Looking for a free business expense tracker template? Look no further! We’ve got you covered with our comprehensive guide and customizable template to help you keep your finances in check.

As a business owner, it’s essential to keep track of your expenses to ensure financial stability and growth. However, managing expenses can be a tedious task, especially when you’re juggling multiple tasks simultaneously. That’s where a business expense tracker template can come in handy.

In this article, we’ll discuss the benefits of using an expense tracker template and provide you with a free customizable template that you can use to keep your finances in check.

Benefits of Using a Business Expense Tracker Template

Streamlines Your Expense Tracking Process

Manually keeping track of your expenses can be a time-consuming task. An expense tracker template can help streamline the process by providing you with a pre-designed framework to input your expenses. This can help you save time and focus on other essential aspects of your business.

Provides a Comprehensive Overview of Your Finances

An expense tracker template can provide you with a comprehensive overview of your finances. By tracking your expenses, you can identify areas where you can cut back on expenses and save money. You can also identify areas where you’re overspending and take corrective action to bring your finances back on track.

Helps You Stay Organized

Keeping track of receipts and invoices can be a daunting task, especially when you’re managing multiple transactions. An expense tracker template can help you stay organized by providing you with a central location to store all your receipts and invoices. This can help you avoid losing track of important financial documents.

Simplifies Tax Filing

Taxes can be a complicated and stressful process for business owners. However, using an expense tracker template can help simplify the tax filing process by providing you with an organized record of your expenses. This can help you avoid missing out on potential tax deductions and save you money.

How to Use Our Free Business Expense Tracker Template

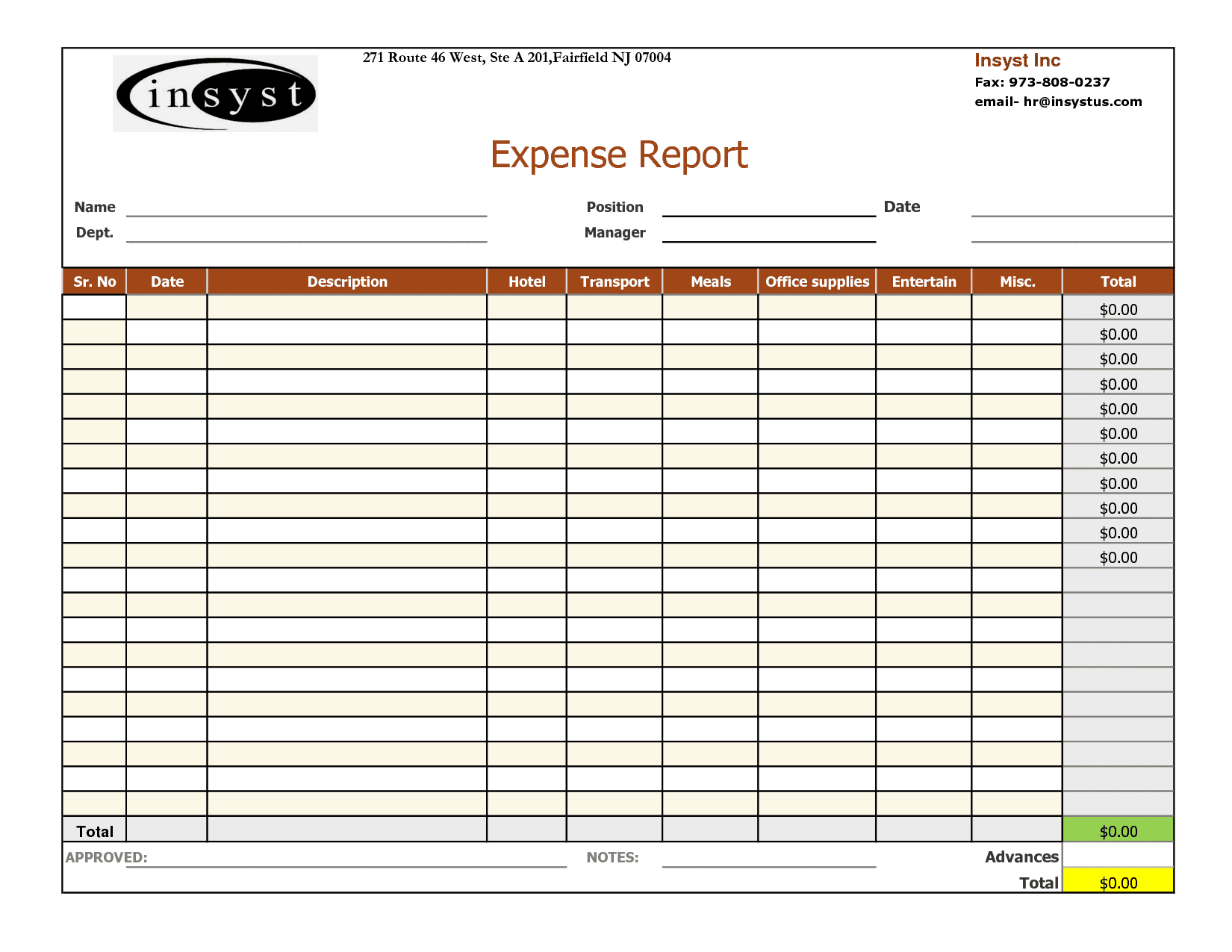

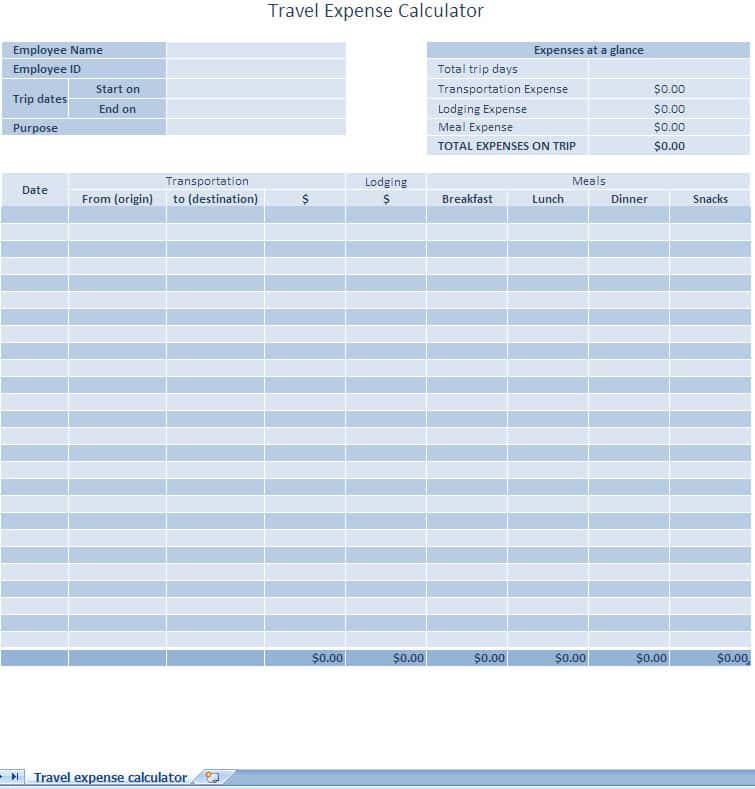

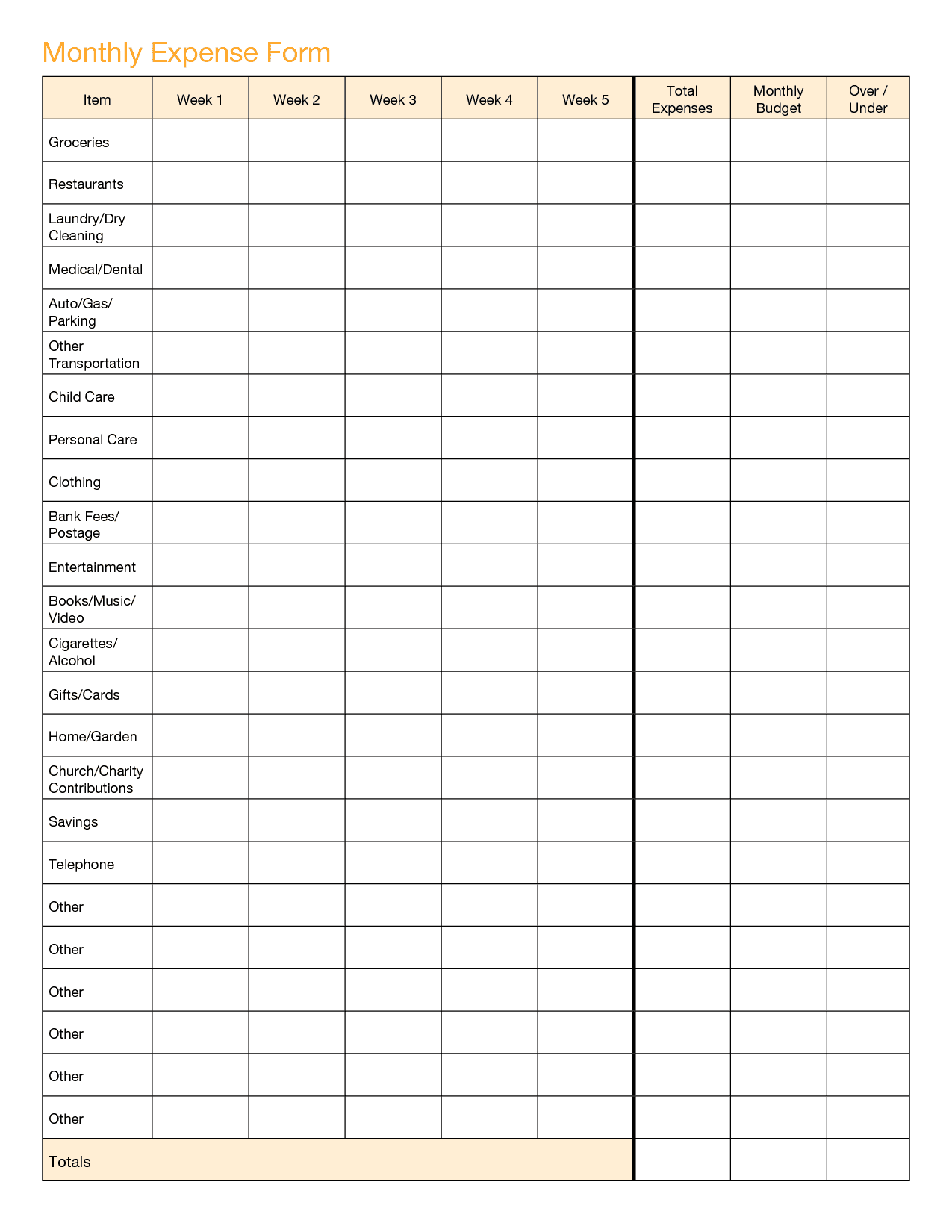

Our free business expense tracker template is easy to use and customizable to suit your business needs. Here’s how you can get started:

Step 1: Download the Template

You can download our free business expense tracker template from our website.

Step 2: Customize the Template

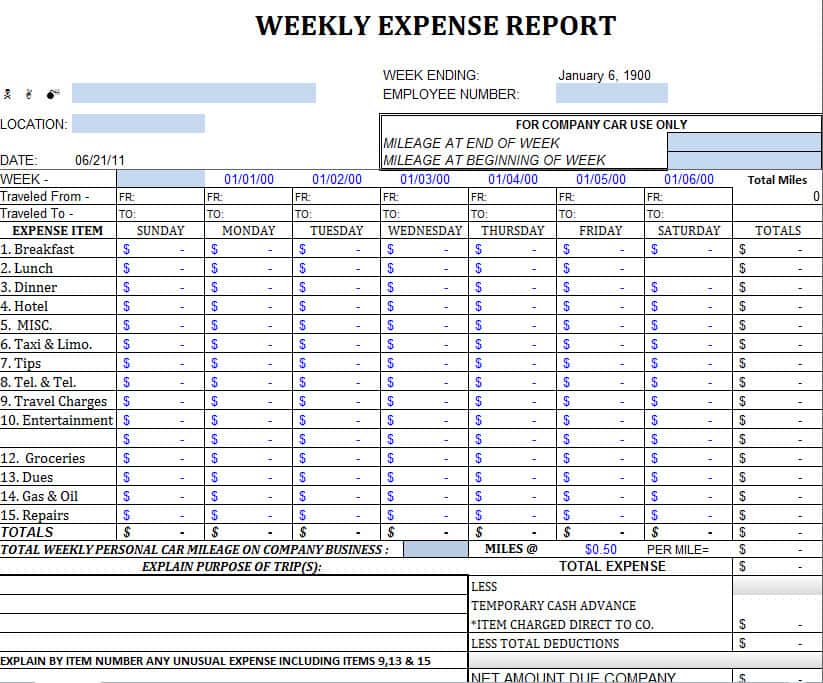

Customize the template to suit your business needs by inputting the necessary details such as expense category, date, amount, and description. You can also add additional columns to track other aspects of your expenses.

Step 3: Input Your Expenses

Once you’ve customized the template, input your expenses as they occur. Make sure to keep track of all receipts and invoices.

Step 4: Review Your Finances

Review your finances regularly to identify areas where you can cut back on expenses and areas where you need to allocate more resources. This can help you make informed financial decisions and ensure the financial stability and growth of your business.

Tips for Effectively Using Our Free Business Expense Tracker Template

Here are some tips to help you effectively use our free business expense tracker template:

Set a Regular Schedule for Updating Your Expenses

Make sure to update your expenses regularly, whether it’s weekly, bi-weekly, or monthly. Setting a regular schedule can help ensure that you don’t miss any expenses and can help you avoid backlogging your expenses.

Categorize Your Expenses

Categorizing your expenses can help you identify areas where you’re spending too much money and areas where you can cut back. Some common expense categories include rent, utilities, office supplies, and travel expenses.

Keep Track of Receipts and Invoices

Make sure to keep track of all receipts and invoices and store them in a safe and organized location. This can help you avoid losing important financial documents and can help simplify the tax filing process.

Review Your Expenses Regularly

Review your expenses regularly to identify areas where you can cut back on expenses and areas where you need to allocate more resources. This can help you make informed financial decisions and ensure the financial stability and growth of your business.

Use the Data to Make Informed Financial Decisions

Use the data collected from your expense tracker template to make informed financial decisions. For example, if you notice that you’re spending too much money on office supplies, you may want to consider buying in bulk or finding a more cost-effective supplier.

Conclusion

Managing your business expenses can be a challenging task, but with our free business expense tracker template, it doesn’t have to be. By using our customizable template, you can streamline your expense tracking process and ensure the financial stability and growth of your business. Make sure to set a regular schedule for updating your expenses, categorize your expenses, keep track of receipts and invoices, review your expenses regularly, and use the data to make informed financial decisions. Download our free template today and take control of your finances!