly tool designed to streamline your financial management.

Key Features:

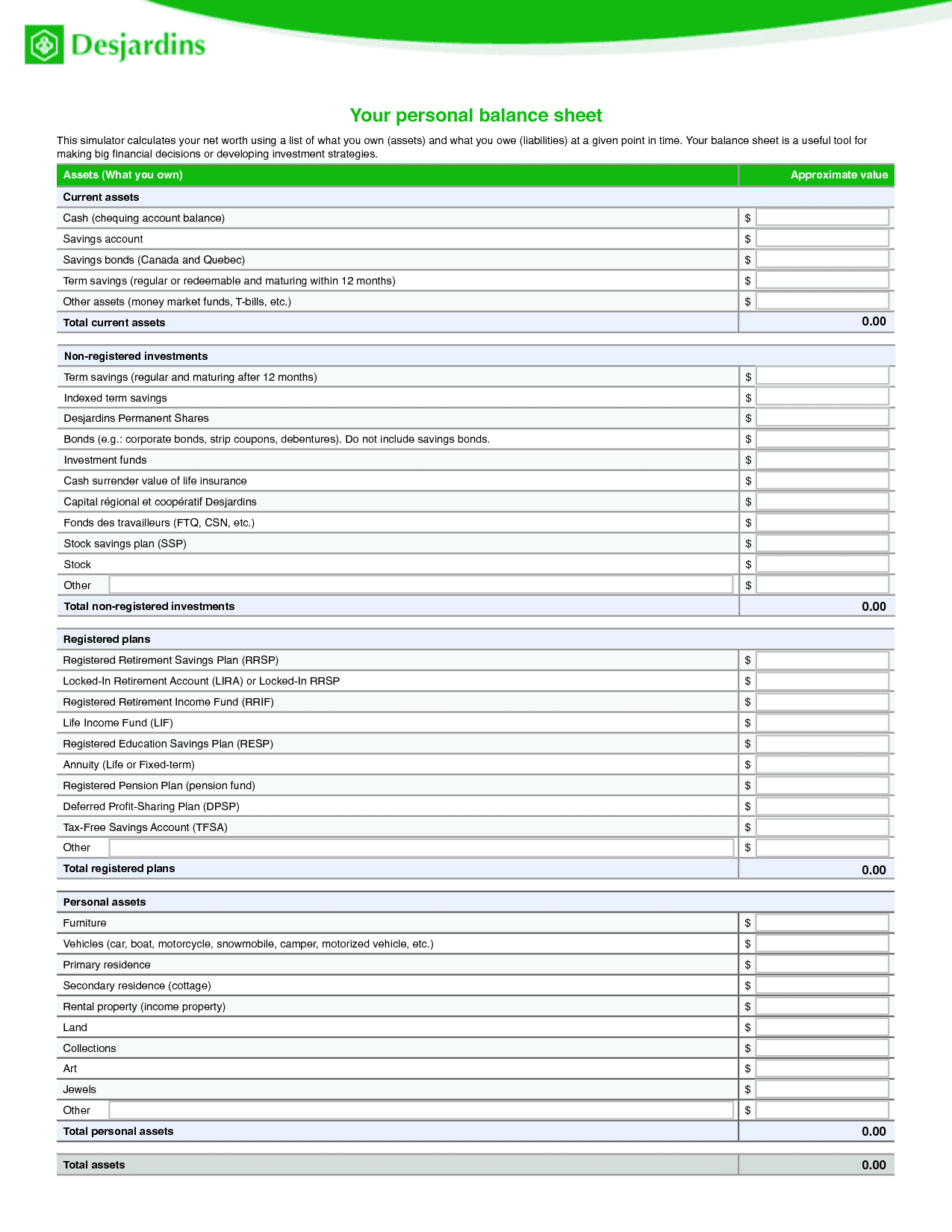

- Easy-to-Use Format

No finance degree required! Our template boasts a straightforward layout, making it suitable for everyone, from fresh graduates to seasoned professionals. - Comprehensive Categories

We’ve thought of everything – from bank accounts to retirement funds, ensuring you can account for every penny. - Customizable Options

Personalize your balance sheet to suit your needs. Add or remove categories, tweak formulas – it’s your financial canvas.

How to Get Started

- Download

Head over to our website, pruneyardinn.com, and download the template – it’s completely free, no strings attached! - Fill in the Blanks

Armed with your financial documents, populate the template with your assets and liabilities. Don’t worry; we’ve included instructions to guide you every step of the way. - Analyze and Act

Once your balance sheet is complete, take a moment to analyze the numbers. Identify areas for improvement and set realistic financial goals. - Update Regularly

Life is dynamic, and so are your finances. Make it a habit to update your balance sheet regularly – monthly, quarterly, or annually – to stay on track.

Tips for Maximizing Your Balance Sheet’s Potential:

1. Be Honest and Thorough

Transparency is paramount when it comes to your finances. Don’t shy away from listing all your assets and liabilities, even if some may seem insignificant. Every dollar counts towards your overall financial picture.

2. Update Regularly

Life moves fast, and so do your finances. Make it a habit to update your balance sheet regularly, especially after major life events like marriage, buying a house, or changing jobs. This ensures your financial roadmap remains accurate and actionable.

3. Seek Professional Advice

While our template is a powerful tool, sometimes you need expert guidance. Don’t hesitate to consult a financial advisor for personalized insights and strategies tailored to your unique situation.

4. Set Realistic Goals

Rome wasn’t built in a day, and neither are your finances. Set realistic, achievable goals based on your current financial standing and future aspirations. Whether it’s saving for a dream vacation or building a retirement nest egg, break it down into manageable steps and track your progress on your balance sheet.

5. Embrace Financial Literacy

Knowledge is power, especially in the realm of finance. Take the time to educate yourself on topics like budgeting, investing, and debt management. The more you understand, the better equipped you’ll be to make informed financial decisions.

Conclusion

Your financial journey begins with a single step – and our Free Personal Balance Sheet Template is the perfect starting point. It’s not just about numbers on a page; it’s about empowerment, control, and the freedom to shape your financial future.

At Pruneyard Inn, we believe that everyone deserves financial stability and success. That’s why we offer this invaluable resource to help you take charge of your finances and achieve your goals.

So why wait? Download our Free Personal Balance Sheet Template today and embark on a journey towards financial prosperity. With the right tools and a little determination, the sky’s the limit. Here’s to a brighter, wealthier tomorrow – starting now.