Discover how Credit Card Bill Templates can simplify your financial record-keeping and help you stay organized. Learn how to create, customize, and use these templates effectively in this comprehensive guide.

In today’s fast-paced world, managing your finances efficiently is crucial. Credit cards have become an integral part of our lives, making transactions more convenient. However, keeping track of your expenses and payments can sometimes be a daunting task. That’s where Credit Card Bill Templates come to the rescue, offering a seamless solution to help you stay organized and on top of your financial game.

Understanding Credit Card Bill Templates

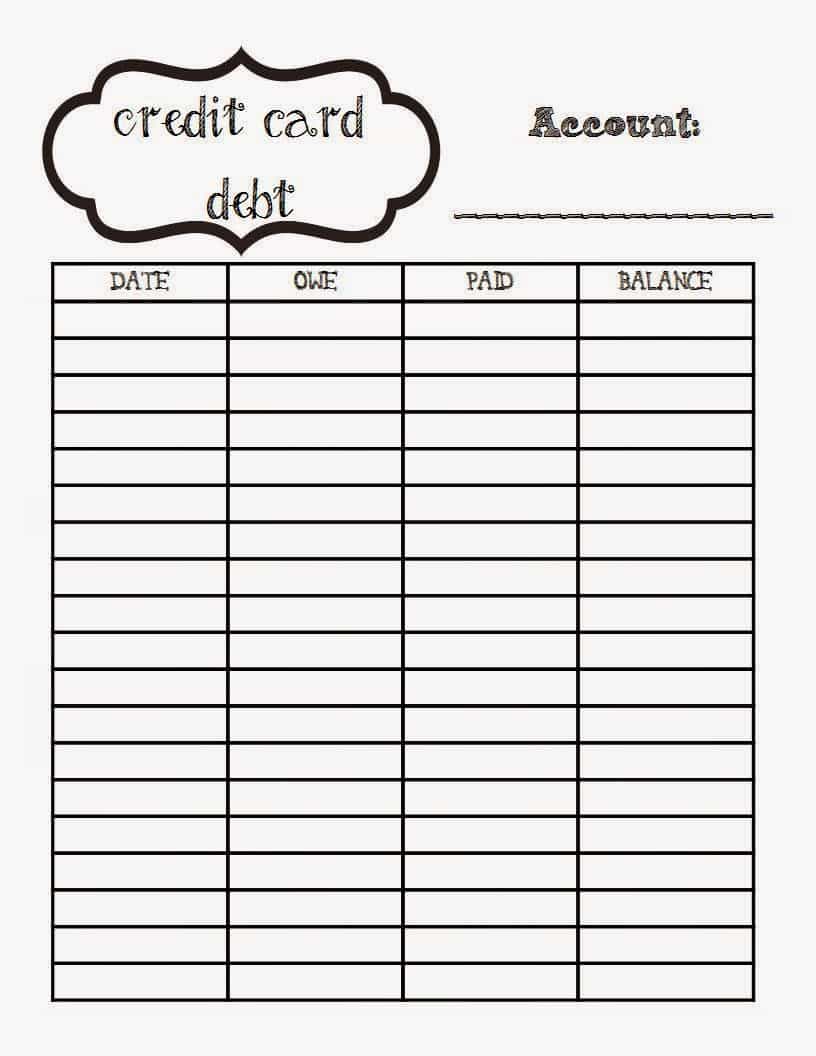

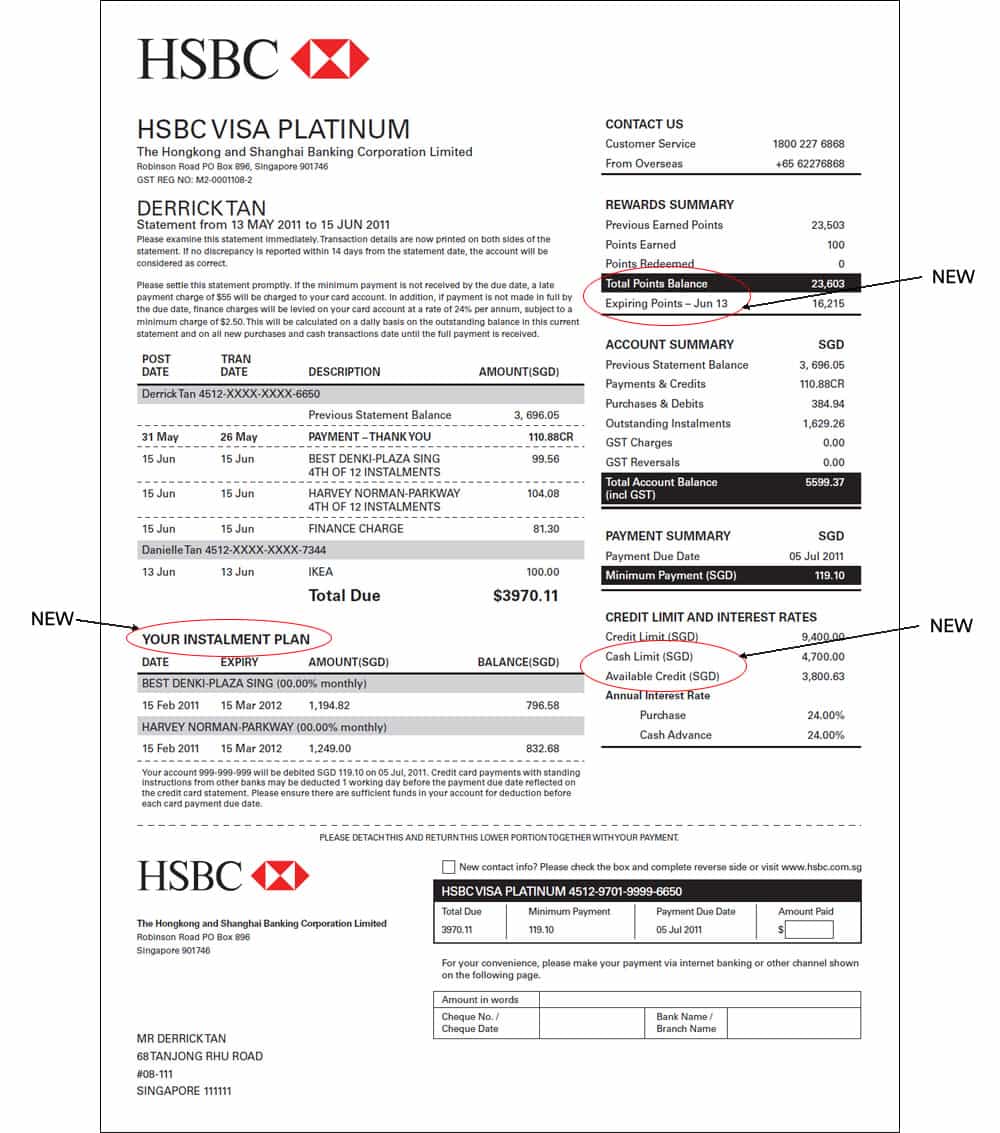

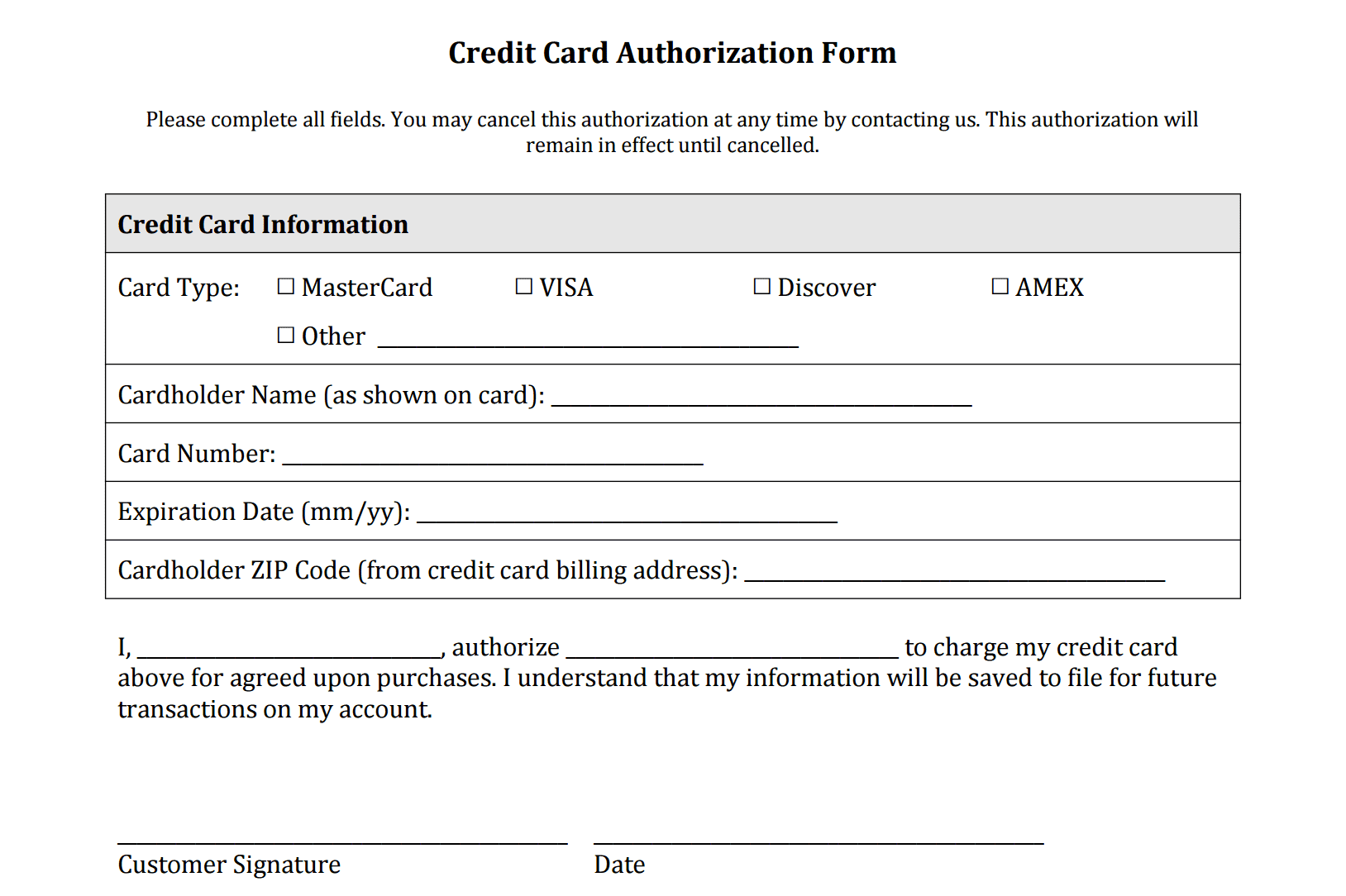

Credit Card Bill Templates are pre-designed forms or digital documents that allow you to record and monitor your credit card transactions, payments, and due dates. They serve as a structured framework for documenting your financial activities. These templates come in various formats, including Excel spreadsheets, PDFs, and even online tools, making it easy for users to choose the one that suits them best.

The Benefits of Using Credit Card Bill Templates

- Organization: Keeping track of multiple credit card transactions can be overwhelming, especially if you use different cards for various purposes. Credit Card Bill Templates help you consolidate all your financial information in one place, making it easy to manage and analyze.

- Timely Payments: With due dates clearly marked on your bill template, you’ll never miss a payment. Late payments can lead to interest charges and damage your credit score. By using a credit card bill template, you’ll ensure that you pay your bills on time.

- Budgeting: Tracking your expenses and categorizing them with a bill template allows you to create a budget and set spending limits. This helps you manage your finances more effectively and work towards your financial goals.

- Financial Awareness: Credit Card Bill Templates provide a snapshot of your financial health. You can easily identify spending patterns, areas where you can cut back, and opportunities to save or invest.

Creating Your Credit Card Bill Template

Creating your credit card bill template is a straightforward process. Here are the basic steps to get you started:

- Choose a Format: Decide whether you want a digital template (Excel, PDF, Google Sheets) or prefer a physical version. Select the one that you’re most comfortable with.

- Add Basic Information: Include your personal details, such as your name, address, and contact information, at the top of the template.

- List Your Credit Cards: Create a section for each of your credit cards, including the card name, account number, and issuer details.

- Track Transactions: Design a table where you can input transaction details, including date, description, amount, and category (e.g., groceries, entertainment, bills).

- Record Payments: Have a separate section for recording your payments, noting the date, amount, and any applicable fees or interest charges.

- Set Due Dates: Clearly mark the due dates for each credit card bill to ensure you make timely payments.

- Analyze Your Finances: Use the template to analyze your spending habits and assess your financial health regularly.

Customizing Your Credit Card Bill Template

One of the significant advantages of using Credit Card Bill Templates is the ability to customize them to suit your unique needs. Here are a few ways to make your template even more effective:

- Color-Coding: Use different colors for various spending categories to make it easier to identify where your money is going.

- Graphs and Charts: Create visual representations of your financial data to help you grasp your financial situation quickly.

- Automatic Calculations: Incorporate formulas in your digital template to automatically calculate totals, balances, and percentages.

- Expense Categories: Customize the categories on your template to match your spending habits and budgeting goals.

Using Credit Card Bill Templates Effectively

Now that you have your customized Credit Card Bill Template, it’s essential to use it effectively. Here are some tips:

- Regular Updates: Consistently update your template with new transactions and payments. Don’t let it become outdated.

- Review and Analyze: Take time each month to review your template and analyze your financial habits. Look for opportunities to save or invest.

- Stay Organized: Keep all your credit card statements and supporting documents in one place, making it easy to refer to when needed.

- Back Up: If you’re using a digital template, ensure you have a backup copy to prevent data loss.

In conclusion, Credit Card Bill Templates are invaluable tools for maintaining financial control and ensuring you never miss a payment. By creating and customizing your template, you can streamline your financial management, achieve your budgeting goals, and secure your financial future. So, why wait? Get started with your Credit Card Bill Template today and take charge of your finances with ease and confidence.