Discover the ins and outs of Due Diligence Report Examples in this informative guide. Learn how to conduct a successful due diligence process and create a thorough report that covers all essential aspects.

In the world of business, the term “Due Diligence” is often thrown around, but what does it really mean, and how can you ensure that you’re conducting it effectively? Whether you’re a seasoned entrepreneur or just starting your business journey, due diligence is a critical step in making informed decisions. In this article, we’ll dive deep into the world of due diligence report examples to help you understand this process better and how to create a comprehensive report.

What is Due Diligence?

Due diligence is a comprehensive investigation or review of a potential investment or business deal. It’s a way to minimize risks by thoroughly assessing all relevant factors before making a decision. Due diligence can be applied to various scenarios, such as mergers and acquisitions, partnerships, or even evaluating potential investors.

The Importance of Due Diligence

Due diligence is not just a formality; it’s a crucial step that can make or break a business deal. Here are some reasons why it’s vital:

- Risk Mitigation

It helps identify potential risks and challenges associated with the deal. By uncovering these risks early on, you can take steps to mitigate them. - Informed Decision-Making

With a due diligence report in hand, you have all the information you need to make an informed decision. It’s the foundation for making confident choices. - Legal and Financial Compliance

Ensures that the deal complies with all legal and financial regulations, reducing the chances of future legal issues.

Components of a Due Diligence Report

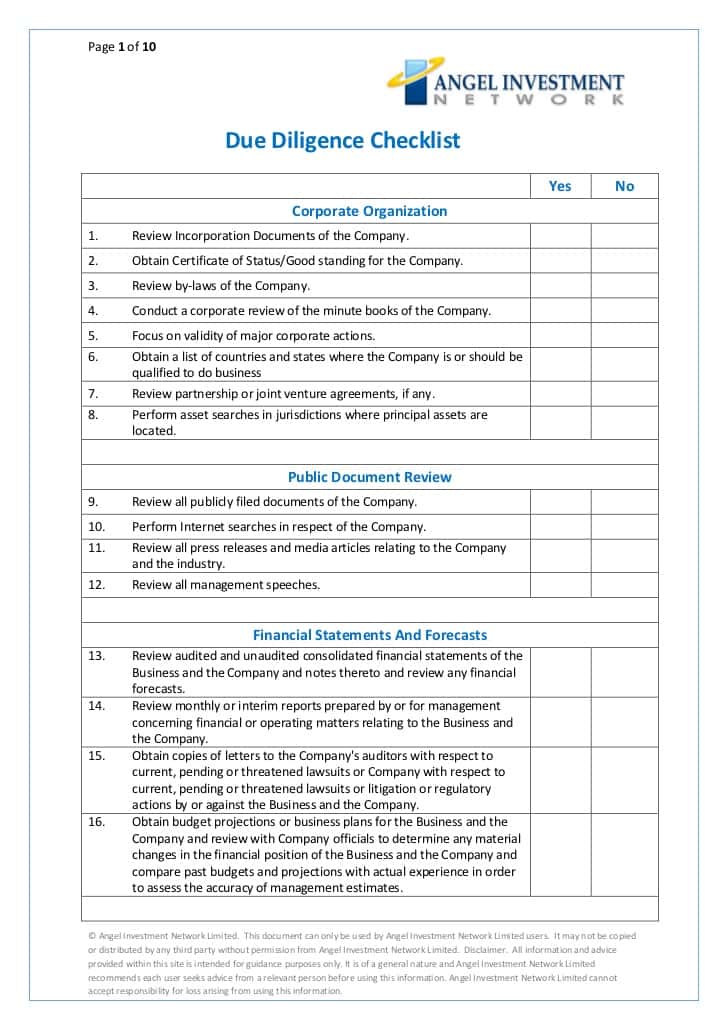

A due diligence report is a comprehensive document that encapsulates all the findings and assessments from the due diligence process. Here are the essential components of a due diligence report:

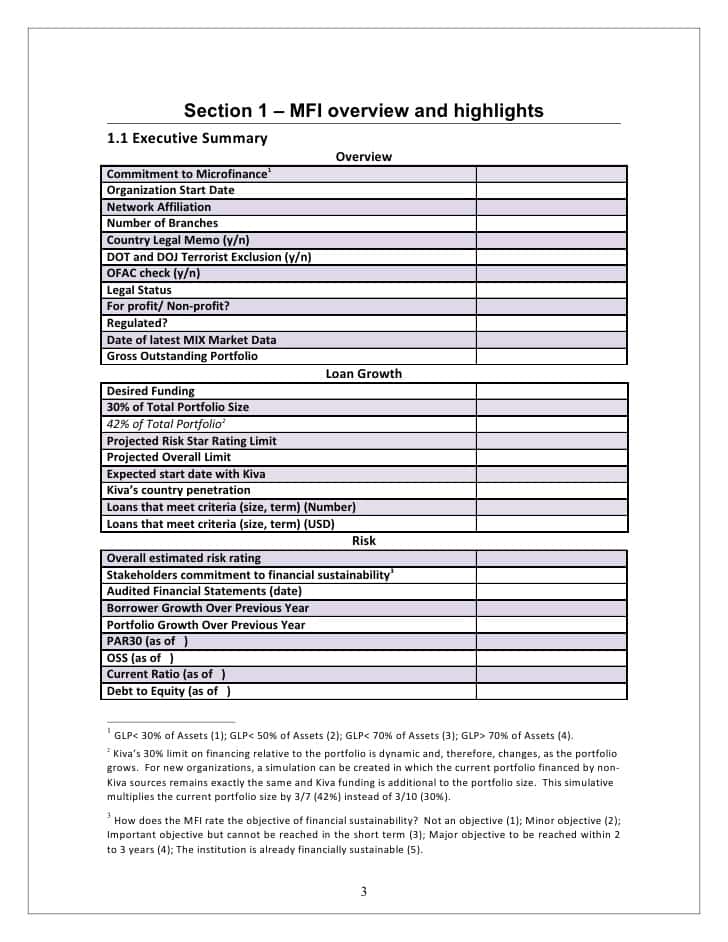

- Executive Summary

A concise overview of the report, highlighting the key findings and recommendations. - Introduction

An introduction to the subject of the due diligence and the purpose of the report. - Financial Due Diligence

This section covers financial statements, tax records, and any financial documents relevant to the deal. - Legal Due Diligence

A review of legal documents, contracts, agreements, and any potential legal issues. - Operational Due Diligence

Evaluation of the business operations, including processes, technology, and systems. - Market and Industry Analysis

Research into the market, industry trends, and the competitive landscape. - Risk Assessment

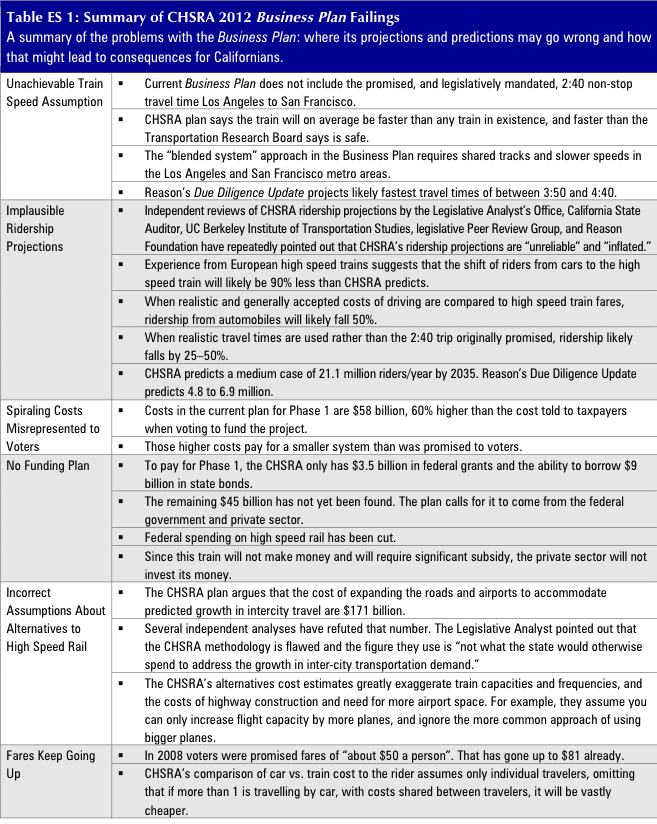

Identification of potential risks and a discussion of risk mitigation strategies. - Conclusion and Recommendations

Summarizes the findings and provides recommendations for the decision-making process.

Due Diligence Report Example

To understand the due diligence process better, let’s take a look at a hypothetical example. Suppose you are considering acquiring a small software development company. Your due diligence report might include:

- Financial statements of the target company for the past three years.

- Legal contracts and agreements, including any ongoing litigation.

- Assessment of the company’s software development processes and technology stack.

- Market analysis showing the demand for the software they develop.

- Identification of potential risks, such as reliance on a single key client.

By examining these aspects in detail, you can make an informed decision about whether to proceed with the acquisition.

Conducting Effective Due Diligence

To conduct effective due diligence, consider the following tips:

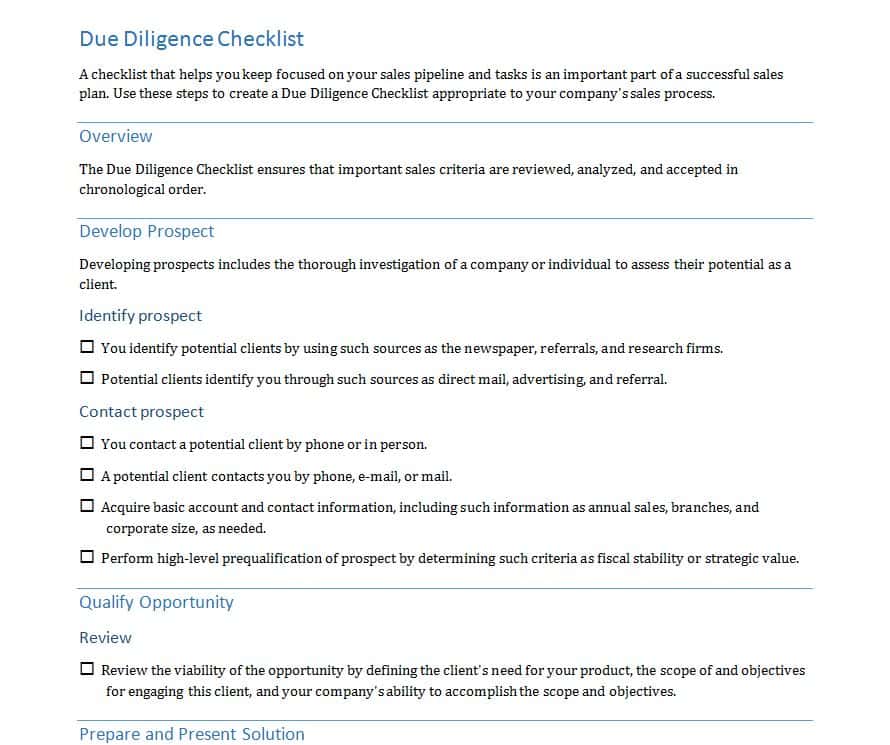

- Plan Thoroughly

Create a due diligence checklist that covers all the necessary aspects of the deal. - Assemble a Team

Gather a team of experts who can provide insights into various areas, such as finance, legal, and operations. - Document Everything

Keep meticulous records of all your findings and assessments. - Be Diligent

Don’t rush the process; take the time needed to ensure a comprehensive review. - Consult Professionals

When in doubt, consult legal and financial professionals to ensure compliance and accuracy.

Using Due Diligence Report Examples

One of the most effective ways to learn about creating a due diligence report is by studying real-life examples. These examples serve as practical guides and templates, giving you insights into what a thorough due diligence report should look like. Here’s how you can use due diligence report examples to your advantage:

- Reference Material

Use due diligence report examples as reference materials when creating your report. They can help you structure your report correctly and ensure you don’t miss out on any crucial details. - Learning from Best Practices

Analyze due diligence reports from successful deals in your industry. These reports often embody best practices, which you can incorporate into your own due diligence process. - Adapt to Your Needs

While due diligence report examples are valuable, remember that each deal is unique. Customize the structure and content of your report to suit the specifics of your situation. - Highlighting Key Metrics

Pay attention to the key metrics and data presented in the examples. This can guide you in identifying what’s most important for your report.

Conclusion

In the world of business, due diligence is a non-negotiable step in making informed decisions. It’s a process that can save you from potential disasters and set you up for success. By creating a comprehensive due diligence report, you can ensure that you’ve covered all the necessary aspects and make confident decisions that will benefit your business in the long run.

Remember, every due diligence report is unique, tailored to the specific circumstances of the deal. Take the time to understand the intricacies of your situation, assemble a dedicated team, and use due diligence report examples as a reference to guide you in creating a report that covers all the essential aspects of your deal.