Get organized and streamline your bookkeeping process with a bookkeeping invoice template. Read on to learn how to create and use one.

If you’re a small business owner, bookkeeping is an essential part of your daily operations. Keeping accurate records of your income and expenses is crucial to ensure that your business is profitable and to stay compliant with tax regulations. However, bookkeeping can be a time-consuming and overwhelming task, especially if you don’t have a proper system in place.

One way to streamline your bookkeeping process is by using a bookkeeping invoice template. This simple tool can help you keep track of your income, expenses, and payments in a clear and organized manner. In this article, we’ll show you how to create and use a bookkeeping invoice template to make your bookkeeping process more efficient.

What is a Bookkeeping Invoice Template?

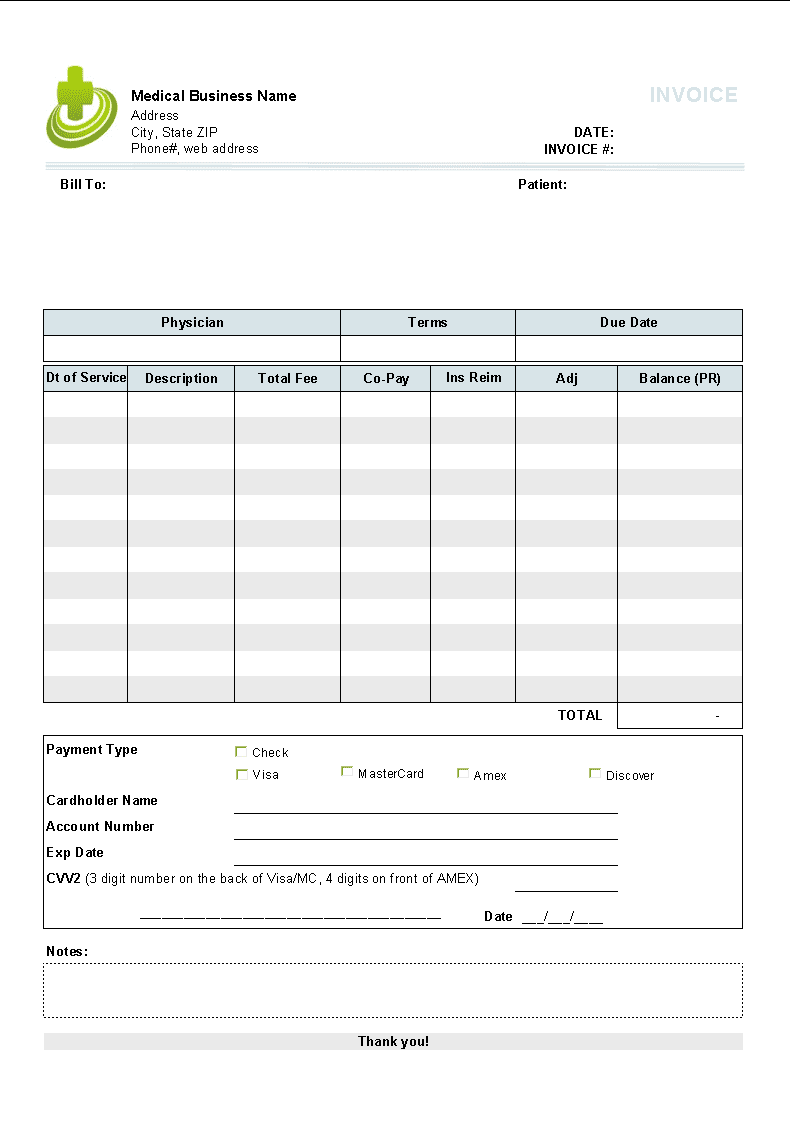

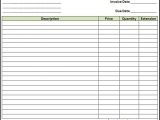

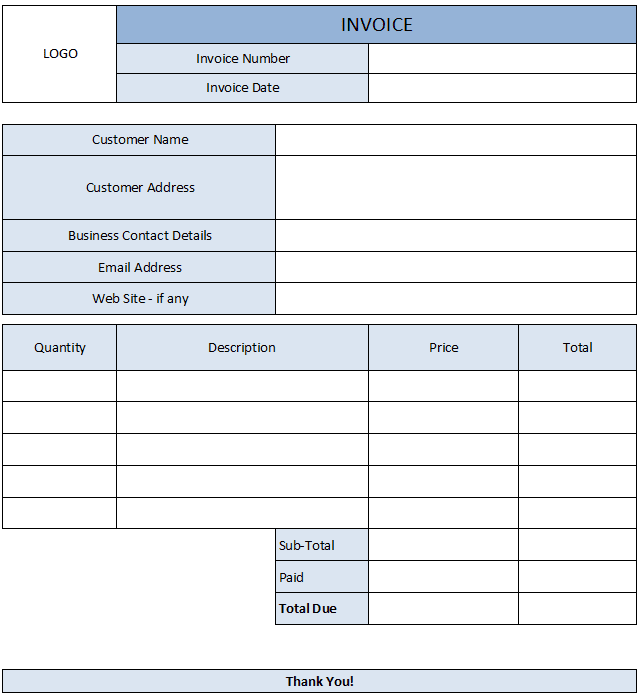

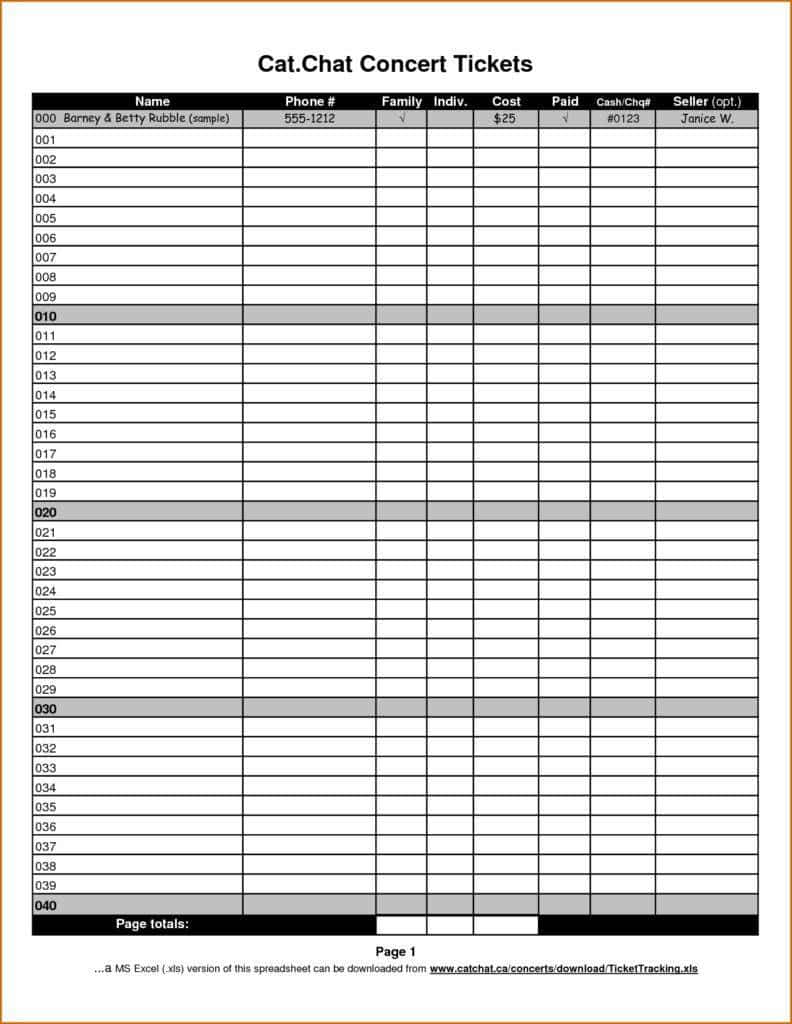

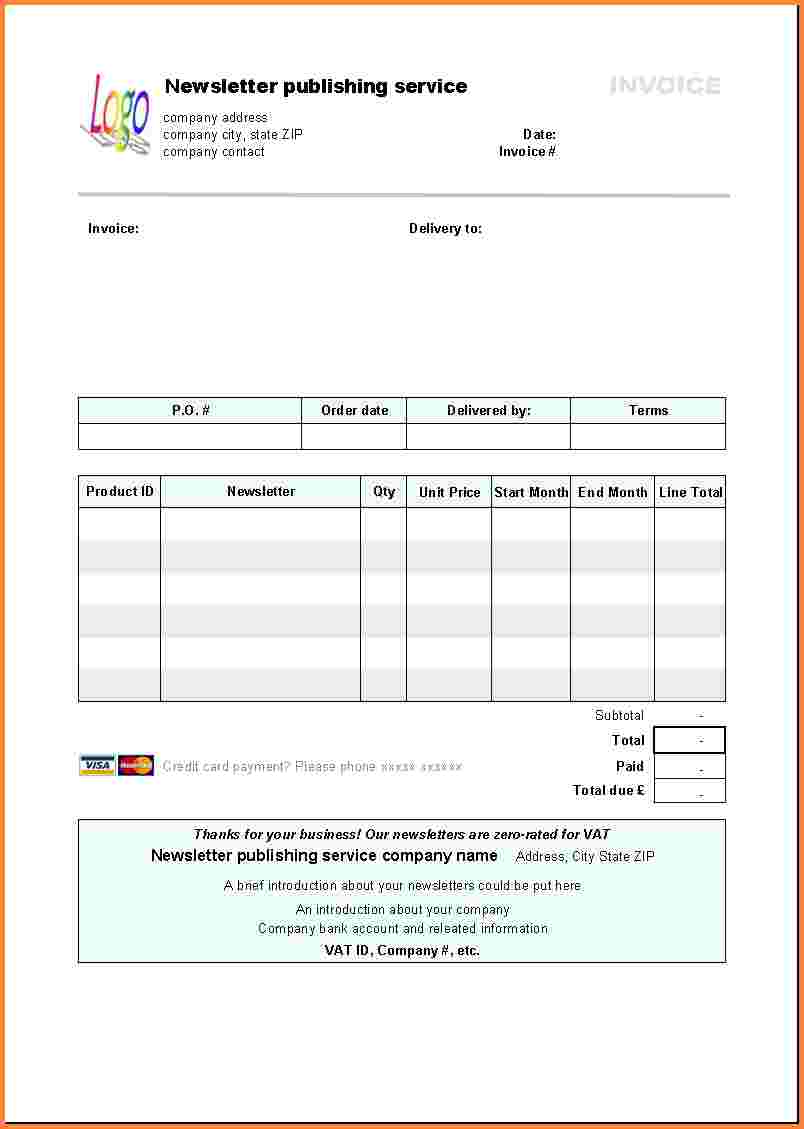

A bookkeeping invoice template is a pre-designed document that you can use to record your business transactions. It typically includes fields for the date, description of the transaction, amount, and payment method. You can customize the template to suit your business needs and preferences.

How to Create a Bookkeeping Invoice Template?

Creating a bookkeeping invoice template is easy. You can either design one yourself using a spreadsheet software like Microsoft Excel or Google Sheets, or download one from the internet. There are many free templates available online that you can use as a starting point.

To create a bookkeeping invoice template, follow these steps:

- Open a spreadsheet software like Microsoft Excel or Google Sheets.

- Create a new spreadsheet and add headers for the following fields: date, description, amount, payment method, and total.

- Customize the template by adding or removing fields based on your business needs.

- Save the template for future use.

How to Use a Bookkeeping Invoice Template?

Using a bookkeeping invoice template is simple. Here’s how you can use it to track your business transactions:

- Enter the date of the transaction in the first column.

- Add a description of the transaction in the second column. This can include the name of the customer, product or service purchased, or any other relevant information.

- Enter the amount of the transaction in the third column.

- Select the payment method used for the transaction in the fourth column.

- Add up the total amount of transactions at the end of the sheet.

You can use this template to record all your business transactions, including sales, expenses, and payments. By keeping track of all your transactions in one place, you can easily calculate your income and expenses, and identify any areas where you can reduce costs.

Benefits of Using a Bookkeeping Invoice Template

Using a bookkeeping invoice template has several benefits, including:

- Time-saving

A bookkeeping invoice template can save you time by eliminating the need to create a new document for each transaction. - Organized record-keeping

A bookkeeping invoice template can help you keep your business transactions organized and easily accessible. - Improved accuracy

By recording all your transactions in one place, you can reduce the risk of errors and ensure that your financial records are accurate. - Better financial analysis

By using a bookkeeping invoice template, you can easily calculate your income and expenses, and generate financial reports that can help you make better business decisions.

Tips for Using a Bookkeeping Invoice Template

To get the most out of your bookkeeping invoice template, here are some tips to keep in mind:

- Customize the template to suit your business needs. If you have specific fields or information that you want to track, add them to the template.

- Use consistent naming conventions for your transactions. This will help you easily identify and sort your transactions.

- Use the template consistently. Make it a habit to record all your transactions in the template regularly to ensure that your records are up to date.

- Review your records regularly. Set aside time each week or month to review your records and ensure that they are accurate and complete.

- Back up your records. Make sure to save a backup of your bookkeeping invoice template in case of computer or data loss.

By following these tips, you can maximize the benefits of using a bookkeeping invoice template and make your bookkeeping process more efficient.

Conclusion

In summary, bookkeeping is an essential part of running a small business, and using a bookkeeping invoice template can help you streamline your bookkeeping process and ensure that your financial records are accurate and organized. By creating and using a bookkeeping invoice template, you can save time, improve your record-keeping, and make better business decisions based on your financial data. Don’t hesitate to try using a bookkeeping invoice template to see how it can help your business thrive.