Accounting Spreadsheets for Small Business: A Guide to Streamlining Your Finances

As a small business owner, managing your finances is crucial for the success and growth of your business. However, keeping track of your financial transactions can be time-consuming and overwhelming, especially if you’re not an accounting expert. Luckily, there’s a solution that can help you streamline your finances: accounting spreadsheets for small business.

What are Accounting Spreadsheets?

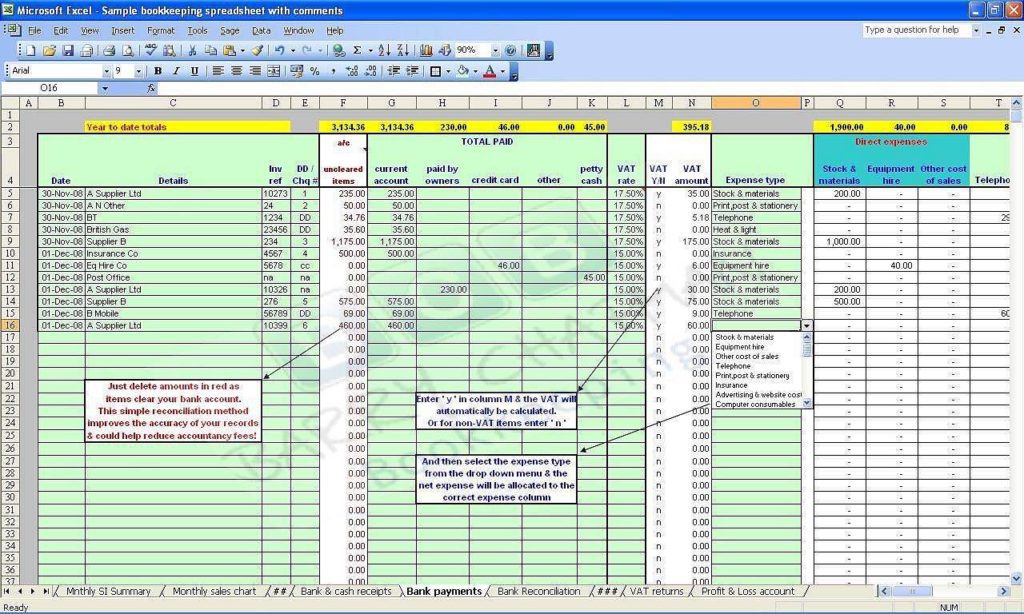

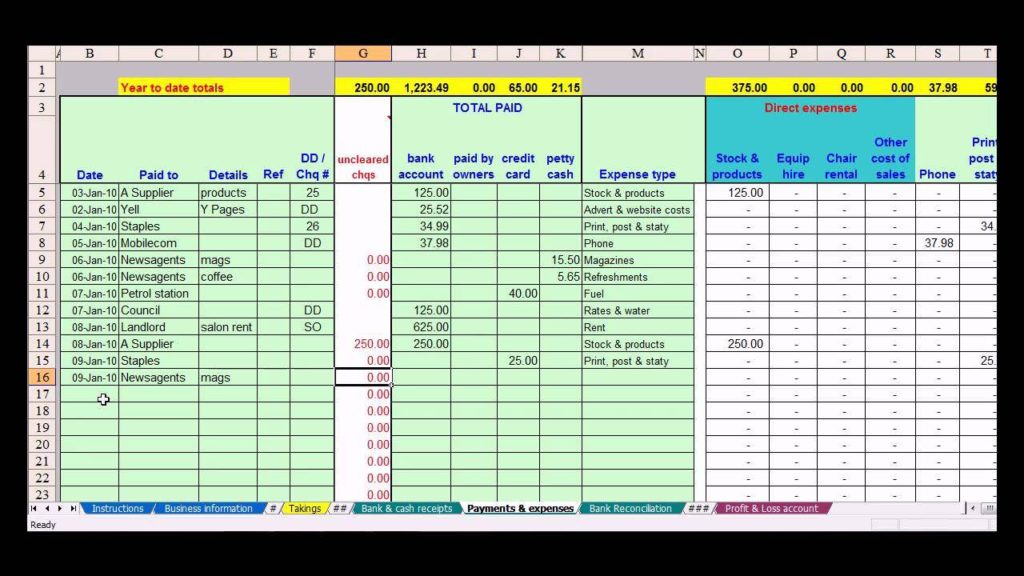

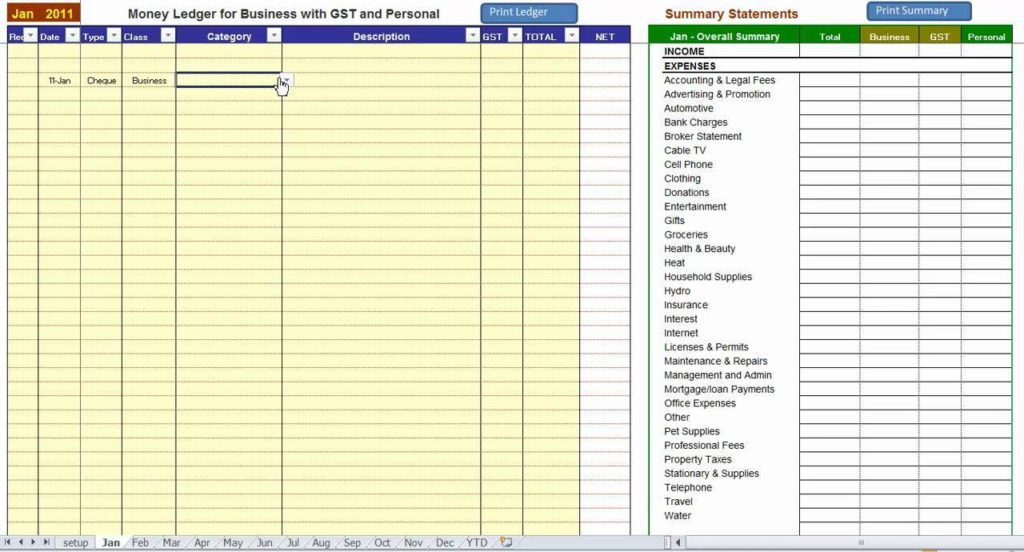

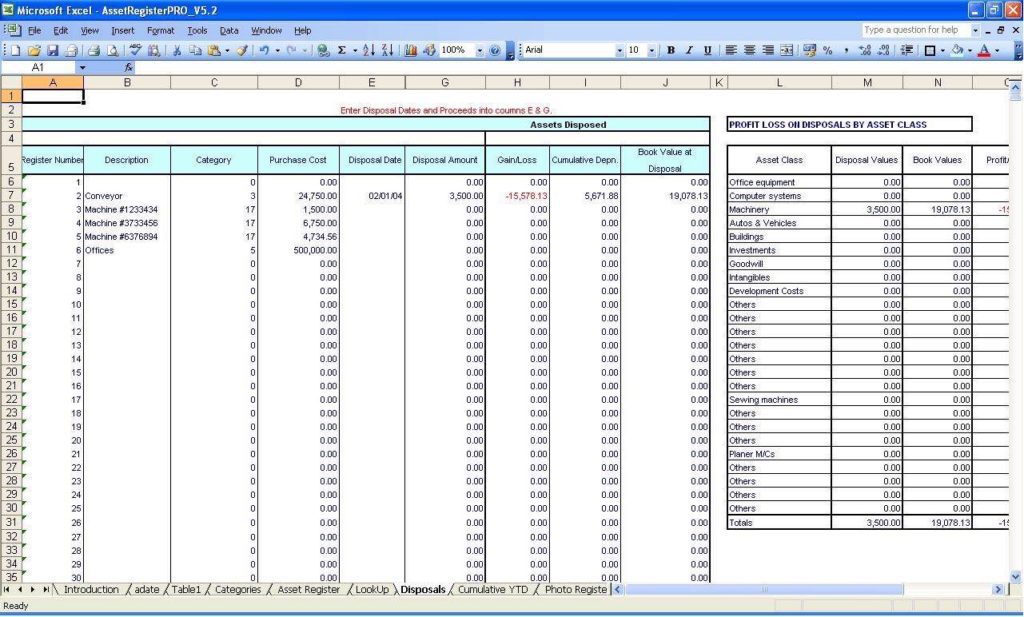

An accounting spreadsheet is a tool that helps you track and manage your financial transactions. It’s a document that’s created using spreadsheet software like Microsoft Excel or Google Sheets. Accounting spreadsheets typically contain several tabs or sheets, each dedicated to a different aspect of your finances, such as income, expenses, assets, and liabilities.

Why Use Accounting Spreadsheets for Small Business?

Using accounting spreadsheets for small business has several advantages. Firstly, they provide an easy-to-use and affordable way to keep track of your finances. You don’t need to be an accounting expert to use them. Secondly, they help you stay organized and save time. Instead of manually entering data and calculating totals, accounting spreadsheets do the work for you, which can free up time for other tasks. Finally, they provide a clear picture of your financial health, allowing you to make informed decisions about the future of your business.

How to Create an Accounting Spreadsheet for Small Business

Creating an accounting spreadsheet for small business is easy. Here’s a step-by-step guide to get you started:

- Determine what you need to track – Before creating your spreadsheet, determine what financial information you need to track. This could include income, expenses, assets, liabilities, and more.

- Choose a spreadsheet software – There are many spreadsheet software options available, including Microsoft Excel, Google Sheets, and others. Choose the one that works best for you.

- Create your tabs/sheets – Create a new spreadsheet and add tabs/sheets for each category of financial information you need to track.

- Input your data – Start inputting your financial data into the appropriate tabs/sheets. Be sure to include all relevant information, such as dates, amounts, and descriptions.

- Use formulas and functions – To make your spreadsheet work for you, use formulas and functions to automatically calculate totals, averages, and other relevant information.

- Review and analyze your data – Regularly review and analyze your financial data to make informed decisions about your business. Use your spreadsheet to identify trends and areas for improvement.

Tips for Using Accounting Spreadsheets for Small Business

Here are some tips to help you get the most out of your accounting spreadsheets:

- Keep your spreadsheet up-to-date – Regularly update your spreadsheet with the latest financial information to ensure its accuracy.

- Use consistent formatting – Use consistent formatting for all financial data to make it easy to read and analyze.

- Backup your data – Make sure to backup your spreadsheet regularly to avoid losing any important financial data.

- Keep it simple – Don’t overcomplicate your spreadsheet with unnecessary data. Keep it simple and easy to understand.

- Use templates – If you’re not sure where to start, there are many accounting spreadsheet templates available online that you can use as a starting point.

In conclusion, using accounting spreadsheets for small business can help you streamline your finances, stay organized, and make informed decisions about the future of your business. By following these tips and best practices, you can create an accounting spreadsheet that works for you and your business needs.

When it comes to managing the finances of a small business, one of the most important tools you can have is an accounting spreadsheet. With a well-designed spreadsheet, you can keep track of your income and expenses, monitor your cash flow, and prepare for tax time with ease. But with so many different accounting spreadsheets out there, how do you know which one is right for your small business? In this article, we’ll take a closer look at some of the key features of accounting spreadsheets for small businesses, and provide some tips for selecting the right one for your needs.

One of the first things to consider when choosing an accounting spreadsheet is your level of expertise with spreadsheets in general. If you’re comfortable using Microsoft Excel or Google Sheets, you may want to choose a more advanced spreadsheet that offers a lot of customization options. On the other hand, if you’re new to spreadsheets, or you don’t have a lot of time to spend learning how to use a complicated program, you may want to choose a simpler spreadsheet with pre-built formulas and templates.

Another key factor to consider is the type of business you have. Different industries have different accounting needs, so it’s important to choose a spreadsheet that is tailored to your specific needs. For example, if you run a retail business, you may need a spreadsheet that includes columns for sales, inventory, and cost of goods sold. If you’re a freelancer, on the other hand, you may need a spreadsheet that focuses more on invoicing and tracking payments.

When it comes to features, there are a few key things to look for in an accounting spreadsheet for small businesses. One of the most important is the ability to track income and expenses on a monthly basis. This will help you keep track of your cash flow and make sure that you’re not overspending or underspending in any given month. You’ll also want to look for a spreadsheet that allows you to categorize your expenses, so you can see exactly where your money is going.

Other features to look for might include the ability to create invoices and receipts, track sales tax, and generate financial reports. Some spreadsheets also offer budgeting tools and forecasting capabilities, which can be helpful for planning ahead and staying on top of your finances. Of course, the more features a spreadsheet has, the more complex it may be to use, so make sure you choose one that fits your skill level and needs.

In terms of cost, there are both free and paid options available for accounting spreadsheets for small businesses. Free options like Google Sheets can be a great choice for those on a tight budget, while paid options like QuickBooks or Xero offer more advanced features for a monthly fee. Keep in mind that while free options may be tempting, they may not always offer the same level of support or security as paid options.

In conclusion, accounting spreadsheets for small businesses can be incredibly useful tools for managing your finances. When choosing a spreadsheet, consider your level of expertise, the type of business you have, and the features you need to keep track of your income and expenses. By selecting the right accounting spreadsheet, you’ll be able to stay on top of your finances, make informed decisions about your business, and ultimately achieve greater financial success.