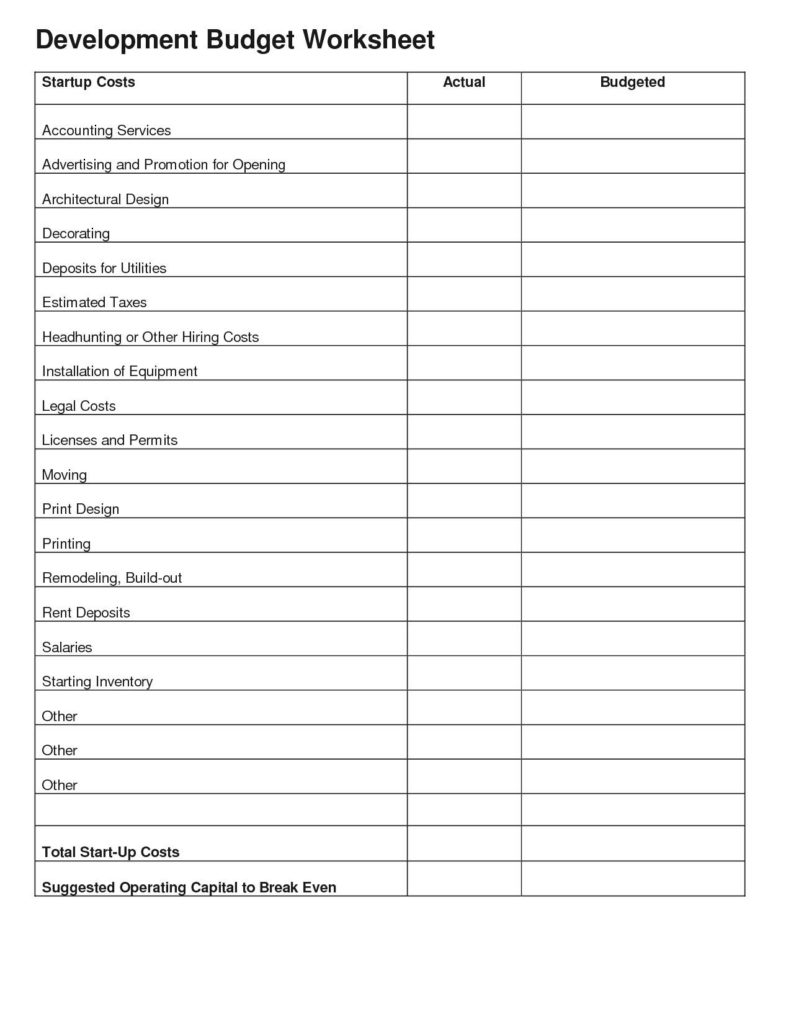

It is not an easy task to start up your business and that’s why you need a Business Expense Spreadsheet. It will help you manage all the expenses that you incur during the process of starting up a business. You may need it if you have a franchise business and you will be registering the franchise by paying a certain amount of money.

When you are about to register your franchise, you need to get a Business Expense Spreadsheet that will help you to manage all the costs that you incurred so far and after that you will be required to give a lot of details on how you managed your finances, the numbers you have worked out by yourself or somebody else for you. The accounting information that you provide to your franchise will help to prepare the documents that will help you take a decision on the financing options for your franchise.

Then, the accounting records that are available online will help you keep track of all the expenses. This is important because there can be many reasons that your franchise needs to be re-financed and you have to find ways to come up with the capital without spending too much money. It is a crucial process so the accounting data should be prepared properly to avoid any future risks.

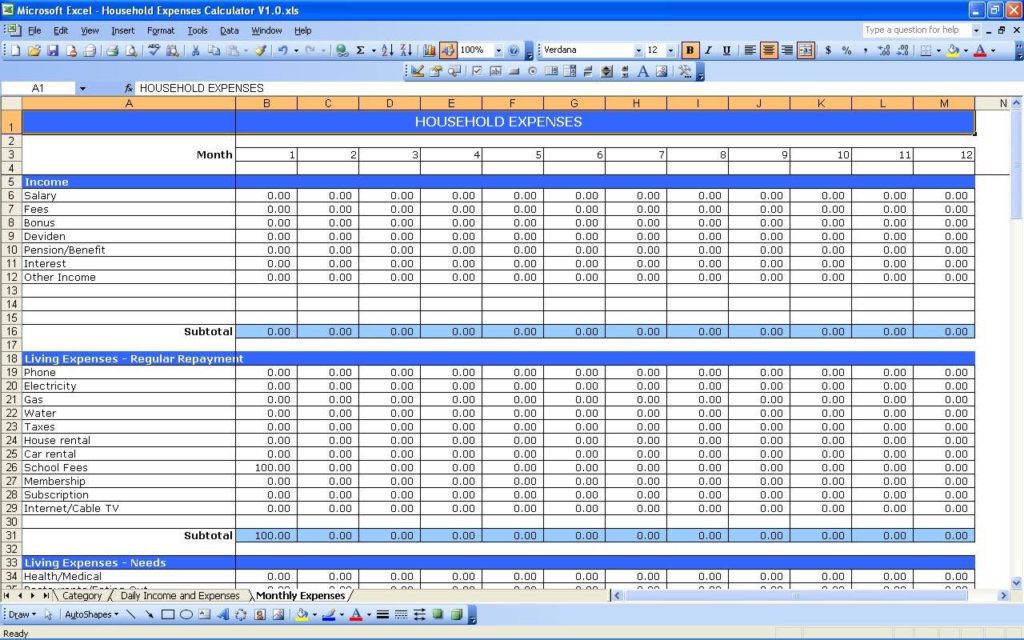

Expense Spreadsheet software is very easy to use and all you need to do is simply input the information to it. Once the data are entered, you can save it to a hard disk or other storage media. Now you can access this data anytime you want.

Once you have prepared your expenses and other relevant information, you can enter them into the accounting spreadsheets so that you will be able to track your various costs. A business expense spreadsheet will help you save a lot of time that you would have used in calculating your costs. This will also help you come up with the expenses that will help you keep a track of the expenses and it will also help you to plan your business budget that can be considered for the start up of a business.

It is important to note that a business expense spreadsheet can be maintained by itself as a system. There will be some newbies who will have problems handling the different budgets. This is why it is important that they work with a business expense spreadsheet that will help them in managing their budgets.

Since a business expense spreadsheet is a budgeting tool, it will be easier for a newbie to control their budgets. With this, they can easily work on their budgeting rather than a separate planning system that are provided by a business expense spreadsheet. It will also be easier for the newbie to deal with the different expenses that they might encounter during the startup of a business.

Expense spreadsheet software is quite easy to use and a beginner can easily handle his budgeting easier than a separate tracking system. They can even use the finance tools available within the spreadsheet. And this will help them to save a lot of time that they would have used if they had worked on their own budgeting software.